Coach Reports Sales Improvement

January 26 2016 - 9:50AM

Dow Jones News

Coach Inc. said sales continued to improve in its latest

quarter, as the handbag and accessories maker's efforts to revamp

merchandise and reign in promotions boosted sales.

Those moves have cost money and bit into earnings, but the

retailer still managed to top analysts' profit expectations. Coach

shares, down 7% over the last three months through Monday's close,

rose 4.4% premarket.

After overexpansion and heavy discounting damaged the brand,

Chief Executive Victor Luis has scaled back promotions, shut

underperforming stores and upgraded design and material

quality—efforts that have come as fellow handbag makers Michael

Kors Holdings Ltd. and Kate Spade & Co. have similarly

struggled with a slowdown in the overall handbag market.

In the latest quarter, Coach booked $14 million in charges

stemming from its transformation. Amid higher overall costs,

Coach's gross margin slipped to 67.4% from 68.9% a year earlier.

While costly, the moves have helped sales recover.

North American sales for the Coach brand fell 7% in the December

quarter, or 6% on a currency-adjusted basis, with sales excluding

newly opened or closed Coach stores down 4%. Though still steep,

the decline in North American sales reflects a continued

improvement: sales in the region fell 11% in the third quarter and

20% in the second period.

Coach, meanwhile, continues to see rising sales outside of the

U.S. In mainland China, the company logged a double-digit sales

increase, despite a slowdown in the world's second-biggest economy

that is hurting other American companies. Coach also said it saw

double-digit sales growth in Europe.

The Stuart Weitzman brand, which Coach bought last year,

continued to bolster results. Performance in the segment surpassed

expectations, Mr. Luis said, with boots selling particularly well

even amid unseasonably warm weather across most of the country.

In all, Coach booked a profit of $170.1 million, or 61 cents a

share, down from $183.5 million, or 66 cents a share, a year

earlier. Excluding certain items, earnings per-share fell to 68

cents from 72 cents a year earlier.

Revenue increased 4.4% to $1.27 billion. Adjusted for currency

fluctuations, Coach said, total sales rose 7%. Analysts projected

66 cents in adjusted per-share profit on $1.28 billion in revenue,

according to Thomson Reuters.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

January 26, 2016 09:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

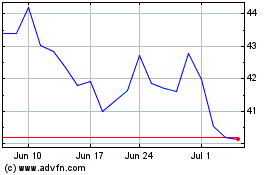

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

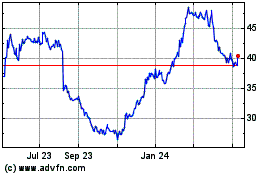

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024