Current Report Filing (8-k)

October 18 2016 - 6:49AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 13, 2016

COMERICA INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

------------

|

1-10706

----------

|

38-1998421

---------------

|

|

(State or other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

Comerica Bank Tower

1717 Main Street, MC 6404

Dallas, Texas 75201

------------------------------

(Address of principal executive offices) (zip code)

(214) 462-6831

---------------------------------------------------------------------------

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

ITEMS 2.02 and 7.01

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION AND REGULATION FD DISCLOSURE

|

Comerica Incorporated (“Comerica”) today released its earnings for the quarter ended

September 30, 2016

. A copy of the press release and the presentation slides which will be discussed on Comerica's webcast earnings call are filed herewith as Exhibits 99.1 and 99.2, respectively.

Additionally, on October 13, 2016, as part of its GEAR Up Initiative, the Board of Directors of Comerica amended and restated its tax-qualified defined benefit retirement plan (the “Pension Plan”) to freeze final average pay benefits accrued as of December 31, 2016, other than for participants who are 60 or older as of December 31, 2016, and to add a cash balance plan provision, effective January 1, 2017. These amendments are generally consistent with the amendments to the Amended and Restated Benefit Equalization Plan for Employees of Comerica Incorporated (the “SERP”) described below, except that the Pension Plan has a lower threshold for the required cash out of benefits, as required by applicable law.

As part of the amendment and restatement of the Pension Plan, eligibility will be extended to all employees who meet the age and service requirements (age 21 and one year period of service) under the Pension Plan as of January 1, 2017.

Eligible employees who were currently participating in the Comerica Incorporated Retirement Account Plan (the “RAP”) will be eligible to participate in the Pension Plan effective January 1, 2017. Contributions to the RAP for periods beginning on January 1, 2017 and thereafter will cease. The RAP is a defined contribution plan under Section 401(a) of the Internal Revenue Code, which provides a benefit to eligible employees who are not actively accruing benefits in the Pension Plan.

These changes will not reduce benefits earned by participants prior to January 1, 2017.

The information reported in Items 2.02, 7.01 and 9.01 of this report (including Exhibits 99.1 and 99.2 hereto) is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

|

|

|

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

|

In connection with the changes outlined in Item 7.01 above related to the Pension Plan, as part of the GEAR Up Initiative, the Board of Directors of Comerica amended and restated the SERP on October 13, 2016 to effectively adjust the final average pay benefit under the SERP so that only compensation and service prior to December 31, 2016 is taken into account, other than for active participants on December 31, 2016 who are 60 or older as of that date. This means that any final average pay benefit that would have been earned under the SERP based on compensation and service after December 31, 2016 is effectively frozen (other than for active participants age 60 or older). The SERP will continue to restore benefits that are capped under the Pension Plan by Internal Revenue Service (“IRS”) limits on annual compensation and benefit amounts, and the amendments to the SERP are generally necessitated by the amendments to the Pension Plan.

These amendments will not reduce benefits under the SERP that are based on service prior to January 1, 2017.

Consistent with the amendments to the Pension Plan, the Board of Directors also adopted amendments to the SERP, effective as of January 1, 2017, that will restore participants with the cash balance benefit that cannot be provided under the Pension Plan due to IRS limits and taking into consideration deferred compensation that is not included under the Pension Plan. Due to these changes to the Pension Plan and the SERP, in effect, the SERP will operate as follows:

|

|

|

|

•

|

Provides a monthly credit to each participant of 3% to 6% of compensation that is not taken into account under the Pension Plan, based on the participant’s age and period of service;

|

|

|

|

|

•

|

Interest is credited monthly with an interest factor equal to 1/12 of the annual interest rate on 30-year Treasury securities on the measurement date, but in no case less than an annual interest rate of 3.79% or exceeding an annual interest rate of 8%;

|

|

|

|

|

•

|

Participants are not eligible for a SERP benefit until they have at least 3 years of service;

|

|

|

|

|

•

|

Benefits are paid following termination of service in the form of a lump sum payment to participants who have an excess cash balance benefit in an amount that does not exceed $250,000 and a final average pay benefit less than the limit under Section 402(g) of the Internal Revenue Code (currently, $18,000), and in the form of an annuity to all other participants; and

|

|

|

|

|

•

|

Late retirement cash balance benefits are limited and will only increase by pay and interest credits for service after age 65.

|

As part of the amendments, the SERP was also renamed the Supplemental Retirement Income Account Plan.

Through the operation of the SERP in providing the excess benefits not available under the Pension Plan, active employees who are 60 or older with a final average pay SERP benefit will be eligible to receive the greater of: (x) a final average pay SERP benefit that takes into account all eligible compensation and service, including eligible compensation and service after December 31, 2016 or (y) a final average pay SERP benefit that takes into account only eligible compensation and service prior to January 1, 2017 plus a cash balance SERP benefit calculated from January 1, 2017 until severance from employment.

Of Comerica’s named executive officers, Mr. Babb and Mr. Duprey are currently participants in the SERP and Mr. Farmer will commence participation in the SERP effective January 1, 2017, with the benefit formula under the amended SERP that applies to each executive to be determined by reference to the applicable Pension Plan benefit based on his age and number of years of credited service with Comerica.

This summary of the amended SERP is qualified in its entirety by the terms of the Supplemental Retirement Income Account Plan, a copy of which is being filed herewith as Exhibit 10.1.

ITEM 9.01

FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

|

|

|

10.1

|

Supplemental Retirement Income Account Plan (formerly known as the Amended and Restated Benefit Equalization Plan for Employees of Comerica Incorporated) (amended and restated October 13, 2016, with amendments effective January 1, 2017)

|

|

|

|

|

99.1

|

Press Release dated

October 18, 2016

|

|

|

|

|

99.2

|

Earnings Presentation Slides

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COMERICA INCORPORATED

By:

/s/ John D. Buchanan

Name: John D. Buchanan

Title: Executive Vice President - Governance,

Regulatory Relations and Legal Affairs,

and Corporate Secretary

October 18, 2016

EXHIBIT INDEX

|

|

|

|

10.1

|

Supplemental Retirement Income Account Plan (formerly known as the Amended and Restated Benefit Equalization Plan for Employees of Comerica Incorporated) (amended and restated October 13, 2016, with amendments effective January 1, 2017)

|

|

|

|

|

99.1

|

Press Release dated

October 18, 2016

|

|

|

|

|

99.2

|

Earnings Presentation Slides

|

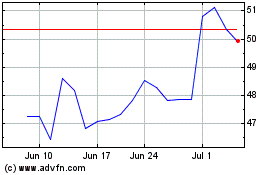

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

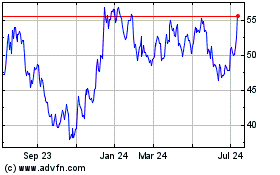

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024