Kate Spade Revenue Misses Expectations

March 01 2016 - 8:40AM

Dow Jones News

Kate Spade offered downbeat earnings and revenue guidance for

the year, as the retailer reported fourth-quarter sales below Wall

Street expectations amid a volatile handbag market.

Shares in the company, down 42% this year through Monday's

close, slid 4% premarket to $19.02.

For 2016, Kate sees full-year sales of $1.39 billion to $1.41

billion; analysts polled by Thomson Reuters were expecting $1.45

billion. Kate anticipates per-share earnings in a range of 70 cents

to 80 cents for 2016, down from analysts' projection of 82

cents.

Kate Spade also said it expects direct-to-consumer

comparable-sales growth in the low- to mid-teens this year.

Kate Spade, the former Fifth & Pacific Cos. and Liz

Claiborne Inc., has shifted its focus amid weakness in a saturated

handbag market. Rivals including Michael Kors Holdings Ltd. and

Coach Inc. have similarly felt the pinch as shoppers spend less on

purses and increasingly opt for smaller, less-expensive options

when they do spring for a new bag.

In February, Kors reported revenue climbed more than expected on

such factors as strong demand for its accessories and footwear.

Coach in January said its strategy of scaling back promotions and

upgrading design and material quality helped buoy its top line.

Kate Spade had tried to cope with the slowdown in the overall

handbag market by shedding labels such as Lucky Brand and Juicy

Couture as it seeks to focus on its flagship Kate Spade New York

brand. Meanwhile, Kate Spade is edging into more-attractive markets

such as athleisure through its Beyond Yoga brand.

The company said Tuesday it plans to open 40 to 45 stores this

year.

Over all, Kate Spade reported a profit of $61.5 million, or 48

cents a share, compared with $126.5 million, or 99 cents a share, a

year earlier. Excluding discontinued operations and other items,

earnings per share were 32 cents, compared with 24 cents a share a

year ago.

Revenue increased 7.6% to $429 million.

Analysts projected 32 cents a share in adjusted earnings on $442

million in revenue, according to Thomson Reuters.

Fourth quarter 2015 direct-to-consumer comparable sales growth

was 14%, or 9% excluding eCommerce. Analysts were expecting 11.4%,

or 10.8% excluding eCommerce, according to Consensus Metrix.

Kate Spade's profit margin expanded to 60.2% from 57.8% a year

earlier.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

March 01, 2016 08:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

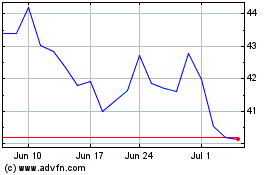

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

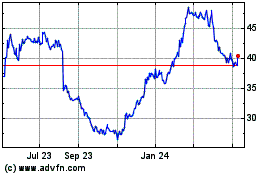

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024