Bank of America Corp. is among a number of financial firms to

temporarily cut off the flow of information to some websites and

mobile applications that aggregate consumer financial data,

according to people familiar with the matter.

The bank's move reflects the rising tension between Wall Street

and technology firms over these services, which are popular with

consumers and a cause of concern for banks. Several banks have

recently posted warnings on their websites discouraging customers

from dealing with these financial aggregators.

The Wall Street Journal previously reported that J.P. Morgan

Chase & Co. and Wells Fargo & Co. disrupted the data flow

to such sites in recent months.

"This is a shot across the bow from banks," said Michael Kitces,

director of planning research at Pinnacle Advisory Group Inc.,

which offers wealth-management services.

Consumers in recent years have flocked to aggregator sites in

particular as a way to monitor numerous financial relationships in

one place. In the past five years, the number of users on

aggregator Mint.com rose more than sixfold to 20 million, according

to the company.

While the banks have an interest in protecting their turf and

not sharing customers with tech-savvy upstarts, they have also

raised concerns that the aggregator sites may threaten consumers'

account security and the performance of bank websites. Banks said

they are within their rights to block or slow customers' access to

their own financial data.

Banks are in part responding to a surge in venture-capital

investment in personal finance startups, many of which aim to lure

customers from banks or at least make it easier for consumers to

shop among banks and startups for the best price or services.

Consumer banking and retail investing startups have raised $673

million globally so far in 2015, the most since the dot-com peak in

2000, according to Dow Jones VentureSource.

Consumers and industry executives have reported a number of

incidents in recent months that disrupted services to various

aggregator sites.

The rivalry came to a head in recent weeks when J.P. Morgan

restricted customers of Mint.com and Quicken, two popular products

of Intuit Inc., from seeing information about the customers' own

bank accounts through the Intuit products, according to the

Mountain View, Calif., financial-information company.

A spokeswoman for Intuit said "security is central to everything

we do. This includes continuously strengthening online account

security and data transmission for all our offerings, including

Mint, to safeguard customers' information."

San Francisco-based Digit.co, an aggregator that tracks

customers' balances and automatically shifts a portion to a savings

account as directed by the customer, said in an Oct. 27, blog post

that it was having "intermittent connection issues" with some users

who bank with J.P. Morgan.

The issues affected Digit's ability to report checking account

balances and to transfer some of the consumer's money into savings.

The outage has since been resolved, Digit said Friday.

"We know that our customers love these apps, so we're working

with the providers to make these interactions more secure," a J.P.

Morgan spokeswoman said in an email. "But in the meantime, we want

our customers to realize that they may be trading account security

for convenience when handing over their password" to third-party

sites.

J.P. Morgan Chairman and CEO James Dimon has publicly complained

about the rise of the aggregator sites and the implications for

data security.

Wells Fargo added an additional level of security to its

accounts last month that a bank spokesman said "may inadvertently

impact the ability of financial aggregators to gather customer

information."

Bank of America's action dates to July, when the firm took steps

that led to at least two aggregators being shut out, according to

people familiar with the matter. One of the aggregators was shut

out for about four hours, the people said.

"Our highest priority is to serve our customers in a secure

manner across the various channels we provide to them directly,"

said a Bank of America spokesman. "We actively manage any

trade-offs needed to ensure this."

The recent snafus have frustrated at least some customers at

aggregators. The recent Digit interruption with J.P. Morgan "threw

my financial life in disarray," said Henry Yeh, a systems engineer

from San Francisco who is a customer of both companies. "I'm

someone who places complete faith in technology to make smarter

decisions than I would."

"Banks might say they own the data, but they're my

transactions," said John Luciano, founder of Aqumulate, an

aggregation service for financial advisers. "Who are they to say I

can't view them over here?"

A banking-industry group said Monday that it is developing

security guidelines that it wants financial aggregators to

follow.

The recommendations, set to be released this month, would aim to

get aggregators to use more of security practices that banks use.

"Clearly, there is convenience here for consumers, but let's make

sure the data is secure," said Bill Nelson, chief executive of the

group, known as FS-ISAC.

"Aqumulate utilizes the same security measures that the big

banks do," said Mr. Luciano.

The view from some banks is that if a customer willingly

provides passwords and login information, whether to a friend or

aggregator, the bank wouldn't be on the hook if that account lost

money through a hack. No aggregator has been the victim of a known

major data breach.

To collect information seamlessly, aggregators often require

that customers turn over bank-account passwords. Banks including

J.P. Morgan, Capital One Financial Corp. and Fifth Third Bancorp

have warned customers that such sharing could be a security

risk.

Aggregators "may be smaller startup companies that do not have

sophisticated security and fraud teams," noted Fifth Third on its

website. Capital One, which is one of the largest credit-card

issuers in the U.S., told customers in a notice on its website: "If

you choose to share account access information with a third-party,

Capital One is not liable for any resulting damages or losses."

A Capital One spokeswoman said, "We have that language in place

for security reasons. We may need to block access to a specific

aggregator if they experience a data security issue in order to

protect our customers and their information."

Fifth Third declined to comment.

Robin Sidel

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 20:45 ET (01:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

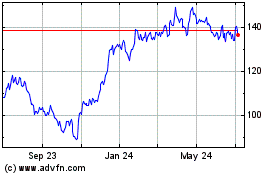

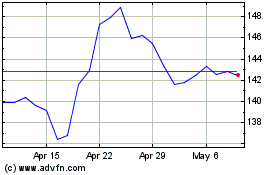

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024