A.M. Best Affirms Ratings of Sooner Insurance Company

June 03 2015 - 3:20PM

Business Wire

A.M. Best has affirmed the financial strength rating of A

(Excellent) and the issuer credit rating of “a” of Sooner

Insurance Company (Sooner) (Burlington, VT). The outlook for

both ratings is stable.

The ratings reflect Sooner’s excellent capitalization, history

of consistent operating profitability driven by favorable

underwriting results, conservative reserve levels and the position

it holds as the captive insurer for its ultimate parent,

ConocoPhillips [NYSE: COP]. The ratings also consider the

level of commitment on the part of ConocoPhillips, whose management

incorporates Sooner as a core element in its overall risk

management program.

Partially offsetting these positive rating factors are Sooner’s

significant reinsurance credit risk stemming from the large limits

offered on its policies and the possible change in the captive’s

net retentions that could happen year over year, as well as the

limited diversification of business written, which is expected with

a single parent captive.

Sooner provides property damage, business interruption and

general liability insurance to ConocoPhillips and its subsidiaries

worldwide.

Sooner has a history of generally positive underwriting results

and strong operating return measures. Over a 10-year period, the

company’s loss experience has remained favorable due, in part, to

ConocoPhillips’ strong risk management programs.

ConocoPhillips’ corporate insurance and health, safety and

environmental groups conduct periodic reviews of their potential

loss exposures through a specialist in industrial risks. Sooner may

have high net retentions based upon the capacity of the overall

insurance market from year to year. Nonetheless, Sooner does have

the capital to retain these risks, if net retentions were to

increase. Although the majority of Sooner’s capital is loaned to

ConocoPhillips, it is considered to have relatively low risk due to

this affiliation as well as the parent’s strong balance sheet and

history of positive earnings.

A.M. Best is unlikely to upgrade Sooner’s ratings over the long

term due to its limited market profile. Key rating drivers that

could lead to rating downgrades are a significant loss of surplus,

consistent adverse reserve development or a significant change in

the company’s risk profile. In addition, deterioration in the

credit profile of ConocoPhillips could impact Sooner’s ratings.

A.M. Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit www.ambest.com/captive.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- Alternative Risk Transfer (ART)

- Catastrophe Analysis in A.M. Best

Ratings

- Evaluating Non-Insurance Ultimate

Parents

- Risk Management and the Rating Process

for Insurance Companies

- Understanding BCAR for

Property/Casualty Insurers

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150603006518/en/

A.M. BestAlexander Sarfo, 908-439-2200, ext.

5779Senior Financial

Analystalexander.sarfo@ambest.comorSteven Chirico, CPA,

908-439-2200, ext. 5087Assistant Vice

Presidentsteven.chirico@ambest.comorChristopher Sharkey,

908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

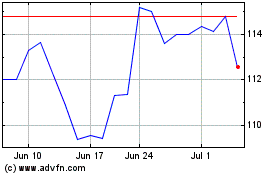

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

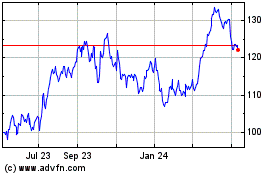

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024