Cummins Slashes Jobs, Citing Global Slowdown -- Update

October 27 2015 - 2:14PM

Dow Jones News

By Bob Tita

Cummins Inc. plans to cut about 3.7% of its workforce as lower

demand for its engines intensified during the third quarter,

causing the company's sales and profit to fall short of

expectations.

Cummins said it would trim about 2,000 white-collar jobs, most

by the end of the year. The company also is ratcheting down

manufacturing capacity at its assembly plants and intends to

evaluate whether more aggressive reductions are needed in the

coming months. Cummins lowered its 2015 guidance after

third-quarter profit dropped 11% from last year and revenue fell

5%. The company also offered a glum glimpse of 2016, noting that it

expects "challenging conditions to persist for some time."

Cummins stock sank to a new 52-week low earlier Tuesday and was

recently down 7.9% at $103.16.

Columbus, Ind.-based Cummins has been struggling for the past

several quarters with a weaker global economy, especially in China

and Brazil, and a stronger U.S. dollar that makes its products more

expensive in overseas markets. But Chairman and Chief Executive Tom

Linebarger said the severity of the downturn in many of the

company's end markets intensified during the third quarter.

"They've gone down further. We haven't clearly bottomed in most

of those markets," he said during a conference call Tuesday with

analysts. "We thought we had and we have not. Where the bottom is,

we're not exactly sure, but it doesn't look like we've reached

it."

Engine sales for electricity generators dropped 13% in the third

quarter led by an 11% decline in North America on lower sales of

backup generators to computer data centers. Third-quarter sales of

Cummins engines for off-highway vehicles, such as construction

machinery and farm equipment, fell 20% from a year earlier.

"It's hard to see any immediate [increase] in these off-road,

industrial markets," said Chief Financial Officer Pat Ward.

Cummins' significant exposure to markets for commercial trucks

and construction equipment in China and Brazil had been a strength

of the company's business mix. But international sales during the

third quarter fell 18% from a year earlier amid a strong dollar and

weaker economic growth. Cummins' overall revenue in China declined

6% during the quarter to a $775 million, as market share gains

helped blunt plunging industrywide demand for commercial trucks and

construction excavators. The company now expects 2015 sales from

China to be flat with 2014 after previously predicting a 6%

increase.

India was one of Cummins few bright spot among overseas markets,

as revenue there rose 7% during the third quarter on improving

sales of truck engines and power generators. The company expects

overall sales in India to rise about 12% this year.

Cummins had been able to offset the weakness in overseas markets

with strong demand for truck engines in North America where

heavy-duty truck sales this year are expected to be the highest in

a decade. But Cummins' third-quarter sales of heavy-duty truck

engines dropped 9% from last year amid slowing orders.

"The production's been running higher than orders," said Rich

Freeland, chief operating officer. "It's evident now that retail

sales [of trucks] and production will be down going forward."

Overall for the third quarter, Cummins reported a profit of $380

million, or $2.14 a share, down from $423 million, or $2.32 a

share, a year earlier. Revenue declined to $4.62 billion from $4.89

billion last year. Analysts expected $2.60 in earnings per share

and $4.91 billion in revenue.

Cummins warned that sales would be flat to down 2% after

previously predicting growth of 2% to 4%. The company also scaled

back its 2015 profit margin guidance before interest and taxes to

12.75% to 13%, implying earnings per share of about $8.95 at the

middle of the range. Analysts were expecting $9.95 a share.

Write to Bob Tita at robert.tita@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 13:59 ET (17:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

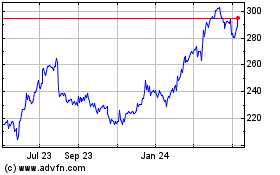

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024