By AnnaMaria Andriotis and Robin Sidel

U.S. credit-card balances are on track to hit $1 trillion this

year, as banks aggressively push their plastic and consumers grow

more comfortable carrying debt.

That sum would come close to the all-time peak of $1.02 trillion

set in July 2008, just before the financial crisis intensified, and

could signal an easing of frugal habits ingrained by the

recession.

The boom has been driven by steady economic conditions and an

improving job market that have made creditworthy consumers less

reluctant to take on debt. In addition, lenders have signed up

millions of subprime consumers who previously weren't able to get

credit.

Consumers are taking on other forms of debt, too. Auto-loan

balances surpassed $1 trillion in the first quarter, a record for

the industry, according to a report Thursday from credit bureau

Experian.

Credit cards are one of the few business lines working for banks

right now. Low interest rates have hurt margins on ordinary

lending, and a combination of tougher regulation and volatile

markets has crimped profits in trading. But banks' card operations

are benefiting from low delinquency rates and could become even

more profitable if interest rates rise.

Card issuers are trying to capitalize on the good times by

raising customers' credit limits, giving out more cards and pumping

up perks.

"We'll continue to take this opportunity as far as it will take

us," Richard Fairbank, chief executive at Capital One Financial

Corp., said in a recent conference call with investors.

Capital One, the nation's fourth-largest credit-card issuer,

said credit-card sales jumped 14% in the first quarter from a year

earlier. The company's strategy to boost card usage by raising

spending limits and giving out more cards is also paying off:

Capital One customers spent 20% more on their cards during the

first three months of the year than they did a year ago.

At Citigroup Inc., average credit-card balances in the first

quarter posted the first year-over-year increase since 2008. Such

balances also grew at Discover Financial Services Inc. and J.P.

Morgan Chase & Co., the nation's largest lender.

Even American Express Co., which historically has focused on

customers who pay their bills off every month, is now concentrating

on lending money to consumers who keep a balance.

Outstanding balances reached nearly $952 billion in the first

quarter, up 6% from a year earlier, and the highest level since

August 2009, according to the Federal Reserve.

"You could see $1 trillion this year," said David Blitzer,

managing director and chairman of the S&P Dow Jones index

committee, which tracks consumer-loan performance.

Overall consumer-spending trends remain uneven. Retail sales

were stronger than expected in April, although there are signs that

consumers are cutting back on nonessential purchases.

Because many creditworthy consumers are still cautious about

spending, lenders are turning more aggressively to subprime

borrowers. Lenders issued some 10.6 million general-purpose credit

cards to subprime borrowers last year, up 25% from 2014 and the

highest level since 2007, according to Equifax.

Citigroup and Discover, which typically focus on prime

customers, have rolled out cards aimed at less creditworthy

borrowers that carry a lower risk for issuers if those customers

can't pay their bills. Known as "secured" cards, they require

subprime borrowers to make a deposit that equals their card's

spending limits.

Many issuers are now lending to borrowers with a broader range

of credit scores, said Wayne Best, chief economist at Visa Inc.

That includes "some of the areas that have not been as fully

explored or serviced before, such as near-prime and subprime."

Overall, lenders gave out more than 104 million general-purpose

and store credit cards in 2015, up 6.5% from a year earlier and up

47% from the bottom in 2010, according to Equifax.

The boom isn't without risks. A return to economic turbulence

could trigger more defaults, which now stand near historic lows.

Industry wide, default rates on general-purpose credit cards

increased each of the first four months this year. In March,

default rates registered the largest month-over-month increase

since March 2010, according to Mr. Blitzer.

Delinquency rates on credit cards and car loans are rising in

several states hit by the energy slump as a growing number of

unemployed workers battle to keep up with their bills.

So far, though, business is good. Credit-card returns on assets,

a measure of profitability, are expected to hit 4.25% to 4.50% this

year for big lenders, compared with 4% in 2015, according to R.K.

Hammer Inc., a credit-card consulting firm. Overall bank returns

are roughly 1%, according to industry estimates.

"Credit cards are the best business in banking," said Robert

Hammer, who runs the consulting firm

Card profits could rise further as the Federal Reserve raises

benchmark interest rates, as most credit cards have variable rates

that move in tandem with the Fed.

The binge marks a reversal for lenders, many of whom retreated

from the credit-card market during the recession as defaults

increased. Some lowered credit lines for existing customers in an

attempt to limit additional losses, and others pulled back on

soliciting new customers.

Now, as the national unemployment rate remains low and more

borrowers have the income to pay their debts, competition among

lenders for new card customers is heating up again.

The new plastic comes with richer perks. Just a few years ago,

new customers who received Chase's popular co-brand card with

United Airlines received 30,000 miles and other perks. The lender

now is offering 50,000 miles on its British Airways card, with a

chance to pump that up to 75,000 miles.

In another popular perk, creditworthy borrowers can now receive

cash-back bonuses of as much as 5% in certain categories, compared

with longtime standards of 1%.

Keith Little, a telecom analyst in Maumelle, Ark., says he and

his wife recently signed up for a Citi card that returns 2% of all

purchases in cash. The couple, who stopped using credit cards in

2005 after paying off $10,000 in balances, now favors the cash-back

card for most of their purchases, which total about $2,500 a month.

The couple hopes that the windfall will defray some of the costs on

their next trip.

"Anything [that] can, goes on the Citi card," Mr. Little

said.

(END) Dow Jones Newswires

May 20, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

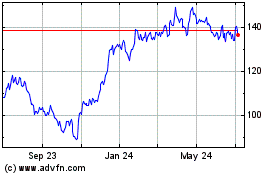

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

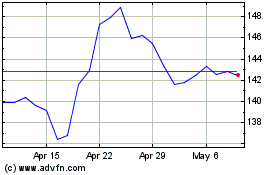

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024