Cummins Announces $500 Million Accelerated Share Repurchase

February 09 2016 - 7:34AM

Cummins Inc. (NYSE: CMI) today announced that it has entered into

an accelerated share repurchase (ASR) agreement with Goldman, Sachs

& Co. (GS &Co.) to repurchase $500 million of Cummins'

common stock. Today's ASR is part of Cummins' previously announced

share repurchase plans authorized by the Board of Directors.

Under the terms of the ASR agreement, Cummins will repurchase

$500 million of its common stock from GS &Co. with an initial

delivery of approximately 4 million shares based on current market

prices. The final number of shares to be repurchased will be based

on Cummins' volume-weighted average stock price during the term of

the transaction, less a discount. The ASR is expected to be

completed by the end of the second quarter of 2016.

"This $500 million ASR agreement reflects our view that the

Company's shares are currently trading well below intrinsic value,

and is consistent with our plans to return 75 percent of Operating

Cash Flow to shareholders in 2016," said Chairman and CEO Tom

Linebarger.

Forward-looking disclosure statement

Information provided in this release that is not purely

historical are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding our forecasts, guidance, preliminary results,

expectations, hopes, beliefs and intentions on strategies regarding

the future. Our actual future results could differ materially from

those projected in such forward-looking statements because of a

number of factors, including, but not limited to: the adoption and

implementation of global emission standards; the price and

availability of energy; the pace of infrastructure development;

increasing global competition among our customers; general

economic, business and financing conditions; governmental actions;

changes in our customers' business strategies; competitor pricing

activity; expense volatility; labor relations; and other risks

detailed from time to time in our Securities and Exchange

Commission filings, including particularly in the Risk Factors

section of our 2014 Annual Report on Form 10-K. Shareholders,

potential investors and other readers are urged to consider these

factors carefully in evaluating the forward-looking statements and

are cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements made herein are made

only as of the date of this press release and we undertake no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future events or otherwise.

More detailed information about factors that may affect our

performance may be found in our filings with the Securities and

Exchange Commission, which are available athttp://www.sec.gov or at

http://www.cummins.com in the Investor Relations section of our

website

About Cummins

Cummins Inc., a global power leader, is a corporation of

complementary business units that design, manufacture, distribute

and service diesel and natural gas engines and related

technologies, including fuel systems, controls, air handling,

filtration, emission solutions and electrical power generation

systems. Headquartered in Columbus, Indiana, (USA) Cummins

currently employs approximately 55,000 people worldwide and serves

customers in approximately 190 countries and territories through a

network of approximately 600 company-owned and independent

distributor locations and approximately 7,200 dealer locations.

Cummins earned $1.4 billion on sales of $19.1 billion in 2015.

Press releases can be found on the Web at www.cummins.com. Follow

Cummins on Twitter at www.twittter.com/cummins and on YouTube at

www.youtube.com/cumminsinc.

CONTACT: Jon Mills

Director, External Communications

Cummins Inc.

317-658-4540

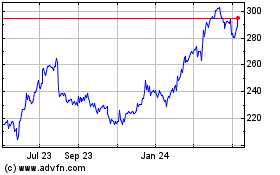

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024