Coach Earnings Rise, but Sales Forecast Eases--Update

January 31 2017 - 12:40PM

Dow Jones News

By Suzanne Kapner

Coach Inc.'s decision to curtail discounts paid off during its

most recent quarter, as sales and profit rose even as it pulled

back from North American department stores.

North American sales for the Coach brand rose 2% to $744 million

in the three months to Dec. 31, despite a 30% drop in sales to

department stores.

The handbag and accessories maker has spent the past three years

working on its image, after it lost share to Michael Kors Holdings

Ltd. and other rivals who ran with its strategy of selling luxury

goods at affordable prices. Coach hired a new designer who

introduced higher-end products and is in the process of remodeling

its stores. Last month, the company recruited pop singer and

actress Selena Gomez to be the new face of the brand to appeal to

younger shoppers.

A key part of its strategy is to reduce promotions. It pulled

out of 120 North American department stores during the quarter,

part of a plan to reduce its distribution by 20% to these stores,

which rely on deep discounts to sell goods.

Coach also has reduced the number of online flash sales, though

the pullback continued to weigh on its online business. Sales at

its existing North American brick-and-mortar stores grew 4% in the

period, but when e-commerce is included, sales only grew 3%.

Still, fewer promotions helped the company raise its gross

margin to 68.6% of sales from 67.4% a year earlier.

Handbags priced over $400 accounted for half of Coach's sales,

up from 30% last year.

Over all, the company's total sales, including its Stuart

Weitzman brand, which it acquired in 2015, grew 4% to $1.32

billion. Net income increased to $199.7 million from $170.1

million.

International sales of the Coach brand rose 3% to $448 million

driven by strength in mainland China, Hong Kong, Macau and Japan,

which offset weakness elsewhere in Asia.

Coach's shares rose 2.5% to $36.88% in midmorning trading.

Coach is on the hunt for additional acquisitions and has been

considered a contender to buy rival handbag maker Kate Spade &

Co.

Coach Chief Executive Victor Luis said Tuesday on a call with

analysts that he is looking for brands in the handbag and

accessories, footwear and outerwear space. He added that he wants a

strong brand that has the potential to grow overseas and isn't

interested in purchasing a brand that needs to be turned around.

Company executives added, however, that no deal was imminent.

Citing the strong dollar, Coach said it now expects sales to

increase 1% to 3% this year, down from an earlier growth forecast

of as much as 5%.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

January 31, 2017 12:25 ET (17:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

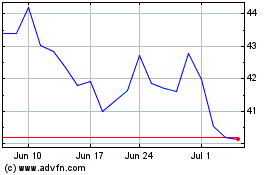

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

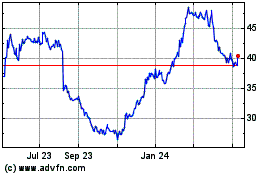

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024