Comerica Profit Grows on Cost Cuts, Smaller Loan Provisions -- Update

October 18 2016 - 2:46PM

Dow Jones News

By Rachel Louise Ensign and Austen Hufford

Comerica's earnings grew in the third quarter, beating Wall

Street expectations as concerns about energy loans receded.

The Dallas-based regional bank reported a profit of $149

million, up from $136 million in the same period a year ago. On a

per-share basis, earnings grew to 84 cents from 74 cents.

In all, revenue in the third quarter, a combination of net

interest income and noninterest income, rose 5.9% to $722 million.

Analysts polled by FactSet had anticipated 74 cents in per-share

profit and $720.9 million in revenue.

The beat was largely driven by a lower-than-expected provision

for loan losses, analysts said. When the recent slide in energy

prices began, Comerica had a relatively high share of loans in the

sector and had to take large provisions to cover loans potentially

going bad. But with oil prices up in the quarter and few loans

going bad, the bank didn't have to set aside as much.

In recent quarters the energy issues, combined with flagging

profitability metrics and a balance sheet positioned for rate

increases that haven't materialized, got the bank into hot water

with some investors. This came to a head at the bank's annual

meeting in April, when several shareholders spoke up in an unusual

show of dissent.

But since then, rising energy prices and new, aggressive

cost-cutting plans have helped Comerica. Shares are up 18% so far

in 2016 including a 3% rise after the Tuesday earnings report,

beating the performance of other regionals.

Comerica also said Tuesday it found $40 million in additional

savings through the previously announced plan, which includes cuts

to about 9% of its workforce and the closure about 8% of its bank

network. Around two-thirds of the workforce reduction will be

completed by year's end. In the quarter, Comerica took a $20

million restructuring charge.

Comerica, which does a chunk of its business in Texas and lends

to many companies in the energy sector, has continued to reduce its

exposure to energy loans, which are now 5% of its total portfolio,

even as they have stabilized. The bank had $2.5 billion in energy

business loans compared with $2.7 billion in the previous quarter.

The company took energy net charge-offs of $6 million in the

quarter, compared with $32 million in the previous quarter.

"The companies were very quick to react in the right way and do

the right things," Comerica CEO Ralph W. Babb Jr said.

The decline in energy and other business weighed on the bank's

loans, which fell slightly from the prior quarter. Across the

banking industry, business lending contracted in the quarter for

the first time in six years, the Journal reported last week.

Comerica had $631 million of nonaccrual loans in the third

quarter, meaning there is uncertainty about whether they will be

paid back on time. The bank reported $357 million in nonaccrual

loans in the year prior and $605 million in the previous quarter.

Net charge-offs were 0.13% of total loans, down from 0.38% in the

prior quarter.

Net interest margin, an important measure of lending

profitability largely tied to interest rates, was 2.66% in the

September quarter, down from 2.74% in the second quarter and up

from 2.54% a year prior.

Net interest income increased 6.6% from the same quarter a year

before on higher yields on loans and Federal Reserve deposits and

earning asset growth.

Fee-based income increased 4.6% to $272 million in the third

quarter on an increase in deferred compensation asset returns, card

fees and commercial lending fees.

Noninterest expenses rose 7.9% to $493 million on the

restructuring and increases in deferred compensation, software

expenses and FDIC insurance premiums.

For the fourth quarter, Comerica said it expects lower

noninterest expenses, excluding an estimated $30 million to $35

million in restructuring charges.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com and

Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 18, 2016 14:31 ET (18:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

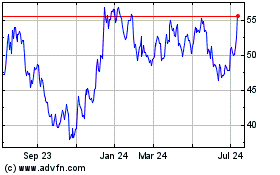

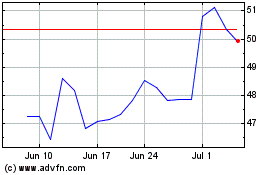

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024