By Suzanne Kapner

It was a simple test. The slides showed photos of mall stores

with the names obscured. Which was a Coach store? Which was Michael

Kors?

A roomful of people gathered in New York City two years ago

couldn't tell the difference. The truth is most shoppers probably

couldn't either. But this wasn't a focus group. They were Coach

Inc.'s own employees.

The pioneer of selling luxury handbags at affordable prices had

been beaten at its own game by Michael Kors Holdings Ltd., which

aped Coach's store designs, prices and even used the same factories

to make its goods.

In the latest fiscal year, Michael Kors's revenue reached $4.7

billion, eclipsing Coach's $4.5 billion. Three years ago, Kors had

less than half the sales.

"We were slow to evolve," Victor Luis, Coach's chief executive,

said in an interview. "We did not innovate quickly enough, did not

invest enough in differentiating ourselves from the new competition

that was in some ways taking our playbook."

Coach, which is based in Manhattan, paid the price with three

years of declining sales, but it is starting to turn the corner.

Its sales are up 2% at existing North American stores in the

October quarter. Global sales at existing Michael Kors stores fell

5.4% in the same period.

"Coach has made great strides in becoming more fashion

relevant," said Oliver Chen, a Cowen & Co. analyst. "Kors had

been very successful, but tastes have changed and they need to

evolve."

The 75-year-old Coach brought in a new executive creative

director, Stuart Vevers, who launched a high-end collection this

year that includes $2,700 shearling coats, $900 sweaters and $800

bags -- well above the $300 to $400 range of its regular

handbags.

And Coach is on the hunt for acquisitions following its purchase

last year of the shoe company Stuart Weitzman Holdings LLC. It

approached Burberry Group PLC about a takeover but was rebuffed; it

is considered a potential suitor for Kate Spade & Co.,

according to people familiar with the situation.

Coach also has closed a third of its North American full-priced

stores, pulled out of 250 department stores and scaled back online

discounts, part of a bigger effort to reduce promotions.

But not everyone is convinced Coach's problems are fixed.

Sales are growing slowly and profits, at $461 million in the

most recent fiscal year, remain well below 2013 levels, when the

company earned $1 billion.

Coach's North American outlet stores, which analysts estimate

account for about two-thirds of the region's retail revenue,

continue to struggle with heavy discounting and sluggish sales.

Moreover, after binging on handbags in recent years, women

appear to be taking a breather. The global market, estimated at

$24.3 billion by Euromonitor International, is barely growing.

"What we see is consumers looking for innovation," Mr. Luis

said.

Coach's shares are up 8% this year, closing Wednesday at $35.66,

but remain well below their all-time high of $79.03 reached in

March 2012.

Founded in 1941, Coach became known for its sturdy handbags,

created from a type of cowhide used to make baseball gloves that

becomes more supple over time. Lew Frankfort, who served as CEO for

nearly two decades starting in 1995, hit on a novel idea of selling

luxury at affordable prices. The strategy drew derision from

European rivals, who dubbed Coach the " McDonald's of luxury." But

it opened the brand to an untapped market.

By 2013, Coach's global sales had grown to $5 billion, from $550

million in 2000, the year it went public. Under the surface,

though, the brand was under strain. It became reliant on online

flash sales, in which consumers could purchase discounted bags for

a limited time. Moreover, the company was overly dependent on logo

bags.

"Those huge C's really cheapened the brand," said Amy McDonald,

a 38-year-old marketing executive, who was turned off by the

proliferation of fabric bags imprinted with its "C" logo.

The launch in 2010 of an eponymous line by Reed Krakoff, who at

the time was the company's creative director, exacerbated the

problems, said previous and current executives.

Mr. Frankfort blamed Mr. Krakoff for taking his eye off the

Coach brand, according to people who know them both. Mr. Krakoff

was frustrated by the CEO's unwillingness to scale back promotions,

these people said.

"Everything comes to an end," Mr. Krakoff, who left in 2013,

said recently in an interview. Mr. Frankfort, who left a year

later, declined to comment.

Meanwhile, Michael Kors was gaining steam, propelled by the

celebrity of its namesake designer, who had become a household name

from his stint as a judge on the television show "Project

Runway."

Like Coach, Kors sells affordable luxury. Mr. Luis and other

Coach executives contend that Michael Kors also borrowed the

company's store design and even used some of the same factories as

Coach.

"Thanks for the playbook," Kors CEO John Idol told Mr. Frankfort

on more than one occasion, according to a person familiar with the

conversations. A Michael Kors spokeswoman declined to comment.

Michael Kors, however, had something that Coach didn't: a full

head-to-toe look, selling clothing and shoes.

Enter Mr. Vevers, a 43-year-old Briton who previously worked for

LVMH Moët Hennessy Louis Vuitton. Since he was hired in 2013, Mr.

Vevers has added about 30 new designers to the 80-person team to

help Coach make the transition to a full fashion house.

Coach held its first runway show last year. Its Rogue handbag is

the talk of fashion blogs. And its Tea Rose bag, introduced this

fall, is adorned with leather flowers that are cut and sewn by

hand.

Customers are starting to notice. Ms. McDonald bought the small

version of the Tea Rose bag for $595 and made a YouTube video

extolling its craftsmanship.

As CEO, Mr. Luis has curtailed discounts and remodeled stores,

moves that helped the company upgrade its image. Coach now holds

two online flash sales a month, down from about 12 a month. The

pullback resulted in $300 million in lost sales. But it helped

reposition the brand.

As a result, handbags and accessories priced at more than $400

accounted for 50% of Coach's sales in the most recent quarter, up

from 30% last year.

Asked whether a slowdown in Kors's sales is further helping

Coach, Mr. Luis responded with his own question. "If we had done

nothing would Coach be better today?" he asked. "The answer is,

no."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

December 22, 2016 08:14 ET (13:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

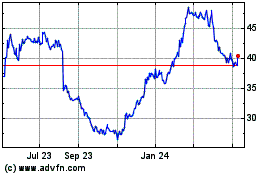

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

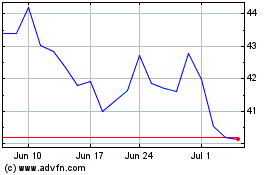

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024