Coach's Sales Slowed by Shift Away From Department Stores -- Update

November 01 2016 - 12:55PM

Dow Jones News

By Suzanne Kapner and Joshua Jamerson

Coach Inc. reported increased demand for higher-end handbags,

but its decision to curtail its business with department stores,

part of a broader effort to reduce discounts, was a drag on

sales.

North American sales for the Coach brand fell 3% in the three

months to Oct. 1, hurt by a 30% drop in sales to department stores.

But sales at existing Coach retail stores in the region rose 4% --

the strongest showing in more than three years.

In August, Coach made a decision to pull out of more than 250

department stores in response to excessive discounting. It exited

120 stores in the most recent quarter, and plans to leave the

remaining locations this spring.

The move comes as Coach tries to position itself as more of a

luxury brand, after years of over expansion and discounting that

hurt its image. The company is also scaling back online outlet

flash sales, closing underperforming stores, and introducing new

products with better quality and higher prices.

Coach Chief Executive Victor Luis told analysts Tuesday that he

was "delighted" with the company's progress, but also warned there

remained numerous challenges, including little to no growth in the

overall handbag and accessories category and heavy discounting by

competitors in the outlet channel.

For the latest period, net income totaled $117.4 million, up

from $96.4 million a year ago. Total sales increased 1% to $1.04

billion.

To help reinvigorate sales at its outlet stores, Coach is

introducing limited edition products, such as handbags imprinted

with images from the Pac-Man videogame. The strategy has worked

well at its full-priced stores, where handbags featuring Mickey

Mouse and other Disney characters sold out.

Full-priced shoppers have shown more of a willingness to pay up

for special items. Bags priced over $400 now account for half of

Coach's sales at its retail stores, up from 30% a year ago.

Overall gross margin expanded to 68.9% of sales in the period,

from 67.6% a year ago.

The company's shares were up 3.6% on the New York Stock Exchange

as of midmorning to $37.18. The stock is up 14% for the year.

Coach's international business continued to perform well with

sales rising 7% in the quarter.

Analysts say Mr. Luis is interested in building an American

luxury conglomerate on par with LVMH Moët Hennessy Louis Vuitton.

Mr. Luis confirmed he was on the hunt for acquisitions, but said

his main priority is reinvigorating the Coach brand and expanding

Stuart Weitzman, the shoe company it bought last year.

Coach backed its guidance for the year ending next June, with

earnings expected to rise more than 10% and revenue to increase by

a percentage in the low-to-mid single digits.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Joshua

Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

November 01, 2016 12:40 ET (16:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

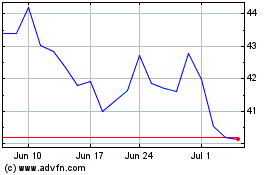

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

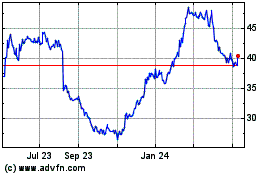

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024