Steve Ells built Chipotle Mexican Grill Inc. into a

restaurant-industry leader by playing offense, brashly touting

fresher and more virtuous food than competitors. His company

boasted of "food with integrity" and ridiculed rivals for using

artificial ingredients.

For much of the past few months, though, he has been playing

defense after E. coli outbreaks sickened dozens, set regulators on

the elusive trail of the cause and sent investors fleeing from the

once-hot leader in healthy fast food.

Mr. Ells, Chipotle's co-chief executive, must show he can revamp

its kitchens to avoid a repeat and revive its fortunes. Chipotle on

Tuesday reported fourth-quarter net income of $67.9 million, or

$2.17 a share, down 44% from a year earlier, on a 6.8% drop in

sales to $997.5 million. It was the first decline in quarterly

revenue since Chipotle went public in 2006.

Mr. Ells told investors Tuesday that Chipotle has prided itself

on being a safe place to eat but that "the events of the last few

months have shown us we need to do better."

People who know Mr. Ells said he has thrown himself into

overhauling Chipotle's food-safety practices, from adding

ingredients tests to altering how employees marinate meat. Some of

those efforts involve undoing practices he had trumpeted as

contributing to the freshness or quality of ingredients, such as a

move last year to start cutting tomatoes and other produce in

restaurant kitchens.

"Food safety is the most important thing," Mr. Ells has told

employees during the crisis, said a person familiar with his

pronouncements who described him as "evangelical" about the

subject. Mr. Ells declined interview requests.

What caused the E. coli may remain a mystery after the Centers

for Disease Control and Prevention said Monday the outbreaks

appeared to be over and it had closed its investigation without

pinpointing an ingredient source.

"Because we will probably never know for sure what caused this,"

Chipotle spokesman Chris Arnold said Monday, "we have taken

significant measures to improve safety for all of the ingredients

we use."

Mr. Ells's team sometimes was at odds with the CDC, which helped

investigate the outbreak of E. coli tied to Chipotle that sickened

55 people across America, as well as a smaller E. coli outbreak

that sickened five more. Chipotle executives publicly complained

the CDC was issuing too many updates. The CDC, in turn, bristled at

Chipotle's going public with statements such as Mr. Ells's

mid-January suggestion that the agency could soon declare the

outbreaks over.

Behind the scenes, Chipotle also disagreed with health officials

about the E. coli's likely source, said people familiar with the

discussions. Government officials leaned toward produce. Chipotle

concluded the E. coli was most likely from contaminated Australian

beef.

Chipotle in 2014 began importing grass-fed beef to meet its

demand for "responsibly raised" meat. It believed the E. coli

spread to other ingredients through improper food handling, said

people familiar with Chipotle.

Matthew Wise, who heads the CDC's outbreak-response team, on

Monday said it isn't uncommon for an outbreak investigation to be

inconclusive. "Because many dishes have the same ingredients and

everyone ate multiple ingredients in their meals" in the Chipotle

case, he said, "it was hard to pull out a common ingredient."

"It's largely been a collaborative relationship" with Chipotle,

Mr. Wise said last month, "but these can be highly emotional

situations."

Chipotle's Mr. Arnold said last month: "We have been diligent in

our efforts to provide CDC with the information it needs to conduct

its investigation, and we fully respect the complexity of the work

they are doing."

The crisis has been deeply personal for 50-year-old Mr. Ells, a

trained chef who borrowed from his father to start the first

Chipotle in 1993. He expanded the chain to more than 2,000

restaurants, with $4.5 billion in 2015 revenue, making it a

forerunner in ingredients like free-range meat.

But after years of rapid store growth, and double-digit sales

increases at existing restaurants in 2014, Chipotle's growth began

to slow. It faced new competitors emulating its model of serving

fresh fare fast, while traditional chains like McDonald's Corp. and

Yum Brands Inc.'s Taco Bell invaded its turf with moves to

eliminate artificial ingredients and switch to antibiotic-free

meat.

The illnesses sidetracked growth further. In addition to the E.

coli cases that started surfacing in the Pacific Northwest in late

October, they include August salmonella cases in Minnesota that

sickened 64 and outbreaks of norovirus—the leading cause of U.S.

foodborne illness— traced to Chipotles in California in August and

Boston in December that together sickened hundreds.

In December, Chipotle was served with a grand-jury subpoena as

part of a federal criminal probe seeking information on the

California norovirus outbreak. On Tuesday, Chipotle said it was

served on Jan. 28 with a subpoena broadening the investigation's

scope, requiring Chipotle to produce documents related to

companywide food-safety matters dating back to Jan. 1, 2013.

The CDC on Dec. 21 announced the smaller E. coli outbreak; it

said Monday that outbreak wasn't genetically related to the bigger

one.

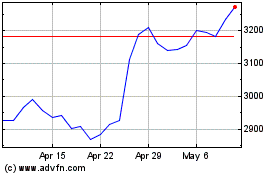

Slide in sales

Sales at existing Chipotles fell 14.6% in the fourth quarter,

dropping 30% in December, the company said Tuesday. Chipotle's

stock has fallen more than 25% since Oct. 30. The shares were down

nearly 6% at $448 in after-hours trading following its earnings

release.

Associates described Mr. Ells as a germaphobe and perfectionist

who, early on, would close restaurants if he noticed they were

dirty and help clean them.

About 15 years ago, he ordered pork from Niman Ranch, a

free-range-meat pioneer. Loving the taste, he dived into studying

new farming techniques, recalled Dan Fogarty, Chipotle's first

marketing director. That led to a review of every ingredient and

formed Chipotle's "food with integrity" philosophy.

Some people familiar with Chipotle said executives didn't always

apply the same intensity to food safety as to ingredients' taste

and origin. "By far the 'food with integrity' vision was always No.

1," said a former Chipotle operations executive. When they

discussed suppliers with employees "they'd never talk about food

safety. It doesn't mean it wasn't checked, but the discussion was

always about the story behind the supplier and keeping up with our

growth."

Chipotle's Mr. Arnold said: "Food safety has always been a

priority, though the level of emphasis is certainly greater now

than it has been."

After customers in Seattle and Portland, Ore., began reporting

E. coli illnesses, Chipotle shut all 43 restaurants in the region,

submitted thousands of ingredient samples to the FDA for testing,

and sanitized and restocked restaurants before reopening them. It

hired food-safety firm IEH Laboratories & Consulting Group to

help identify and fix the problems.

None of the ingredients tested positive for E. coli, Chipotle

has said publicly, likely because the contaminated food had been

consumed or discarded as new shipments came in.

Local health authorities initially suspected locally sourced

produce, said Washington state epidemiologist Scott Lindquist.

Chipotle examined all 64 ingredients it serves, ruling out

many.

When the CDC on Nov. 20 reported the outbreak had spread to

Minnesota, California, New York and Ohio, Chipotle's distribution

records convinced the company the culprit was red onions, cilantro

or beef, said people familiar with its investigation. Onions seemed

unlikely to Chipotle, because its supplier shipped much of its

harvest to other restaurants, but no illnesses tied to them had

been reported.

Two weeks later, the CDC reported cases in Illinois, Maryland

and Pennsylvania. Chipotle crossed cilantro off the list, because

it used a different cilantro supplier in Illinois. That left beef.

As not all sickened customers ate beef, it could have caused the

outbreak only if E. coli bacteria passed from the meat to other

ingredients through improper food handling.

Food & Water Watch, a nonprofit consumer-advocacy group, has

raised concerns about beef from Australia because some meat

producers there use their own trained employees, instead of

government inspectors, to conduct inspections at slaughterhouses. A

2014 USDA audit report of Australian meat facilities, the latest

available publicly, noted that port-of-entry records for the latter

part of 2013 and the first part of 2014 indicated that beef

products shipped to the U.S. from Australia "continue to be in

violations of United States food safety standards," citing the

presence of feces and digestive-tract material on meat.

A spokesman for Australia's Department of Agriculture and Water

Resources said: "Australia has a long history of safe and

successful beef exports over many years and is very proud of its

food safety record." He said the problems in the 2014 report have

been rectified and cited a yet-unpublished 2015 USDA audit report

that found no port-of-entry detections of E. coli contamination in

2014 and 2015. Beef-industry experts said Australian beef is as

safe as U.S. beef.

The contamination risk from meat may have been higher for

Chipotle than other chains, food-safety experts said, because it

brings fresh meat into its kitchens, unlike many big chains.

McDonald's, for example, uses frozen patties that don't thaw until

cooks throw them on the griddle.

Chipotle continues to use the Australian beef supplier but is

now testing meat for pathogens before it arrives at restaurants,

among other changes, said people familiar with Chipotle's actions.

In the past, restaurants transferred arriving raw meat to bowls,

and workers hand-rubbed it with adobo spices before marinating it

in refrigerators and cooking it.

(MORE TO FOLLOW) Dow Jones Newswires

February 02, 2016 22:35 ET (03:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

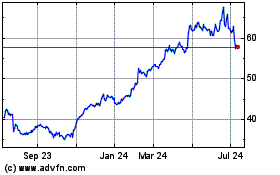

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024