Regulators Question Bid to Create an Outdoor-Gear Juggernaut -- WSJ

December 31 2016 - 3:03AM

Dow Jones News

By Austen Hufford

Federal regulators have raised questions over Bass Pro Shops'

$4.5 billion deal to buy fellow outdoor-sports-gear retailer

Cabela's Inc., creating hurdles for completion of the acquisition

and sending shares of Cabela's lower.

In a regulatory filing Friday, Cabela's said two regulatory

approvals for the deal had hit speed bumps.

The Federal Trade Commission requested additional information

from Cabela's and Bass Pro Shops earlier this week. The FTC says

the vast majority of deals are approved without additional

information requests, but Cabela's said the request doesn't mean

the agency has concluded the deal presents any anticompetitive

concerns.

Bass Pro Shops declined to comment.

Meanwhile, Capital One Financial Corp., which is buying Cabela's

credit-card business as part of the deal, also told Cabela's it

expects a banking regulator, the Office of the Comptroller of the

Currency, to eventually approve the deal -- but not before October,

when the parties to the merger can walk away, and well after the

companies involved had expected the deal to close.

The OCC said it doesn't comment on specific banks or deals.

Nathan Yates, director of research at Forward View Consulting,

said the move by the FTC was unexpected as the market is heavily

fragmented. Still, he said there are some areas on a local level

that could cause concern as the two companies have stores close to

each other.

"We believe that this merger will ultimately be approved," he

said. "The only question is whether or not any asset sales will be

necessary."

KBW analysts said the news from Capital One indicates a

lengthening of the banking deal's process. Capital One said it

continues to believe in the value of its relationship with Cabela's

and is working to meet its commitments.

Bass Pro Shops, Cabela's and Capital One had said previously

they expected both deals to close in the first half of 2017, and

the credit-card transaction was contingent on the primary deal

closing.

Cabela's said it still expects FTC approval in the first half of

the year, but it was exploring alternative structures for the deal

to allow for a closing before the October deadline.

A Bass Pro Shops-Cabela's merger would create a national chain

with more than 180 locations, roughly 40,000 workers and control of

more than 20% of the $50 billion U.S. hunting, camping and fishing

market, Stifel analyst Jim Duffy has said.

In its annual filing, Cabela's said its markets are fragmented

and competitive but also notes some of the largest competitors,

such as Wal-Mart Stores Inc. and Amazon.com Inc., don't compete in

many of the product lines it offers.

Shares of Cabela's fell 5.1% to $58.55 Friday, below the deal

price of $65.50 a share.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 31, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

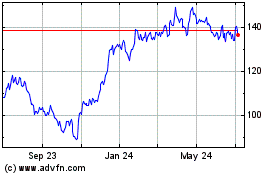

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

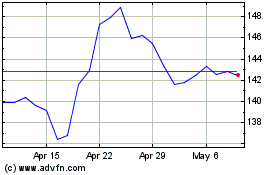

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024