Comerica Says Cost Savings Higher Than Expected

October 18 2016 - 10:20AM

Dow Jones News

Comerica posted revenue and profit increases in its latest

quarter and said a cost-cutting plan would save more than

previously estimated.

Comerica Inc. said a previously announced plan to cut about 9%

of its workforce and close about 8% of its bank network would

increase profit by $40 million more than expected, driving pretax

benefits of about $180 million in 2017 and about $270 million in

2018. Around two-thirds of the workforce reduction will be

completed by year's end. In the quarter, Comerica took a $20

million restructuring charge.

In all, the regional bank reported a profit of $149 million, up

from $136 million in the same period a year ago. On a per-share

basis, earnings grew to 84 cents from 74 cents.

Revenue in the third-quarter, a combination of net interest

income and noninterest income, rose 5.9% to $722 million. Analysts

polled by FactSet had anticipated 74 cents in per-share profit and

$720.9 million in revenue.

Comerica, which does a chunk of its business in Texas and lends

to many companies in the energy sector, has continued to reduce its

exposure to energy loans, which are now 5% of its total portfolio,

even as they have stabilized. The bank had $2.5 billion in energy

business loans compared with $2.7 billion in the previous quarter.

The company took Energy net charge-offs of $6 million in the

quarter, compared with $32 million in the previous quarter.

Comerica had $631 million of nonaccrual loans in the third

quarter, meaning there is uncertainty about whether they will be

paid back on time. The bank reported $357 million in nonaccrual

loans in the year prior and $605 million in the previous

quarter.

Net interest margin, an important measure of lending

profitability largely tied to interest rates, was 2.66% in the

Sept. quarter, down from 2.74% in the quarter before and up from

2.54% a year prior.

Net interest income increased 6.6% from the same quarter a year

before on higher yields on loans and Federal Reserve deposits and

earning asset growth.

Fee-based income increased 4.6% to $272 million in the third

quarter on an increase in deferred compensation asset returns, card

fees and commercial lending fees.

Noninterest expenses rose 7.9% to $493 million on the

restructuring and increases in deferred compensation, software

expenses and FDIC insurance premiums.

For the fourth current, Comerica said it expects lower

noninterest expenses, excluding an estimated $30 million to $35

million in restructuring charges.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 18, 2016 10:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

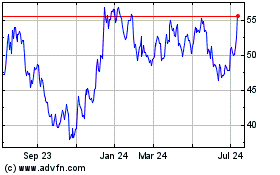

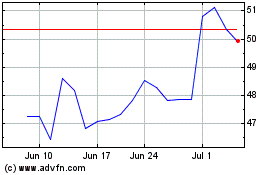

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024