By Rachel Louise Ensign

The biggest bank based in Texas, Comerica Inc., has long

maintained that the burden of low energy prices would be

manageable.

On Tuesday, the bank's executives conceded they are causing more

pain than anticipated.

The Dallas-based bank's first-quarter earnings were hit hard by

souring energy loans, leading the chief executive to say the bank

needs to "earn the right to remain independent" and would consider

potential deals.

It also said it has hired a consulting firm to help the bank

become more profitable through expense cuts and revenue

enhancements.

The bank said profit, which missed analysts' expectations, fell

by more than half in the first quarter as it increased its reserves

for bad energy loans due to persistently low oil and gas

prices.

More than half of the energy loans at the bank are marked as

"criticized" now, meaning they are at higher risk of default.

Deteriorating energy loans are widespread, weighing on the

first-quarter earnings of the largest U.S. banks, including J.P.

Morgan Chase & Co. and Wells Fargo & Co. But the suffering

is especially acute at Comerica, where 6% of loans are

energy-related, higher than at most other large banks.

With headquarters near the Barnett Shale, where the shale

revolution has its roots, Comerica played down the impact even as

the low prices persisted for longer than many expected.

CEO Ralph Babb Jr. said on Tuesday that the bank's "fundamental

view on the energy sector has not changed significantly," even

though it boosted reserves for bad energy loans. In the first

quarter the figure was nearly 8%, up from around 4% in the prior

quarter.

Beyond energy, the bank already was struggling with low interest

rates that have made lending less profitable.

Mr. Babb said the consulting firm, Boston Consulting Group, was

expected to look at "everything," but didn't specify exactly when

the bank would start implementing the firm's suggestions.

Mr. Babb also said Comerica would "not hesitate" to consider

strategic alternatives, though no specifics were given on any

potential deal opportunities. Shares rose 4.2% to $41.64

Tuesday.

Investment firm Hudson Executive, which former J.P. Morgan Chase

deal makers Douglas Braunstein and James Woolery started last year,

disclosed an 0.8% stake in Comerica earlier this year. Hudson,

which seeks to work behind the scenes to make changes at companies,

has been engaging with other Comerica investors and management and

believes the bank needs to cut costs and explore strategic

alternatives, people familiar with the matter said.

Tuesday's announcements "made it clear that they are receptive

to the frustrations of investors," said John Pancari, analyst at

Evercore ISI.

With a market cap of roughly $7 billion, the list of possible

suitors for the bank is relatively short. Most large U.S. banks

that could conceivably buy Comerica are on the deal-making

sidelines due to regulatory constraints, other pending deals or

self-imposed abstentions from mergers. Some large international

banks have expressed interest in U.S. lenders in recent years.

Comerica was in the bottom 25% of its peer group for earnings

growth and return on assets between 2013 and 2015, according to a

securities filing from the bank.

Comerica's criticized energy-related loans increased 41% to $2

billion, or 56% of the segment's loans. That was up from 38% of

energy-related loans in the fourth quarter. Executives attributed

some of that shift to new guidelines on how to evaluate energy

loans issued by regulators earlier this year.

Comerica executives also said they saw a few energy customers

draw down their credit lines, but that this wasn't a widespread

issue. The bank said exploration and production customers'

borrowing capacity has been cut an average of 22% in an ongoing

spring review.

The bank's overall provision for credit losses rose to $148

million from $60 million in the prior quarter.

The energy issues overshadowed the benefit from the Federal

Reserve interest-rate increase. Higher rates boosted revenue at

Comerica, which is poised to benefit as rates rise.

The bank said it expected to gain about $90 million in revenue

in 2016 from the December 2015 rate increase, which helped lift the

net interest margin, a key metric of lending profitability, to

2.81% from 2.58% in the prior quarter.

At the same time, Mr. Babb conceded that the rate-sensitive

position hurt the bank over the past few years. "In hindsight, we

left too much yield on the table during a weak recovery," he

said.

--David Benoit and Austen Hufford contributed to this

article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 19, 2016 18:27 ET (22:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

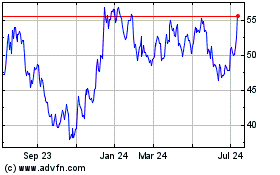

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

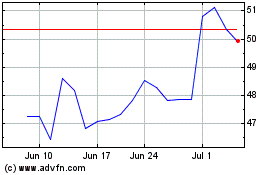

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024