Capital One Profit Falls, Revenue Increases

October 25 2016 - 5:40PM

Dow Jones News

By Josh Beckerman

Capital One Financial Corp. said its third-quarter profit fell

9.8%, although revenue increased as the lender posted loan growth

in most categories.

Shares fell 1.8% in after-hours trading to $74, even as results

topped Wall Street estimates.

Capital One, one of the country's largest credit-card lenders,

also offers traditional bank accounts, mortgages, auto loans and

commercial loans.

Provision for credit losses rose to $1.59 billion from $1.09

billion a year earlier. The increase follows reserve increases from

Capital One and several other lenders, a move that partly reflects

efforts to expand loan volume.

Last week, Capital One said its domestic delinquency rate at the

end of the quarter was 3.68%, the highest level in several

years.

Over all, Capital One reported a profit of $1 billion, or $1.90

a share, compared with $1.11 billion, or $1.98 a share, a year

earlier. Excluding items, earnings were $2.03 a share. Revenue rose

9.5% to $6.46 billion.

Analysts polled by Thomson Reuters expected earnings of $1.94 a

share on revenue of $6.42 billion.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

October 25, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

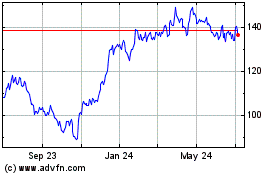

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

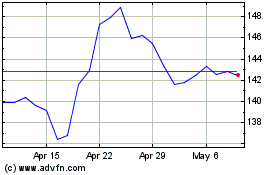

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024