As filed with the U.S. Securities and Exchange Commission on June 29, 2015

Registration Statement No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Coach, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

|

52-2242751 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

| |

|

|

| 516 West 34th Street, New York, NY |

|

10001 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Amended and Restated Coach, Inc. 2010 Stock Incentive Plan

(Full Title of Plan)

Todd Kahn, Esq.

Global Corporate Affairs Officer, General Counsel and Secretary

516 West 34th Street

New York, NY 10001

(Name and address

of agent for service)

(212) 594-1850

(Telephone number, including area code, of agent for service)

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

x |

|

Accelerated filer |

o |

| Non-accelerated filer |

o |

|

Smaller reporting company |

o |

| (Do not check if a smaller reporting company) |

|

|

|

CALCULATION OF REGISTRATION FEE

|

Title of securities

to be registered

|

Amount to be

Registered(1)

|

Proposed

maximum offering

price per share(2)

|

Proposed maximum

aggregate

offering price(2)

|

Amount of

registration

fee (2)

|

|

Common Stock,

$0.01 par value

|

7,900,000 Shares

|

$36.39

|

$287,481,000

|

$33,405.30

|

|

(1)

|

This Registration Statement is being filed to register 7,900,000 shares of common stock, par value $0.01 per share, of Coach, Inc. that may be issued pursuant to the Amended and Restated Coach, Inc. 2010 Stock Incentive Plan (the “Plan”). Pursuant to Rule 416 of the Securities Act of 1933, as amended, this Registration Statement also covers such additional and indeterminate number of shares that may be issuable under the Plan as the result of any future stock split, stock dividend or similar adjustments.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act of 1933, as amended, based upon the average of the high and low price of the Registrant's Common Stock on June 24, 2015 as reported on the New York Stock Exchange. Pursuant to General Instruction E to Form S-8, a filing fee is only being paid with respect to the registration of additional securities for the Plan.

|

EXPLANATORY NOTE

Coach, Inc., a Maryland corporation (the “Company”), filed a Registration Statement on Form S-8 (File No. 333-172699) (the “Prior Registration Statement”) on March 9, 2011 registering 30,000,000 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), under the Coach, Inc. 2010 Stock Incentive Plan. The Company hereby incorporates by reference the contents of the Prior Registration Statement to the extent not otherwise amended or superseded by the contents of this Registration Statement on Form S-8 (this “Registration Statement”).

Pursuant to General Instruction E of Form S-8, this Registration Statement is being filed to register an additional 7,900,000 shares of Common Stock under the Amended and Restated Coach Inc. 2010 Stock Incentive Plan (the “Amended Plan”). The Amended Plan was authorized by the Company’s stockholders at its 2014 Annual Meeting.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Company are incorporated herein by reference:

|

|

(a)

|

The Company’s Annual Report on Form 10-K for the fiscal year ended June 28, 2014 (the “2014 Form 10-K”), filed with the Commission on August 15, 2014;

|

|

|

(b)

|

The Company’s Quarterly Reports on Form 10-Q for the quarters ended September 27, 2014, December 27, 2014 and March 28, 2015, filed with the Commission, respectively, on November 6, 2014, February 4, 2015, and May 6, 2015;

|

|

|

(c)

|

The Company’s Current Reports on Form 8-K and Form 8-K/A filed with the Commission on July 2, 2014, July 2, 2014, July 17, 2014, September 9, 2014, September 10, 2014, September 22, 2014, September 25, 2014, November 12, 2014, January 6, 2015, January 29, 2015 (other than any portions of such filing that are furnished pursuant to Item 2.02 (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01) under applicable Commission rules rather than filed), February 5, 2015, February 23, 2015, February 24, 2015, March 2, 2015, March 18, 2015, April 24, 2015, May 4, 2015, and June 26, 2015;

|

|

|

(d)

|

The portions of the Company’s Definitive Proxy Statement on Schedule 14A (filed with the Commission on September 26, 2014) which were incorporated by reference into the Company’s 2014 Form 10-K; and

|

|

|

(e)

|

The description of the Company’s common stock contained in the Company’s registration statement on Form 8-A filed with the Commission on September 27, 2000, and any amendment or report filed for the purpose of updating such description, including without limitation the description of the Company’s common stock contained in the Company’s Registration Statement on Form 8-A filed with the Commission on May 9, 2001, and the Company’s Amendment No. 1 to Form 8-A/A filed with the Commission on February 3, 2005.

|

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities and Exchange Act of 1934, as amended, before filing a post-effective amendment to this Registration Statement that indicates that all of the shares of common stock offered have been sold or which deregisters all of such shares the remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. In no event, however, will any information that the Company discloses under Item 2.02 or 7.01 of any Current Report on Form 8-K (unless otherwise indicated therein), including any exhibits furnished with such report, that the Company may from time to time furnish to the Commission be incorporated by reference into, or otherwise become part of, this Registration Statement. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document, which is, or is deemed to be, incorporated by reference, herein modifies or supersedes such earlier statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

The exhibits to this Registration Statement are included in the Exhibit Index and are incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York on June 29, 2015.

| |

COACH, INC. |

|

| |

|

|

|

|

|

By:

|

/s/ Victor Luis |

|

| |

|

Name: Victor Luis |

|

| |

|

Title : Chief Executive Officer |

|

| |

|

|

|

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Name

|

|

Title

|

Date

|

|

/s/ Victor Luis

|

|

Chief Executive Officer and Director

|

June 29, 2015

|

| Victor Luis |

|

(Principal Executive Officer)

|

|

| /s/ Jane Nielsen |

|

Chief Financial Officer (Principal |

June 29, 2015 |

|

Jane Nielsen

|

|

Financial Officer and Principal

Accounting Officer)

|

|

| * |

|

Chairman and Director |

June 29, 2015 |

|

Jide Zeilin

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

David Denton

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

Andrea Guerra

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

Susan Kropf

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

Gary Loveman

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

Ivan Menezes

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

William Nuti

|

|

|

|

| * |

|

Director |

June 29, 2015 |

|

Stephanie Tilenius

|

|

|

|

| |

|

|

|

*By:

|

|

/s/ Victor Luis

|

|

| |

|

Victor Luis

Attorney-in-Fact

|

|

| |

4.1

|

Amended and Restated Bylaws of Coach, Inc., dated February 7, 2008, which is incorporated herein by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on February 13, 2008

|

| |

|

|

| |

4.2

|

Articles Supplementary of Coach, Inc., dated May 3, 2001, which is incorporated herein by reference from Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on May 9, 2001

|

| |

|

|

| |

4.3

|

Articles of Amendment of Coach, Inc., dated May 3, 2001, which is incorporated herein by reference from Exhibit 3.3 to the Company’s Current Report on Form 8-K filed on May 9, 2001

|

| |

|

|

| |

4.4

|

Articles of Amendment of Coach, Inc., dated May 3, 2002, which is incorporated by reference from Exhibit 3.4 to the Company’s Annual Report on Form 10-K for the fiscal year ended June 29, 2002

|

| |

|

|

| |

4.5

|

Articles of Amendment of Coach, Inc., dated February 1, 2005, which is incorporated by reference from Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on February 2, 2005

|

| |

|

|

| |

4.6

|

Specimen Certificate for Common Stock of Coach, which is incorporated herein by reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-1 (Registration No. 333-39502)

|

| |

|

|

| |

4.7

|

Deposit Agreement, dated November 24, 2011, between Coach, Inc. and JPMorgan Chase Bank, N.A., as depositary, which is incorporated by reference from Exhibit 4.1 to Coach’s Current Report on Form 8-K filed on November 25, 2011

|

| |

|

|

| |

4.8

|

Deed Poll, dated November 24, 2011, executed by Coach, Inc. and JPMorgan Chase Bank, N.A., as depositary, pursuant to the deposit agreement in favor of and in relation to the rights of the holders of the depositary receipts, which is incorporated by reference from Exhibit 4.1 to Coach’s Current Report on Form 8-K filed on November 25, 2011

|

| |

|

|

| |

4.9

|

Indenture, dated as of March 2, 2015, relating to the 4.250% senior unsecured notes due 2025, between the Company and U.S. Bank National Association, as trustee, which is incorporated by reference from Exhibit 4.1 to Coach’s Current Report on Form 8-K filed on March 2, 2015

|

| |

|

|

| |

4.10

|

First Supplemental Indenture, dated as of March 2, 2015, relating to the 4.250% senior unsecured notes due 2025, between the Company and U.S. Bank National Association, as trustee, which is incorporated by reference from Exhibit 4.2 to Coach’s Current Report on Form 8-K filed on March 2, 2015

|

| |

|

|

| |

4.11

|

Form of 4.250% senior unsecured notes due 2025, which is included in the First Supplemental Indenture filed as Exhibit 4.2 of Coach’s Current Report on Form 8-K filed on March 2, 2015

|

| |

|

|

| |

5.1*

|

Opinion of Venable LLP regarding legality of securities being registered

|

| |

|

|

| |

23.1*

|

Consent of Venable LLP (included as part of Exhibit 5.1 hereto)

|

| |

|

|

| |

23.2*

|

Consent of Deloitte & Touche LLP

|

| |

|

|

| |

24.1*

|

Powers of Attorney

|

| |

|

|

| |

99.1

|

Amended and Restated Coach, Inc. 2010 Stock Incentive Plan (incorporated by reference to Appendix B in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on September 26, 2014).

|

_______________________

* Filed herewith.

Exhibit 5.1

June 29, 2015

Coach, Inc.

516 West 34th Street

New York, New York 10001

Re: Coach, Inc. – Registration Statement on Form S-8

Ladies and Gentlemen:

We have served as Maryland counsel to Coach, Inc., a Maryland corporation (the "Company"), in connection with certain matters of Maryland law relating to the registration by the Company of up to 7,900,000 shares (the "Shares") of common stock, par value $.01 per share (the "Common Stock"), of the Company covered by the Registration Statement on Form S-8, and all amendments thereto (the "Registration Statement"), as filed with the United States Securities and Exchange Commission (the "Commission") by the Company on or about the date hereof under the Securities Act of 1933, as amended (the "1933 Act"). The Shares will be issued pursuant to the Company's Amended and Restated 2010 Stock Incentive Plan (the "Plan").

In connection with our representation of the Company, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents (collectively, the "Documents"):

1. The Registration Statement in the form in which it was transmitted to the Commission under the 1933 Act;

2. The charter of the Company, certified by the State Department of Assessments and Taxation of Maryland (the "SDAT");

3. The Bylaws of the Company, certified as of the date hereof by an officer of the Company;

4. Resolutions (the "Resolutions") adopted by the Board of Directors of the Company relating to the approval of the Plan and the issuance of the Shares, certified as of the date hereof by an officer of the Company;

5. The Final Report of the Inspector of Election for the meeting of the stockholders of the Company held on November 6, 2014, at which the Plan was approved, certified as of the date hereof by an officer of the Company;

6. The Plan;

7. A certificate of the SDAT as to the good standing of the Company, dated as of a recent date;

8. A certificate executed by an officer of the Company, dated as of the date hereof; and

9. Such other documents and matters as we have deemed necessary or appropriate to express the opinion set forth in this letter, subject to the assumptions, limitations and qualifications stated herein.

In expressing the opinion set forth below, we have assumed the following:

1. Each individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so.

2. Each individual executing any of the Documents on behalf of a party (other than the Company) is duly authorized to do so.

3. Each of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents to which such party is a signatory, and the obligations of such party set forth therein are legal, valid and binding and are enforceable in accordance with all stated terms.

4. All Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted to us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

5. Upon issuance of any of the Shares, the total number of shares of Common Stock issued and outstanding will not exceed the total number of shares of Common Stock that the Company is then authorized to issue.

6. Each option, restricted stock unit, deferred stock unit, right or other security exercisable or exchangeable for a Share will have been duly authorized, validly granted and duly exercised or exchanged in accordance with the terms of the Plan, including any option or similar agreement entered into in connection therewith, at the time of any exercise of such option, restricted stock unit, deferred stock unit, right or other security.

Based upon the foregoing, and subject to the assumptions, limitations and qualifications stated herein, it is our opinion that:

1. The Company has been duly incorporated and is validly existing under the laws of the State of Maryland and is in good standing with the SDAT.

2. The Shares have been duly authorized and, when and if issued and delivered against payment therefor in accordance with the Plan, the Resolutions and any other resolutions of the Board or a duly authorized committee thereof relating thereto, will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the laws of the State of Maryland and we do not express any opinion herein concerning any other law. We express no opinion as to compliance with any federal or state securities laws, including the securities laws of the State of Maryland, or as to federal or state laws regarding fraudulent transfers. To the extent that any matter as to which our opinion is expressed herein would be governed by the laws of any jurisdiction other than the State of Maryland, we do not express any opinion on such matter.

The opinion expressed herein is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact that might change the opinion expressed herein after the date hereof.

This opinion is being furnished to you for submission to the Commission as an exhibit to the Registration Statement. We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the use of the name of our firm therein. In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the 1933 Act.

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports relating to the consolidated financial statements and consolidated financial statement schedule of Coach, Inc. and subsidiaries (the “Company”) and the effectiveness of the Company’s internal control over financial reporting dated August 15, 2014, appearing in the Annual Report on Form 10-K of the Company for the year ended June 28, 2014.

/s/ DELOITTE & TOUCHE LLP

New York, New York

June 29, 2015

Limited Power of Attorney

KNOW ALL PERSONS BY THESE PRESENTS, that the undersigned, a director of COACH, INC., a Maryland corporation (“the Company”), does hereby constitute and appoint Victor Luis and Jane Nielsen and either of them, with the full power of substitution and resubstitution, the true and lawful attorney-in-fact and agent of the undersigned, to do or cause to be done any and all acts and things and to execute any and all instruments and documents which said attorney-in-fact and agent may deem advisable or necessary to enable the Company to comply with the Securities Act of 1933, as amended (the “Securities Act”), and any rules, regulations and requirements of the Securities and Exchange Commission in respect thereof, in connection with the registration of the securities of the Company being registered on the Registration Statement on Form S-8 to which this power of attorney is filed as an exhibit (the “Securities”), including specifically, but without limiting the generality of the foregoing, power and authority to sign, in the name and on behalf of the undersigned as a director of the Company, the Registration Statement on Form S-8 to which this power of attorney is filed as an exhibit, a Registration Statement under Rule 462(b) of the Securities Act, or another appropriate form in respect of the registration of the Securities, and any and all amendments and supplements thereto, including post-effective amendments, and any instruments, contracts, documents or other writings of which the originals or copies thereof are to be filed as a part of, or in connection with, any such Registration Statement or any other appropriate form or amendments thereto, and to file or cause to be filed the same with the Securities and Exchange Commission, and to effect any and all applications and other instruments in the name and on behalf of the undersigned which said attorney-in-fact and agent deem advisable in order to qualify or register the Securities under the securities laws of any of the several States or other jurisdictions; and the undersigned does hereby ratify all that said attorney-in-fact and agent shall do or cause to be done by virtue thereof.

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 25th day of June, 2015.

| |

|

| |

|

|

/s/ DAVID DENTON

|

|

|

David Denton

|

|

| |

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 26th day of June, 2015.

| |

|

| |

|

|

/s/ ANDREA GUERRA

|

|

|

Andrea Guerra

|

|

| |

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 25th day of June, 2015.

| |

|

| |

|

|

/s/ SUSAN KROPF

|

|

|

Susan Kropf

|

|

| |

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 25th day of June, 2015.

| |

|

| |

|

|

/s/ GARY LOVEMAN

|

|

|

Gary Loveman

|

|

| |

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 24th day of June, 2015.

| |

|

| |

|

|

/s/ IVAN MENEZES

|

|

|

Ivan Menezes

|

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 25th day of June, 2015.

| |

|

| |

|

|

/s/ WILLIAM NUTI

|

|

|

William Nuti

|

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 25th day of June, 2015.

| |

|

| |

|

|

/s/ STEPHANIE TILENIUS

|

|

|

Stephanie Tilenius

|

|

IN WITNESS WHEREOF, I, the undersigned, have executed this Limited Power of Attorney as of this 22nd day of June, 2015.

| |

|

| |

|

|

/s/ JIDE ZEITLIN

|

|

|

Jide Zeitlin

|

|

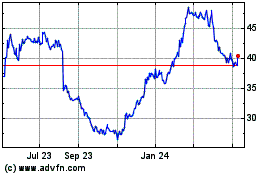

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

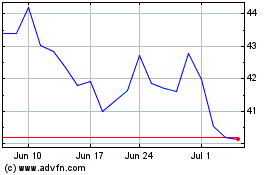

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024