AmEx CEO 2015 Compensation Valued at $22 Million

March 21 2016 - 8:50PM

Dow Jones News

American Express Co.'s Chief Executive Kenneth Chenault received

compensation in 2015 valued at $22 million, a 3.5% drop from

2014.

Based on guidelines from the Securities and Exchange Commission,

Mr. Chenault added some $18.9 million in stock and other option

awards to a base salary of $2 million in 2015, plus about $1

million in other forms of compensation, according to a regulatory

filing Monday.

American Express noted, though, that its figures valued Mr.

Chenault's total direct compensation at about $18.5 million, 16%

less than his target compensation.

The difference between the numbers from the SEC and the company

is linked to how some performance-based awards are tallied. SEC

rules counted performance-based bonuses in the calendar year that

they are awarded. As a result, the company said, equity grants in

respect of Mr. Chenault's 2015 performance—which were granted in

January 2016—will be included in next year's proxy statement;

meanwhile, the 2015 total of $22 million in this year's proxy

reflects equity awards granted in 2015 for Mr. Chenault's 2014

performance.

American Express's total direct compensation, in comparison,

matches the bonus with the year.

Earlier this month, American Express outlined plans to boost

sagging results with a focus on getting more out of its existing

cardholders rather than attracting newcomers.

In a meeting with investors and analysts, Mr. Chenault and other

top executives said the company's focus was on getting more

merchants around the world to accept AmEx cards, while encouraging

current customers to spend more on their AmEx plastic rather than

competitors' cards.

AmEx has been facing enormous competition from rival credit

cards issued by companies such as J.P. Morgan Chase & Co. and

Capital One Financial Corp., which are targeting AmEx's traditional

base of affluent consumers.

The company also faces challenges on other fronts, including the

end of a 16-year partnership with Costco Wholesale Corp. in June,

new fee limits in Europe and an uncertain economic environment. The

company has repeatedly fallen short of its revenue growth targets,

and its stock price is down 25% from year-ago levels.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

March 21, 2016 20:35 ET (00:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

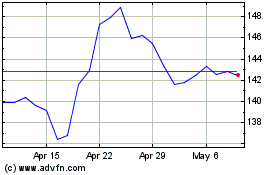

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

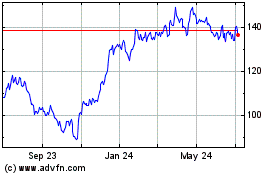

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024