UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

March 11, 2015

Date of Report (Date of earliest event reported)

__________________________________

CAPITAL ONE FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________

|

| | |

Delaware | 1-13300 | 54-1719854 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

1680 Capital One Drive, McLean, Virginia | 22102 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (703) 720-1000

(Former name or former address, if changed since last report)

__________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 8.01 | Other Information. |

On March 11, 2015, Capital One Financial Corporation (the “Company”) issued a press release announcing that the Board of Governors of the Federal Reserve had completed its review under the Comprehensive Capital Analysis and Review (“CCAR”) process and that it did not object to the Company’s proposed capital plan submitted pursuant to CCAR. The Company expects to increase its quarterly dividend from $0.30 per share to $0.40 per share starting with the dividend for the first quarter of 2015, subject to final approval of the Board of Directors at its scheduled meeting in April. The Company also announced that its Board of Directors has authorized the repurchase of up to $3.125 billion of shares of the Company’s common stock from the second quarter of 2015 through the end of the second quarter of 2016. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The timing and exact amount of any common stock repurchases will depend on various factors, including market conditions, opportunities for growth and the Company’s capital position and amount of retained earnings. The Company’s share repurchase program does not include specific price targets, may be executed through open market purchases or privately negotiated transactions, including utilizing Rule 10b5-1 programs, and may be suspended at any time.

|

| | |

Item 9.01 | Financial Statements and Exhibits. |

(d) | Exhibits |

|

| | |

Exhibit No. | | Description of Exhibit |

99.1 | | Press Release, dated March 11, 2015 |

Cautionary Statements Regarding Forward-Looking Statements.

The attached press release and information provided pursuant to Items 8.01 and 9.01 contain forward-looking statements, which involve a number of risks and uncertainties. The Company cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that the Company files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2014.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| CAPITAL ONE FINANCIAL CORPORATION |

Dated: March 11, 2015 | By: | /s/ John G. Finneran, Jr. |

| | John G. Finneran, Jr. |

| | General Counsel and Corporate Secretary |

3

Exhibit 99.1

Media Release

Contact:

Tatiana Stead, 703-720-2352

Tatiana.Stead@capitalone.com

Julie Rakes, 804-284-5800

Julie.Rakes@capitalone.com

FOR IMMEDIATE RELEASE: March 11, 2015

Capital One’s CCAR Capital Plan Receives No Objection from the Federal Reserve

Expects to repurchase $3.125 billion of shares of common stock through the end of the second quarter of 2016; Expects to increase quarterly dividend to $0.40 per share

McLean, Va. (March 11, 2015) – Capital One Financial Corporation (NYSE:COF) today announced that the Federal Reserve has completed its 2015 Comprehensive Capital Analysis and Review (“CCAR”) and did not object to Capital One’s proposed capital plan submitted on January 5, 2015. Capital One’s submission included a planned increase in the quarterly dividend on its common stock from the current level of $0.30 per share to $0.40 per share. Consistent with the capital plan, Capital One expects to declare a quarterly dividend of $0.40 per share for the first quarter of 2015, subject to final approval of the Board of Directors at its scheduled meeting in April. In addition, the company’s Board of Directors has authorized the repurchase of up to $3.125 billion of shares of the company’s common stock beginning in the second quarter of 2015 through the end of the second quarter of 2016.

The timing and exact amount of any Capital One common stock repurchases will depend on various factors, including market conditions, opportunities for growth, and the company’s capital position and amount of retained earnings. Capital One's share repurchase program does not include specific price targets, may be executed through open market purchases or privately negotiated transactions, including utilizing Rule 10b5-1 programs, and may be suspended at any time.

Forward Looking Statements

Certain statements in this release are forward-looking statements, which involve a number of risks and uncertainties. Capital One cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that Capital One files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2014.

About Capital One

Capital One Financial Corporation (www.capitalone.com) is a financial holding company whose subsidiaries, which include Capital One, N.A., and Capital One Bank (USA), N. A., had $205.5 billion in deposits and $308.9 billion in total assets as of December 31, 2014. Headquartered in McLean, Virginia, Capital One offers a broad spectrum of financial products and services to consumers, small businesses and commercial clients through a variety of channels. Capital One, N.A. has branches located primarily in New York, New Jersey, Texas, Louisiana, Maryland, Virginia and the District of Columbia. A Fortune 500 company, Capital One trades on the New York Stock Exchange under the symbol “COF” and is included in the S&P 100 index.

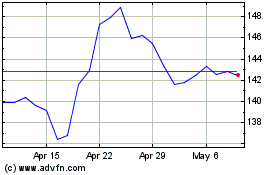

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

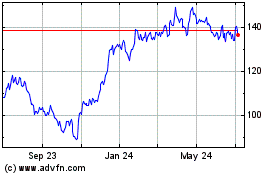

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024