American Apparel Agrees to $90 Million Asset-Based Infusion

August 17 2015 - 7:00PM

Dow Jones News

American Apparel Inc. has reached an agreement with creditors

for a $90 million asset-based infusion, averting default.

Still, the retailer warned Monday a bankruptcy threat remains

given its financial results thus far and its projections for the

next four fiscal quarters.

The retailer had warned last week it had about $13 million of

available cash, roughly the amount of an interest payment due on

Oct. 15—and risked default unless it raised another cash infusion

or refinance its debt.

As of Aug. 11, the retailer said Monday, it was down to $11.2

million in cash.

The company, which has been staving off bankruptcy through a

series of cash infusions, last amended its $50-million line of

credit with Capital One in March, according to regulatory

filings.

A day later, Moody's Investors Service on Wednesday cut American

Apparel's rating to Caa3, nine notches into junk territory, saying

the retailer's financial condition was "untenable."

The amended credit facility matures on April 4, 2018.

The company's stock, which ended the year at $1.03, closed

Monday at 15 cents.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 17, 2015 18:45 ET (22:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

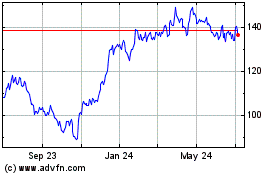

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

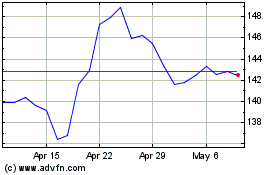

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024