BankUnited CEO to Retire, Operating Chief Named to Top Post

August 31 2016 - 6:40PM

Dow Jones News

BankUnited Inc.'s chief operating officer will become chief

executive next year, succeeding John A. Kanas, the New York banker

who led the bank's comeback following the financial crisis.

The Florida-based lender, one of the largest banks to fail

during the crisis, was bought in 2009 by a group of private-equity

firms, including W.L. Ross & Co., Carlyle Group LP, Blackstone

Group LP and Centerbridge Partners.

BankUnited said Mr. Kanas intends to retire as president and

chief executive on Dec. 31 but will stay on as board chairman.

The 45-year-old Rajinder P. Singh, who also part of the 2009

founding team, has held the title of operating chief since October

2010. He will be succeeded by Thomas M. Cornish, currently

president for the Florida region. Mr. Cornish, 57, joined the bank

in 2014.

Mr. Kanas, best known for building North Fork Bancorp into a

regional-banking powerhouse in the 1990s, was installed as CEO and

under his leadership BankUnited became a success story. Its initial

public offering was the first stock sale by a bank that failed

during the financial crisis.

The $27-a-share IPO valued the bank at $2.6 billion. Today, with

more than $26 billion under assets, the bank is valued at $3.35

billion, according to FactSet, based on Wednesday's $32.15 closing

price.

Robin Sidel contributed to this article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 31, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

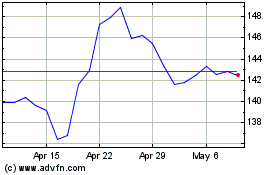

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

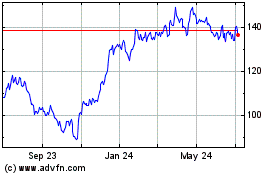

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024