Coach, in Turnaround Mode, Reports Sales Growth -- Update

August 09 2016 - 1:04PM

Dow Jones News

By Suzanne Kapner

Coach Inc. reported strong demand for higher-priced handbags at

its retail stores and said it would slash its business with

department stores, as the fashion company works to wean customers

off discounts.

Sales at the handbag maker's existing North American stores grew

for the first time in more than three years in its latest quarter,

evidence that the company's turnaround is starting to take

hold.

Coach Chief Executive Victor Luis told analysts on Tuesday that

the results "capped a year where we returned the Coach brand to

growth while elevating brand perception." He predicted sales would

continue to improve in the current fiscal year even as the company

reduces sales to retail chains.

The company plans to pull out of 250 department stores in the

current fiscal year, which would reduce its distribution in the

channel by about 25%. It is also reducing the amount of money it

provides department stores to cover the cost of discounts, which

would exclude the brand from certain storewide promotions. The move

will hurt the company's operating margin, with most of the effect

felt in the first quarter.

"This is very much a surgical move that is meant to drive the

long-term sustainable health of our brand," Mr. Luis said, adding

that he wants to avoid confusing shoppers who see Coach items

selling for higher prices at its retail stores than at department

stores.

Coach has upgraded its handbags and accessories with better

quality and more fashion, while curtailing discounts -- efforts

that have helped it stem a long sales decline in the Coach brand in

its home market, where sales at existing stores increased 2% in the

three months to July 2.

The company still faces challenges, including sluggish growth in

overall handbag sales, continued competition from Michael Kors

Holdings Ltd. and other rivals and intense discounting across the

retail landscape. Last week, Kate Spade & Co. shares tumbled

after the company slashed its financial forecasts for the year.

Kors reports results on Wednesday.

Investors who had bid Coach stock up 25% since the start of the

year had been looking for even stronger growth. Coach shares

slipped 50 cents to $40.95 in early afternoon trading.

North America outlet stores, which have been hurt by a pullback

in tourist spending, pose another challenge. Sales at existing

Coach outlet stores were flat in the period, and the company isn't

expecting sales to increase materially for the balance of the

year.

The company remodeled 300 stores in its recently completed

fiscal year, bringing total remodels to 450 world-wide.

It is also rolling out its high-end 1941 line, with handbags

that can sell for as much as $800, to all of its Coach stores as

its seeks to appeal to more affluent shoppers. Handbags and

accessories priced over $400 accounted for 40% of is sales in the

quarter, up from 30% a year ago.

Quarterly sales rose 15% to $1.15 billion in the fourth quarter.

Net income totaled $81.5 million, up from $11.7 million a year

ago.

Coach said the Stuart Weitzman brand, which it acquired last

year, had sales of $345 million for the year. Founder Stuart

Weitzman will step down as creative director in May 2017, but will

remain chairman. He will be succeeded by Giovanni Morelli, who has

worked for Marc Jacobs, Chloe and Burberry.

Coach expects revenue for the current fiscal year to increase by

roughly 2% to 5%. Operating margin should range from 18.5% to 19%,

compared with 17.3% in the recently completed year.

--Lisa Beilfuss contributed to this article.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

August 09, 2016 12:49 ET (16:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

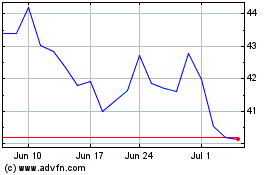

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

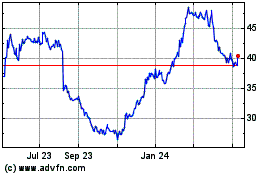

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024