Kors Results Not as Bad as Feared

August 10 2016 - 9:00AM

Dow Jones News

Michael Kors Holdings Ltd. said results in its latest quarter

weren't as bad as it had predicted, though the handbag retailer

warned that dwindling mall traffic and lower tourism in some cities

would continue to hurt sales.

Shares fell 3% in premarket trading.

Chief Executive John Idol said that the company saw solid growth

in its North American flagships while beefing up its presence in

Asia, "however, this progress was muted by the continued decline in

mall traffic trends as well as a decrease in tourism in certain

major cities which negatively impacted our comparable sales

performance during the quarter."

Like its rivals, Kors has contended with a slowdown in purse and

watch sales worsened by shoppers' shift to online retailers like

Amazon.com and away from malls. It has also struggled with

profit-eating promotional pricing that has resulted in

overexposure, and the strong U.S. dollar's negative effect on

tourist spending and international pricing hasn't helped. Analysts

at Credit Suisse noted late last month that Kors is pulling back on

wholesale distribution of handbags at Macy's and Nordstrom, "an

appropriate move to help protect brand equity long term, but [we]

believe this adds risk to revenue."

Rival Coach Inc. said Tuesday that would slash its business with

department stores by about a quarter, part of an effort to wean

customers off discounts. Coach said sales at existing North

American stores grew for the first time in more than three years in

the most recent quarter.

For Kors, comparable-store sales dropped 7.4% during the June

quarter. Wholesales sales fell 7% while licensing revenue tumbled

21%.

While results came in better than the company had warned in

June, Kors signaled that September quarter results are on track to

disappoint. For the current quarter, the retailer predicts 84 cents

to 88 cents in per-share profit on sales of $1.07 billion to $1.085

billion, short of the $1.03 a share and $1.11 billion in sales

analysts have predicted.

For the full year, Kors backed its view, forecasting $4.56 to

$4.64 an adjusted share. Revenue will be flat from a year earlier,

Kors reiterated, with comparable-store sales down in the mid-single

digit range.

In all for the three months ending in June, the company reported

a profit of $147.1 million, or 83 cents a share, down from a

year-earlier profit of $174.4 million, or 87 cents a share. Revenue

edged up 2% to $987.9 million.

Analysts projected 74 cents in earnings per share and $953.0

million in sales, according to Thomson Reuters. The company had

said it anticipated 62 cents to 66 cents in adjusted earnings per

share and $940 million to $950 million in revenue.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 10, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

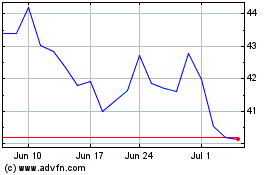

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

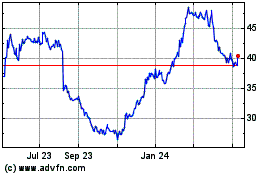

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024