Coach Tops Expectations as Sales Improve -- Update

April 26 2016 - 12:22PM

Dow Jones News

By Suzanne Kapner

Coach Inc.'s namesake brand returned to growth in North America,

the first quarterly sales increase in the handbag maker's home

market in nearly three years.

Sales of the core Coach brand rose 1% to $499 million in North

America and rose 5% to $448 million overseas, a sign the company's

turnaround efforts are starting to take hold. Sales had fallen

sharply after overexpansion and heavy discounting damaged the

brand.

Coach Chief Executive Victor Luis said the company's efforts to

add new, more stylish designs, upgrade stores and scale back

promotions were finally paying off. He said the company's average

unit retail, a measure of what customers are willing to pay, was

above $300 per handbag for the first time since fiscal year

2009.

"The Coach brand is very much on its way to evolving from its

specialty retailer and accessories brand to a true house of fashion

design," Mr. Luis said on a conference call.

On Tuesday, the company said it would eliminate about 300 jobs,

or 10% of its corporate workers, and shuffle its management. Two

executives will leave the company, including Gebhard Rainer,

president and chief operating officer.

As part of the executive shuffle, Andre Cohen was promoted to

president of North America and global marketing, while Todd Kahn

was promoted to president, chief administrative officer and

secretary.

Coach said it would take a charge of $65 million to $80 million

in the current quarter stemming from the layoffs and other

moves.

Coach shares rose 1.9% in midmorning trading, changing hands at

$40.94. The stock is up more than 40% since the end of

September.

In all, the company reported a profit of $112.5 million, up from

$88.1 million, a year earlier. Quarterly revenue increased 11% to

$1.03 billion for the three months to March 26. Stuart Weitzman,

which Coach acquired last year, had sales of $79 million in the

period.

But the company isn't entirely out of the woods. Sales at

Coach's retail stores excluding newly opened or closed locations in

North America were unchanged from a year ago, while e-commerce

sales rose just 1% and sales at department stores fell by around

5%.

Mr. Luis said he expects comparable sales at the retail

locations to turn positive in the current period, when about half

of the company's stores will have been remodeled.

Coach's international sales rose 5% on strength in China and

Europe, despite a negative impact from the strong dollar. The

company said total China sales rose 2% on a constant currency

basis, as strength in the mainland offset weakness in Hong Kong and

Macau.

Lisa Beilfuss contributed to this article.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

April 26, 2016 12:07 ET (16:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

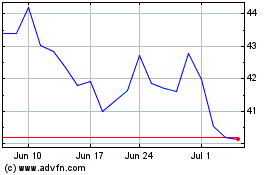

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

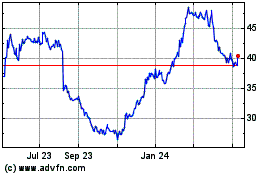

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024