Comerica to Cut Workforce, Close Locations -- Update

July 19 2016 - 2:24PM

Dow Jones News

By Rachel Louise Ensign and Austen Hufford

Comerica Inc. became the latest bank to announce major cost cuts

in a move the lender says will help it cope with profit-sapping low

interest rates that have no end in sight.

The Dallas-based lender said Tuesday in its second-quarter

earnings release that it would cut about 9% of its workforce and

shut down around 40 locations. The bank is also under pressure from

investors to bolster performance and consider potentially selling

itself.

Chief Executive Ralph W. Babb Jr. told investors the new

cost-cutting and revenue-enhancement plans are "fundamentally

changing the way we operate."

The regional bank reported a quarterly profit of $104 million,

down from $135 million a year prior. On a per-share basis, earnings

fell to 58 cents from 73 cents. The bottom line includes 19 cents a

share of charges related to the new plans.

Revenue, a combination of net interest income and noninterest

income, rose 5.2% to $714 million. Analysts polled by Thomson

Reuters had anticipated 69 cents in per-share profit on $715

million in revenue.

The lender's plan is expected lead to $70 million more revenue

through initiatives such as cross-selling and $160 million of cost

reductions by the end of 2018. The company will take restructuring

charges of between $140 million and $160 million over that

time.

The bank's results reflected two key macroeconomic developments

in the second quarter: falling interest rates and rising oil

prices. The former squeezed the bank's lending profits, while the

latter lifted the bank's earnings, which had been stung in recent

quarters by higher provisions for potential loan losses in the

sector.

The efficiency announcement comes after some Comerica

shareholders mounted an effort to pressure the bank to bolster

returns. At the bank's annual meeting in April, several

shareholders publicly voiced their dissatisfaction with the

lender's recent performance in an unusual show of dissent at such

an event. Large shareholders told the bank it has failed to earn

acceptable returns for too long and may be better off as part of a

larger bank that can cut costs. The bank didn't give new specifics

on potential deal talks on Tuesday.

Analysts were divided on whether the new effort would be enough

to placate concerns. Evercore ISI analyst John Pancari wrote the

announcement was "likely enough to appease" investors. The bank's

shares rose 1.5% after the earnings announcement in Tuesday

afternoon trading.

CLSA analyst Mike Mayo, who has spearheaded an effort by several

large shareholders to persuade the bank to explore a sale, was

skeptical about the plan. "Why does management have 2 1/2 more

years when they've underperformed for so long?," he said, adding

that Comerica didn't take the question he tried to ask on the

earnings call. A Comerica spokesman declined to comment.

Comerica said the branch closures would represent about 8% of

its total 473-branch network. The initial job cuts in the third

quarter would be managers, and the rest of the cuts would be made

by the end of 2017, Mr. Babb said in an interview.

Lower rates, which after the Brexit vote seem likely to stick

around for longer than anticipated, also weighed on the bank. Net

interest margin, an important measure of lending profitability

largely tied to interest rates, came in at 2.74% in the June

quarter, down from 2.81% in the quarter before and up from 2.65% a

year prior. Net interest income increased 5.7% from the same

quarter a year earlier on higher yields from loans and Federal

Reserve deposits and asset growth.

The energy lending situation improved somewhat in the second

quarter as oil prices rose from their first-quarter lows. The bank

set aside less money for potential loans going bad than in the

prior quarter and reduced its total loans in the sector. Still, 57%

of its energy loans were criticized.

Fee-based income increased in the quarter. Noninterest income

grew 4.3% to $269 million in the second quarter on increased card

fees from merchant payment processing services and government card

programs.

Higher software expenses and FDIC insurance premiums drove

noninterest expenses up 19.9% to $519 million. The double-digit

percent increase also includes the restructuring charge of $53

million for the quarter.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com and

Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 19, 2016 14:09 ET (18:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

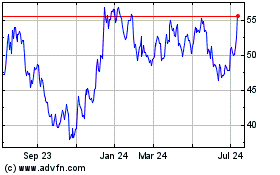

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

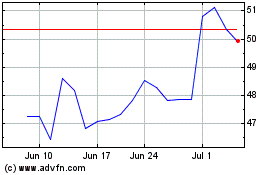

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024