UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of

report (Date of earliest event reported): May 4, 2015

|

|

Coach,

Inc.

|

|

|

(Exact

name of registrant as specified in its charter)

|

|

Maryland

|

|

1-16153

|

|

52-2242751

|

|

(State of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

516 West 34th Street, New York, NY 10001

|

|

|

(Address

of principal executive offices) (Zip Code)

|

|

|

(212) 594-1850

|

|

|

(Registrant’s telephone number, including area code)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously disclosed, on January 5, 2015, Coach, Inc. (“Coach”)

entered into a Purchase Agreement (the “Purchase Agreement”) with Stuart

Weitzman Topco LLC (“Topco”) and Stuart Weitzman Intermediate LLC

(“Stuart Weitzman”), a wholly owned subsidiary of Topco. On May 4,

2015, Coach, through its wholly owned subsidiary, completed the

acquisition of all of the equity interests of Stuart Weitzman, a luxury

footwear company and the parent of Stuart Weitzman Holdings, LLC, from

Topco (the “Closing”) for approximately $530 million in cash, subject to

customary post-closing purchase price adjustments. In addition, under

the terms of the Purchase Agreement, Coach agreed to pay a potential

earnout of up to $14.66 million annually in cash over the next three

calendar years if the following revenue targets are met:

|

|

Year

|

Target

|

|

|

|

|

|

|

|

|

2015

|

$350 million

|

|

|

|

|

|

|

|

|

2016

|

$385 million

|

|

|

|

|

|

|

|

|

2017

|

$425 million

|

|

The Purchase Agreement also contains a catch-up provision that provides

that if the revenue targets are missed in any one year but are surpassed

in succeeding years then amounts for past years become due upon

surpassing targets in succeeding years. Therefore, if the targets are

met each year (or, for example, met only in the year 2017) the earnout

payments would be $44 million in total.

Both Mr. Stuart Weitzman and Wayne Kulkin, the current Executive

Chairman and Chief Executive Officer of Stuart Weitzman Holdings, LLC

respectively, have agreed to remain with Stuart Weitzman following the

transaction.

As previously disclosed, on January 5, 2015, Coach entered into a

letter agreement (the “Letter Agreement”) with Mr. Weitzman. Pursuant

to the terms of the Letter Agreement, Mr. Weitzman paid $2.5 million to

Coach at the Closing. Under the terms of the Letter Agreement, Mr.

Weitzman also agreed to pay $666,667 to Coach each year in which the

earnout described above is payable by Coach. The Letter Agreement also

contains a catch-up provision; therefore, if the earnout target is met

only in the year 2017 (or, if the earnout targets are met each year) the

payment to Coach would be $2 million in total.

The summary descriptions of the Purchase Agreement and the Letter

Agreement in this Item 2.01 do not purport to be complete and are

qualified in their entirety by reference to the full text of the

Purchase Agreement and the Letter Agreement which were filed on February

4, 2015 as exhibits to Coach’s quarterly report on Form

10-Q. Interested parties should read the Purchase Agreement and the

Letter Agreement in their entirety.

Item 8.01 Other Events.

On May 4, 2015, Coach issued a press release announcing the completion

of the transactions contemplated by the Purchase Agreement. A copy of

the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

This document contains forward-looking statements based on management’s

current expectations. These statements can be identified by the use of

forward-looking terminology such as “may,” “will,” “should,” “expect,”

“intend,” “ahead,” “estimate,” “on track,” “to be,” “on course,”

“forward to,” “future,” “to lead,” “provide,” “to help,” “to

delivering,” “to benefiting,” “to advancing,” “believe,” “remains,” “to

reinvigorate,” “to achieve,” “to enable,” “to realize,” “return to,” “to

acquire,” “to execute,” “are positioned to,” “continuing to,”

“trajectory,” “potential,” “project,” “guidance,” “target,” “forecast,”

“anticipated,” or comparable terms. Future results may differ materially

from management’s current expectations, based upon risks and

uncertainties such as expected economic trends, the ability to

anticipate consumer preferences, the ability to control costs,

etc. Please refer to Coach’s latest Annual Report on Form 10-K, its

Quarterly Report on Form 10-Q for the quarterly period ended December

27, 2014 and its other filings with the Securities and Exchange

Commission for a complete list of risks and important factors.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Text of Press Release, dated May 4, 2015

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Dated:

|

May 4, 2015

|

|

|

|

|

|

|

|

|

COACH, INC.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Todd Kahn

|

|

|

|

|

Todd Kahn

|

|

|

|

|

Global Corporate Affairs Officer, General

|

|

|

|

|

Counsel & Secretary

|

EXHIBIT INDEX

|

99.1

|

Text of Press Release, dated May 4, 2015

|

Exhibit 99.1

Coach

Completes Acquisition of Luxury Designer Footwear Brand Stuart Weitzman

NEW YORK--(BUSINESS WIRE)--May 4, 2015--Coach, Inc. (NYSE:COH)

(SEHK:6388), a leading New York design house of modern luxury

accessories and lifestyle collections, today announced that it has

completed the acquisition of Stuart Weitzman Holdings LLC, a leading

designer and manufacturer of women's luxury footwear from private equity

firm Sycamore Partners. This transaction complements Coach’s current

global leadership position in premium handbags and accessories, while

immediately contributing to the company’s earnings as Coach continues to

make meaningful progress against its brand transformation announced

earlier this year.

Stuart Weitzman markets its products in fine specialty and department

stores worldwide and in its own retail stores in the U.S. and Europe.

Stuart Weitzman realized net revenues of $313 million for the twelve

months ended December 31, 2014.

Stuart Weitzman is continuing as Creative Director and Executive

Chairman of Stuart Weitzman Holdings LLC, and together with Wayne

Kulkin, Chief Executive Officer of Stuart Weitzman, and their management

team, remains fully committed to the growth of the business.

At the deal closing, Coach made initial cash payments of approximately

$530 million to Sycamore Partners. In addition, Coach will make up to

$44 million in contingent payments to Sycamore Partners upon the

successful achievement of selected revenue targets over the three years

following the closing of the acquisition.

Coach financed the transaction with cash on hand. The acquisition is

expected to be accretive to earnings per share, exclusive of

transaction-related charges including anticipated purchase accounting

adjustments and contingent payments related to the transaction.

About Coach, Inc.

Coach, established in New York City in 1941, is a leading design house

of modern luxury accessories and lifestyle collections with a rich

heritage of pairing exceptional leathers and materials with innovative

design. Coach is sold worldwide through Coach stores, select department

stores and specialty stores, and through Coach’s website at www.coach.com.

Coach’s common stock is traded on the New York Stock Exchange under the

symbol COH and Coach’s Hong Kong Depositary Receipts are traded on The

Stock Exchange of Hong Kong Limited under the symbol 6388.

About Stuart Weitzman Holdings LLC

Stuart Weitzman, a legendary designer and manufacturer of women’s luxury

footwear, operates 46 retail stores across the United States, including

New York, Beverly Hills, Chicago, Boston and Las Vegas. The company also

has 67 international stores including eight directly operated locations,

19 global shop-in-shops, and e-commerce sites in the United States,

Canada, Europe and Hong Kong. Stuart Weitzman footwear and accessories

are sold in more than 70 countries.

A luxury brand built upon the idea of creating a beautifully-constructed

shoe, Stuart Weitzman’s main objective has always been to merge fashion

and function. The award-winning styles created by founder and designer

Stuart Weitzman are engineered to feel as good as they look, and to look

as good as they feel.

Neither the Hong Kong Depositary Receipts nor the Hong Kong

Depositary Shares evidenced thereby have been or will be registered

under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), and may not be offered or sold in the United States or to, or for

the account of, a U.S. Person (within the meaning of Regulation S under

the Securities Act), absent registration or an applicable exemption from

the registration requirements. Hedging transactions involving these

securities may not be conducted unless in compliance with the Securities

Act.

This press release contains forward-looking statements based on

management’s current expectations. These statements can be identified by

the use of forward-looking terminology such as “may,” “will,” “should,”

“expect,” “intend,” “ahead,” “estimate,” “on track,” “to be,” “on

course,” “forward to,” “future,” “to lead,” “provide,” “to help,” “to

delivering,” “to benefiting,” “to advancing,” “believe,” “remains,” “to

reinvigorate,” “to achieve,” “to make,” “to enable,” “to realize,”

“return to,” “to acquire,” “to execute,” “are positioned to,”

“continuing to,” “trajectory,” “potential,” “project,” “guidance,”

“target,” “forecast,” “anticipated,” or comparable terms. Future results

may differ materially from management’s current expectations, based upon

risks and uncertainties such as expected economic trends, the ability to

anticipate consumer preferences, the ability to control costs, etc.

Additional risks and uncertainties related to the transaction include

the following (i) the risk that the transaction disrupts current

operations, (ii) the risk that anticipated synergies and opportunities

as a result of the transaction will not be realized, (iii) difficulties

or unanticipated expenses in integrating Stuart Weitzman into Coach;

(iv) the risk that Stuart Weitzman does not performed as planned

following the acquisition including that Stuart Weitzman will not

achieve anticipated revenue targets; and (v) potential difficulties in

employee retention following the consummation of the transaction. Please

refer to Coach’s latest Annual Report on Form 10-K, our Quarterly Report

on Form 10-Q for the quarterly period ended December 27, 2014 and its

other filings with the Securities and Exchange Commission for a list of

additional risks and important factors.

CONTACT:

Coach:

Analysts & Media:

Andrea Shaw Resnick,

Global Head Investor Relations & Corporate Communications

212/629-2618

or

Christina

Colone, Director, Investor Relations

212/946-7252

or

Stuart

Weitzman:

Karen Ferko, Executive Vice President of Global

Communications

212/287-0671

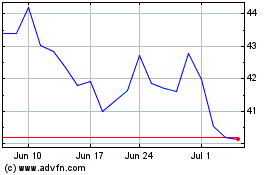

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

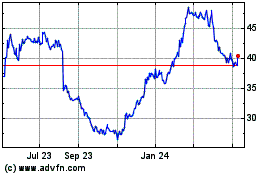

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024