GE to Sell Health-Care Financial Services Operations to Capital One

August 11 2015 - 5:00PM

Dow Jones News

General Electric Co. said it has reached an agreement to sell

$8.5 billion of health-care related loans and its health-care

financial services lending business to Capital One Financial Corp.

for about $9 billion.

Capital One expects to complete the deal in the fourth

quarter.

Separately, GE said it has signed an agreement with another

buyer to sell about $600 million of real estate equity

investments.

The news comes as GE works to sell off the bulk of its finance

arm and refocus on its industrial business. The decision to exit

finance is the most momentous shift of Jeff Immelt's multiyear

realignment of the company he inherited almost 14 years ago.

GE previously said it has signed $68 billion worth of sales for

the lending business and is on track to meet its goal of selling

$100 billion in assets by the end of the year.

Write to Lauren Pollock at lauren.pollock@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

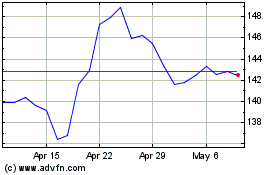

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

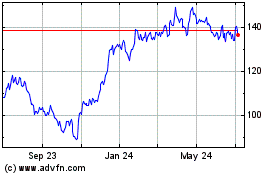

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024