By Ryan Tracy

WASHINGTON--A year ago, the financial industry stirred up a

political furor by inserting relief from postcrisis regulation into

a catch-all year-end spending bill. As Congress scrambles to wrap

up its budget for this year, banks and their political allies are

again angling to insert unrelated rule-reduction measures--and

bracing for a new battle.

The two most significant changes under consideration this year:

easing supervision requirements for banks with about $50 billion in

assets; and changing the process for subjecting BlackRock Inc. and

other big financial firms to banklike regulation.

In a Senate speech last Tuesday, Sen. Elizabeth Warren (D.,

Mass.), the bête noire of the financial industry, warned she

wouldn't let the proposals through "without a fight."

And yet, other Democrats are working more closely with the

industry and its Republican allies, saying it is time to give a

break, at least to some lenders.

A spokeswoman for Democratic Sen. Joe Donnelly of Indiana said

"it is clear that common ground exists" between moderate Democrats

and Republicans and that his priority is reducing regulatory costs

for small banks and credit unions.

Last year, the relief measure in question involved relaxing a

restriction on bank derivatives trading. Ms. Warren launched a

harsh campaign singling out Citigroup Inc. for helping to draft the

legislative language that had been attached to a bill preventing a

government shutdown, adopting the social media hashtag

#CitigroupShutdown. But the measure, which had been discussed for

years and gained bipartisan support, eventually became law as part

of the spending measures.

This year, Citigroup and the other megabanks are lying low. But

other financial institutions, from somewhat smaller big banks to

big asset managers, are pressing for changes to the landmark 2010

Dodd-Frank Act that defined an extensive new regulatory regime to

try and prevent a repeat of the 2008 financial meltdown.

"We're advocating for common-sense changes that would remove

regulatory hurdles that constrain lending and harm banks' ability

to meet their customers' needs," said Rob Nichols, president of the

American Bankers Association.

Among the most consequential of dozens of policy changes that

could be attached to a December funding deal: exempting some big

U.S. banks from annual "stress tests" and revamping the process by

which regulators single out risky financial firms as "systemically

important," and thus subject to extra supervision.

All of the proposals have support among Republicans, who control

both the House and Senate. But earlier this month some of them also

received support from Democrats, whose votes are needed to pass

bills in the Senate and often in the House on contentious

legislation.

Congress must approve a spending bill by Dec. 11 to avoid a

government shutdown.

Despite bipartisan support, the proposals still face hurdles.

The White House is putting heavy pressure on congressional

Democrats to avoid changes to Dodd-Frank, considered one of the

Obama administration's signature accomplishments, along with the

Affordable Care Act. Many of those Democrats, including Ms. Warren,

have said that even if the changes make for good policy, they

should be debated on their own rather than included in a budget

agreement.

The looming fracas over financial regulatory relief comes as

banks remain a bipartisan punching bag in the presidential

campaign.

A few hours after Ms. Warren issued her threat from the Senate

floor Tuesday, Republican candidates in Milwaukee competed with

each other during a debate to attack Wall Street.

And yet, while blasting the banks, many of them also endorsed a

top item on the industry's wish list--Dodd-Frank relief--which

helps explain why the banks may win some legislative battles, even

while appearing to lose the rhetorical war.

The breadth of legislative changes gaining traction is notable

after several years in which partisan impasses stalled nearly any

change to the 2010 Dodd-Frank financial overhaul law.

The House Financial Services Committee recently approved several

Dodd-Frank changes with bipartisan support, despite Treasury Deputy

Secretary Sarah Bloom Raskin raising concerns about the bills in a

private meeting with Democrats on the panel the day before the

vote. Treasury Secretary Jacob Lew had sent a letter characterizing

the bills as "rolling back needed oversight and weakening

safeguards for our largest and most complex financial

companies."

One bill that would make it easier for insurance companies,

asset managers, and others to avoid designation as a "systemically

important financial institution" passed 44 to 12, with 12 of 26

Democrats voting in favor.

The bill is backed by BlackRock and other big financial firms,

who say the measure would give them a chance to address regulatory

concerns before receiving the label of "systemically important" and

the stricter regulation that comes with it.

Another legislative change that appears to have even broader

support is one that would raise the $50 billion threshold at which

large banks become subject to stricter oversight, including "stress

tests" examining their ability to weather a recession.

One Republican-backed bill would direct regulators to identify

the riskiest banks based on multiple criteria, not just asset

size.

Supporters say it wouldn't change any rules for gigantic U.S.

banks, such as Citigroup, but it would ease the burden for

less-large and less-risky firms such as Capital One Financial Corp.

and M&T Bank Corp. Most Democrats on the House panel opposed

that proposal but did try to address the issue with an alternative,

indicating openness to compromise. Federal Reserve Chairwoman Janet

Yellen has also expressed support for similar relief.

In the Senate, rank-and-file Republicans and Democrats have been

meeting privately for months to discuss such issues. Last week,

Sen. Richard Shelby (R., Ala.), the banking committee chairman, and

senior member of the Senate Appropriations Committee joined the

talks with moderate Democrats such as Indiana's Mr. Donnelly, in an

effort to reach a deal, according to congressional aides.

Mr. Shelby's spokeswoman had no comment.

So far, the difficulty has been landing on a compromise that

Republicans would view as significant, but that Democrats would not

view as undermining Dodd-Frank, aides said. Using the spending bill

to move legislation presents another challenge in that the

negotiations are taking place amid other headline -grabbing

partisan fights such as funding for Planned Parenthood.

"Democrats and the administration won't allow Republicans to

hijack must-pass legislation in order to gut" financial rules and

consumer protections, Sen. Sherrod Brown (D., Ohio), the top

Democrat on the banking committee, said in a statement.

(END) Dow Jones Newswires

November 15, 2015 21:26 ET (02:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

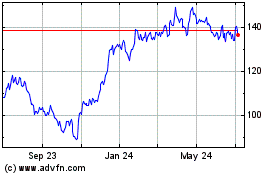

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

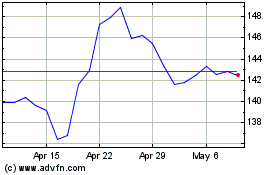

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024