Comerica to Cut Workforce, Close Locations

July 19 2016 - 8:50AM

Dow Jones News

Comerica Inc. said it would cut about 9% of its workforce and

shut down 40 of its locations in a move to cut costs and increase

profitability, as the bank works to recover from energy-related

weakness and lowered profitability across the banking sector.

The regional bank is taking $53 million in severance-related

expenses and professional-service charges in the quarter related to

the cost-cutting and revenue-enhancing initiative. Comerica

estimates it will result in $70 million in revenue increases by the

end of 2018 and $160 in cost reductions. The company will take

restructuring charges of between $140 million and $160 million in

total through 2018.

Comerica said the closures would represent about 8% of its total

473-bank network.

The regional bank reported a quarterly profit of $104 million,

down from $135 million a year prior. On a per-share basis, earnings

fell to 58 cents from 73 cents. The bottom line includes 19 cents a

share of charges related to the cost-cutting plans.

Revenue, a combination of net interest income and noninterest

income, rose 5.2% to $714 million.

Analysts polled by Thomson Reuters had anticipated 69 cents in

per-share profit on $715 million in revenue.

In April, Comerica said it hired a consultant group to help it

undergo a review of its expenses and revenues. That resulted in the

plans released Tuesday.

Comerica does a chunk of its business in Texas and lends to many

companies in the energy sector, who have been hit by the decline in

energy prices, said its customers have worked to reduce their bank

debt. The bank said its energy loans had declined by $356 million

from the previous quarter.

Comerica had $550 million of nonaccrual loans in the quarter,

meaning there is uncertainty about whether they will be paid back

on time. The bank reported $284 million in nonaccrual loans in the

year prior and $627 million in the previous quarter.

Net interest margin, an important measure of lending

profitability largely tied to interest rates, came in at 2.74% in

the June quarter, down from 2.81% in the quarter before and up from

2.65% a year prior. Net interest income increased 5.7% from the

same quarter a year before on higher yields from loans and Federal

Reserve deposits and asset growth.

Fee-based income increased in the quarter. Noninterest income

grew 4.3% to $269 million in the second quarter on increased card

fees from merchant payment processing services and government card

programs.

Higher software expenses and FDIC insurance premiums drove

noninterest expenses up 19.9% to $519 million. The double-digit

percent increase also includes the restructuring charge.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 19, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

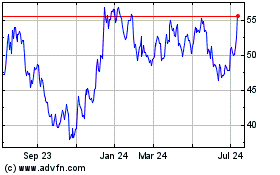

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

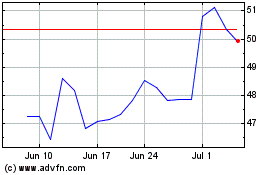

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024