Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 12 2015 - 6:05AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement No. 333-203125

May 11, 2015

FIXED-TO-FLOATING RATE NON-CUMULATIVE PERPETUAL PREFERRED STOCK, SERIES E

Pricing Term Sheet

| Issuer: |

Capital One Financial Corporation |

| Security: |

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series E of the Issuer (the “Preferred Stock”) |

| Expected Security Ratings:* |

Ba1 / BB / BB (Moody’s / S&P / Fitch) |

| Liquidation Preference: |

$1,000 per share of Preferred Stock |

| Dividend Rate (Non-Cumulative): |

From May 14, 2015 to, but excluding June 1, 2020, 5.55% and from and including June 1, 2020, three month LIBOR plus a spread of 3.80%. |

| Dividend Payment Dates: |

From May 14, 2015 to, but excluding June 1, 2020, semi-annually in arrears on June 1 and December 1 of each year, commencing on December 1, 2015. From and including

June 1, 2020, quarterly in arrears on March 1, June 1, September 1 and December 1 of each year, commencing on September 1, 2020. |

| Day Count: |

During the Fixed-Rate Period, 30/360; during the Floating Rate Period, Actual/360. |

| Settlement Date: |

May 14, 2015 (T+3) |

| Optional Redemption: |

The Issuer may redeem the Preferred Stock at its option, (i) in whole or in part, from time to time, on any dividend payment date on or after June 1, 2020 at a redemption price equal

to $1,000 per share, plus any declared and unpaid dividends, or (ii) in whole but not in part, at any time within 90 days following a regulatory capital treatment event (as defined in the preliminary prospectus supplement dated May 11,

2015), at a redemption price equal to $1,000 per share, plus any declared and unpaid dividends. |

| |

Any redemption of the Preferred Stock is subject to the Issuer’s receipt of any required prior approval by the Board of Governors of the Federal Reserve System

(the “Federal Reserve”) and to the satisfaction of any conditions set forth in the capital guidelines or regulations of the Federal Reserve applicable to redemption of the Preferred Stock. |

| Over-Allotment Option: |

None. |

| Listing: |

The Preferred Stock will not be listed on a securities exchange. |

| Public Offering Price: |

$1,000 per share of Preferred Stock |

| Net Proceeds (before expenses) to Issuer: |

$990,000,000 |

| Joint Book-Running Managers: |

Barclays Capital Inc., Credit Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Wells Fargo Securities, LLC and Capital One Securities Inc.

|

| Co-Managers: |

Blaylock Beal Van, LLC, CastleOak Securities, L.P., MFR Securities, Inc. and Samuel A. Ramirez & Company, Inc. |

| CUSIP/ISIN for the Preferred Stock: |

14040HBH7 / US14040HBH75 |

| *Note: |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. |

Capital One Financial Corporation has filed a registration statement (including a prospectus and preliminary prospectus supplement) with the SEC for

the offering to which this communication relates. Before you invest, you should read each of these documents and the other documents Capital One Financial Corporation has filed with the SEC and incorporated by reference in such documents for more

complete information about Capital One Financial Corporation and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, you may obtain a copy of these documents by calling Barclays

Capital Inc. toll-free at 888-603-5847, Credit Suisse Securities (USA) LLC toll-free at 800-221-1037, J.P. Morgan Securities LLC collect at 212-834-4533, Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, Wells Fargo Securities, LLC

toll-free at 800-326-5897, and Capital One Securities Inc. toll-free at 800-666-9174, Attn: Compliance.

Any disclaimers or other

notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers were automatically generated as a result of this communication being sent via Bloomberg or another email system.

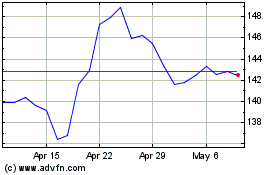

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

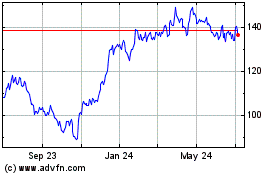

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024