Canada Oil-Sands Giant Suncor Posts Loss

October 28 2015 - 9:30PM

Dow Jones News

CALGARY, Alberta—Suncor Energy Inc., Canada's largest crude-oil

producer, reported a third quarter net loss late Wednesday on

slumping crude oil prices, setting a grim tone for the Canadian

energy industry's earnings.

The Calgary-based company posted a net loss of 376 million

Canadian dollars ($284.9 million), or 26 Canadian cents a share, in

the three months to Sept. 30. That compared with a net profit of

C$919 million, or C$0.63 per share, in the same period last

year.

On an operating, or adjusted, basis that excludes one-time

items, Suncor posted quarterly earnings of C$410 million, or C$0.28

a share, down 68.6% from the C$1.31 billion, or C$0.89 per share,

in the year-earlier period. That was above a consensus forecast of

C$0.24 a share, according to Barclays Capital Inc.

Cash flow from operations came to C$1.88 billion, well below the

C$2.28 billion it generated a year ago, which the company said

reflected "the lower upstream crude oil price environment."

Suncor is the first major Canadian energy producer to post

earnings for the quarter, but its weak results are expected to be

replicated by peers reporting later this week, including Canadian

Oil Sands Ltd., Cenovus Energy Inc. and Husky Energy Inc. Canadian

Natural Resources Ltd., the country's largest natural gas producer

and a large oil-sands operator, plans to report its third quarter

results next week.

The company maintained its full-year production forecast within

a range of 550,000-595,000 barrels of oil equivalent a day and kept

its full year capital spending budget unchanged at between C$5.8

billion and C$6.4 billion. However, that is below an original

spending target of up to C$7.8 billion.

Suncor, which launched a hostile takeover bid earlier this month

for smaller rival Canadian Oil Sands, said its offer of a C$0.25 a

share for the top stakeholder in the Syncrude oil-sands consortium

would create more efficiencies that reward shareholders. "We

believe that we can drive real improvements in Syncrude's

performance with a larger ownership interest," Chief Executive

Steve Williams said in a statement.

Canadian Oil Sands, which has rejected Suncor's overture, owns a

36.7% stake in the giant oil-sands miner Syncrude. Suncor has a 12%

stake in the seven-member consortium and Exxon Mobil Corp. owns a

25% share through its Canadian subsidiary Imperial Oil Ltd., which

is the primary operator of Syncrude.

Overall production volumes at Suncor averaged 566,100 barrels of

oil equivalent a day, up from 559,900 boe in the previous quarter

and above the 519,300 boe it produced a year ago. Oil-sands output

rose to 430,300 barrels a day, up 18,600 barrels a day on the year

and above 423,800 barrels a day last quarter.

Write to Chester Dawson at chester.dawson@wsj.com

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0031348658

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US06738E2046

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 21:15 ET (01:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

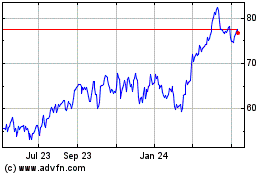

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

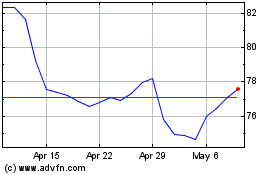

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024