Cummins Cuts Revenue Forecast on Weak Market Outlook

August 02 2016 - 10:00AM

Dow Jones News

Cummins Inc. said profit fell less than expected in the second

quarter, helped by its cost-cutting program, but lowered its

full-year revenue estimate as market conditions become even more

dire.

Cummins said it now sees full-year revenue down 8% to 10% after

it previously guided for a revenue drop between 5% and 9%.

Lower production in North America as well as weak global demand

for off-highway and power generation equipment has dented sales in

recent quarters, and Cummins said an even lower outlook in those

areas led to its revenue forecast cut. The company has also been

hurt by a stronger U.S. dollar that makes its products more

expensive overseas. Currency effects shaved 1% off its top line in

the quarter ended July 3.

Cummins also been pressured by weak commodity prices and soft

economic growth in some developing overseas markets. The company

has faced tough business conditions in markets such as Brazil.

Over all, Cummins reported a profit of $406 million, or $2.40 a

share, down from $471 million, or $2.62 a share, a year earlier.

Revenue declined 9.7% to $4.53 billion. Analysts expected $2.16 in

per-share earnings and $4.5 billion in revenue.

Sales in Cummins' engine segment, its largest, skidded 14%,

while sales in the distribution segment rose 3%. Sales in the

components unit declined 8% and revenue from its smaller power

systems division slipped 16%.

Research, development and engineering expenses fell 6.6% in the

quarter while selling, general and administrative expenses fell

2.4%.

Shares slipped 0.3% to $121.40 in premarket trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

August 02, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

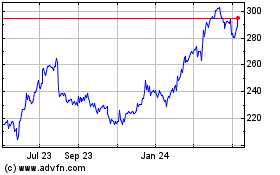

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024