UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 10, 2015

COMERICA INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | |

Delaware ------------ |

1-10706 ---------- |

38-1998421 --------------- |

(State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

Comerica Bank Tower

1717 Main Street, MC 6404

Dallas, Texas 75201

--------------------------------------------------------------------

(Address of principal executive offices) (zip code)

(214) 462-6831

------------------------------------------------------------------------

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| |

ITEM 5.02 | DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

On November 10, 2015, the Governance, Compensation and Nominating Committee (the “Committee”) of the Board of Directors of Comerica Incorporated (“Comerica”) approved a new form of senior executive long-term performance restricted stock ("SELTPP") unit award agreement and a new form of non-qualified stock option agreement that will be used for future grants to executive officers of SELTPP units and non-qualified stock options, respectively. The Committee made certain technical updates to these award agreements, including (1) revisions to the SELTPP unit award agreement related to changes to the Financial Accounting Standards Board's concept of "extraordinary items" and (2) revisions to the non-qualified stock option agreement to treat options granted in the calendar year of retirement the same way that other options are treated in the case of retirement, which will ease administration of Comerica's long-term incentive plan.

The new form of SELTPP unit award agreement and new form of non-qualified stock option agreement are attached hereto as Exhibits 10.1 and 10.2 , respectively, and are incorporated herein by reference. The description in this Current Report on Form 8-K of the new forms of agreement is qualified in its entirety by reference to the attached exhibits.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| |

10.1 | Form of Comerica Incorporated Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement |

| |

10.2 | Form of Comerica Incorporated Non-Qualified Stock Option Agreement |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COMERICA INCORPORATED

| |

Title: | Executive Vice President-Governance, Regulatory Relations and Legal Affairs, |

and Secretary

Date: November 17, 2015

EXHIBIT INDEX

| |

10.1 | Form of Comerica Incorporated Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement |

| |

10.2 | Form of Comerica Incorporated Non-Qualified Stock Option Agreement |

COMERICA INCORPORATED

SENIOR EXECUTIVE LONG-TERM PERFORMANCE RESTRICTED STOCK UNIT AWARD AGREEMENT

THIS AGREEMENT (this “Agreement”) between Comerica Incorporated (the “Company”) and XXXXXX (the “Award Recipient”) is effective as of XXXXXX (the “Effective Date”). Any undefined terms appearing herein as defined terms shall have the same meaning as they do in the Comerica Incorporated 2006 Long-Term Incentive Plan, as amended and/or restated from time to time, or any successor plan thereto (the “Plan”). The Company will provide a copy of the Plan to the Award Recipient upon request.

WITNESSETH:

| |

1. | Award of Restricted Stock Units. Pursuant to the provisions of the Plan, the Company hereby awards the Award Recipient, subject to the terms and conditions of the Plan (incorporated herein by reference), and subject further to the terms and conditions in this Agreement, a target senior executive long-term performance plan restricted stock unit award (the “Target SELTPP Award”) equal to XXXXX senior executive long-term performance plan restricted stock units (“SELTPP Units”). The Target SELTPP Award shall be adjusted upward or downward (as applicable) based on the achievement of the Adjusted ROCE Goal and the TSR Modifier as provided in Schedule A attached hereto (the “Performance Requirements”). The number of SELTPP Units that the Award Recipient will receive under this Agreement, after giving effect to such adjustment, is referred to as the “Final Award Number.” Each SELTPP Unit shall represent an unfunded, unsecured right for the Award Recipient to receive one (1) share of the Company’s common stock, par value $5.00 per share (the “Common Stock”), as described in this Agreement. The “Performance Period” over which the Final Award Number will be determined shall be the period beginning January __, 20__ and ending December 31, 20__. The Committee, shall, following the end of the Performance Period, determine whether and to the extent which the Performance Requirements for the Performance Period have been satisfied and the Final Award Number. The date of such determinations by the Committee for the Performance Period is referred to as the “Determination Date.” |

| |

2. | Ownership Rights. The Award Recipient has no voting or other ownership rights in the Company arising from the award of SELTPP Units under this Agreement. |

| |

3. | Dividend Equivalents. Cash dividend equivalents (the “Dividend Equivalents”) shall accrue on the shares of Common Stock underlying the SELTTP Units, whether such SELTPP Units are vested or unvested, if cash dividends are declared by the Company’s Board of Directors on the Common Stock on or after the Effective Date. The Award Recipient shall be entitled to Dividend Equivalents with respect to a number of SELTPP Units equal to the Final Award Number. Such Dividend Equivalents will be in an amount of cash per SELTPP Unit equal to the cash dividend paid with respect to a share of outstanding Common Stock. Dividend Equivalents accrued prior to the Determination Date will be paid to the Award Recipient as soon as administratively feasible after the Determination Date (but in no event later than 45 days following the Determination Date). |

| |

4. | Vesting of Award. The unvested portion of the Award is subject to forfeiture. Subject to the terms of the Plan and this Agreement, including without limitation, achievement of the Performance Requirements as set forth in Schedule A and fulfillment of the employment requirements in paragraph 10 below, the Award will vest in accordance with the following schedule (except in the case of the Award Recipient’s earlier Separation from Service due to death, Disability or Retirement or the occurrence of a Change of Control, as set forth in paragraphs 7 and 8 below): the number of SELTPP Units equal to the Final Award Number shall vest on the Determination Date (or if such date is not a business day, the business day immediately following such date). |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

| |

5. | Special Vesting and Forfeiture Terms. |

| |

a. | Forfeiture Resulting From Acts Occurring During the Grant Year. Notwithstanding any other provision of this Agreement, if it shall be determined at any time subsequent to the Effective Date and prior to the Determination Date (or, in the case of a termination due to death or Disability, the date of Separation from Service) that the Award Recipient has, during the calendar year in which the Effective Date occurs (the “Grant Year”), (i) failed to comply with Company policies and procedures, including the Code of Business Conduct and Ethics or the Senior Financial Officer Code of Ethics (if applicable), (ii) violated any law or regulation, (iii) engaged in negligent or willful misconduct, (iv) engaged in activity resulting in a significant or material Sarbanes-Oxley control deficiency, or (v) demonstrated poor risk management or lack of judgment in discharge of Company duties, and such failure, violation, misconduct, activity or behavior (1) demonstrates an inadequate sensitivity to the inherent risks of Award Recipient’s business line or functional area, and (2) results in, or is reasonably likely to result in, a material adverse impact (whether financial or reputational) on the Company or Award Recipient’s business line or functional area, all or part of the SELTPP Units granted under this Agreement that have not yet become vested at the time of such determination may be cancelled and forfeited. “Inadequate sensitivity” to risk is demonstrated by imprudent activities that subject the Company to risk outcomes in future periods, including risks that may not be apparent at the time the activities are undertaken. |

| |

b. | Forfeiture of SELTPP Units for Acts Occurring in Years other than the Grant Year. Notwithstanding any other provisions of this Agreement, if the Award Recipient receives one or more equity Awards in any calendar years other than the Grant Year (an “Other Grant Year”) pursuant to an Award Agreement that contains a clause substantially similar to paragraph (a) above, and it shall be determined that Award Recipient, as a result of risk-related behavior, should be subject to the forfeiture of all or part of any such Award granted in such Other Grant Year in accordance with the terms of such clause, then the unvested portion of the Award granted under this Agreement shall be subject to forfeiture to the extent necessary to equal the Unsatisfied Forfeiture Value (as defined below). The term “Unsatisfied Forfeiture Value” shall mean the value (as determined by the Committee in its absolute discretion) of any portion of the Award determined by the Committee to be subject to forfeiture with respect to the Other Grant Year (without regard to whether or not some portion thereof has already vested) that has in fact vested prior to such determination by the Committee. All or a portion of the SELTPP Units granted under this Agreement that have not yet become vested shall be subject to forfeiture in order to satisfy as much as possible of the Unsatisfied Forfeiture Value, and the valuation of the Award for such purpose shall be determined in the absolute discretion of the Committee. |

| |

6. | Settlement. Once vested, the Award will be settled as follows: |

| |

a. | In General. Subject to the terms of the Plan and this Award Agreement, the vested portion of the Award shall be settled in Common Stock as soon as reasonably practicable following the Determination Date, provided that the Award Recipient is employed through the Determination Date or terminates employment prior thereto as a result of Retirement; provided, however, in the event of (x) the Award Recipient’s Separation from Service due to death or Disability or (y) a Change of Control (as defined in clause A of Exhibit A of the Plan), the Award shall vest and settle as of such earlier date set forth in paragraph 7 below (the applicable settlement date is referred to herein as the “Settlement Date”). On the Settlement Date, the Company shall issue or cause there to be transferred to the Award Recipient (or, in the case of the Award Recipient’s death, to the Award Recipient’s designated beneficiary or estate, as applicable or, in the case of the Award Recipient’s Disability, to the Award Recipient’s guardian or legal representative, if applicable and if permissible under applicable law) a number of whole shares of Common Stock equal to the Final Award Number (the “Settlement Shares”). Notwithstanding the foregoing, if the Award Recipient’s Separation from Service occurs due to Disability, any such settlement of the Award by reason of such Separation from Service shall be delayed for six months from the date of the Award Recipient’s Separation from Service if the Award Recipient is considered a “specified employee” for purposes of Section 409A of the Code (as determined in accordance with the methodology established by the Company as in effect on the date of Separation from Service). |

| |

b. | Termination of Rights. Upon the issuance or transfer of Settlement Shares in settlement of the Award, the Award shall be settled in full and the Award Recipient (or his or her designated beneficiary or estate, in the case of death) shall have no further rights with respect to the Award. |

| |

c. | Certificates or Book Entry. On the Settlement Date, the Company shall, at the discretion of the Committee or its designee, either issue one or more certificates in the Award Recipient’s name for such Settlement Shares or evidence book-entry registration of the Settlement Shares in the Award Recipient’s name (or, in the case of death, to the Award Recipient’s designated beneficiary, if any). No fractional shares of Common Stock shall be issued in settlement of the SELTPP Units. |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

| |

d. | Conditions to Delivery. Notwithstanding any other provision of this Agreement, the Company shall not be required to evidence book-entry registration or issue or deliver any certificate or certificates representing Settlement Shares in the event the Company reasonably anticipates that such registration, issuance or delivery would violate Federal securities laws or other applicable law; provided that the Company must evidence book-entry registration or issue or deliver said certificate or certificates at the earliest date at which the Company reasonably anticipates that such registration, issuance or delivery would not cause such violation. |

| |

e. | Legends. The Settlement Shares shall be subject to such stop transfer orders and other restrictions as the Committee may deem reasonably advisable under the Plan or the rules, regulations, and other requirements of the Securities and Exchange Commission, any stock exchange upon which such Settlement Shares are listed, any applicable Federal or state laws or the Company’s Certificate of Incorporation and Bylaws, and the Committee may cause a legend or legends to be put on or otherwise apply to any certificates or book-entry position representing Settlement Shares to make appropriate reference to such restrictions. |

| |

7. | Vesting and Settlement on Change of Control and Separation from Service Due to Death or Disability. Notwithstanding anything in this Agreement to the contrary: |

| |

a. | Change of Control. Upon a Change of Control, the Award shall immediately and fully vest and become nonforfeitable with respect to a number of SELTPP Units equal to the Target SELTPP Award, and such SELTPP Units shall be settled for the number of shares of Common Stock underlying the Target SELTPP Award as soon as reasonably practicable following the date of such Change of Control. Notwithstanding the immediately preceding sentence, in the event that such Change of Control does not qualify as an event described in Section 409A(a)(2)(A)(v) of the Code and the regulations thereunder, the vested portion of the Award (at the level provided for in the prior sentence) shall be settled on the Determination Date (which shall be December 31, 20__); provided, however, in the event that the Award Recipient experiences a Separation from Service due to death or Disability following such Change of Control, the Award shall be settled as soon as reasonably practicable following the date of such Award Recipient’s Separation from Service due to death or Disability (subject to the last sentence of paragraph 6(a) and paragraph 7(b)), as applicable. |

| |

b. | Death or Disability. In the event of the Award Recipient’s Separation from Service due to death or Disability prior to the Determination Date (or a Change of Control), unless otherwise specifically prohibited by applicable laws, rules or regulations, a number of SELTPP Units equal to the Target SELTPP Award shall immediately and fully vest and become nonforfeitable effective as of the date of the Award Recipient’s Separation from Service due to death or Disability, and shares of Common Stock equivalent to the Target SELTPP Award shall be settled as soon as reasonably practicable following the date of such Award Recipient’s Separation from Service due to death or Disability (subject to the last sentence of paragraph 6(a) and this paragraph 7(b)), as applicable. For the avoidance of doubt, once an Award Recipient is eligible for Retirement (as set forth in paragraph 8), the Award Recipient shall not be eligible for acceleration of vesting under this paragraph 7(b) due to his or her Disability, regardless of whether he or she otherwise meets the requirements for Disability. |

| |

8. | Retirement. If the Award Recipient’s employment with the Company is terminated due to Retirement prior to the Determination Date (or a Change of Control), then the Award shall continue to vest in accordance with paragraph 4 above, subject to fulfillment of the Performance Requirement pursuant to Schedule A hereof, and shall settle in accordance with paragraph 6 above (subject to earlier vesting and/or settlement in the event of a Change of Control occurring after the date of Retirement as set forth in paragraph 7(a) above). For the purposes of this Agreement, “Retirement” shall be defined as an Award Recipient’s Separation from Service at or after age 65 or after attainment of both age 55 and 10 years of service with the Company or its Affiliates. |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

| |

9. | Cancellation of Award. The Committee has the right to cancel for no consideration all or any portion of the Award in accordance with Section 4 of the Plan if the Committee determines in good faith that the Award Recipient has done any of the following: (a) committed a felony; (b) committed fraud; (c) embezzled; (d) disclosed confidential information or trade secrets; (e) was terminated for Cause; (f) engaged in any activity in competition with the business of the Company or any Subsidiary or Affiliate of the Company; or (g) engaged in conduct that adversely affected the Company. The Delegate shall have the power and authority to suspend the vesting of or the right to receive Settlement Shares in respect of all or any portion of the Award if the Delegate makes in good faith the determination described in the preceding sentence. Any such suspension of an Award shall remain in effect until the suspension shall be presented to and acted on by the Committee at its next meeting. This paragraph 9 shall have no application following a Change of Control of the Company. |

| |

10. | Employment Requirements. Except as provided in this Agreement, in order to vest in and not forfeit the Award (subject to the fulfillment of the Performance Requirement pursuant to Schedule A), the Award Recipient must remain employed by the Company or one of its Affiliates until the Award vests on the Determination Date. If there is a Separation from Service for any reason (other than due to death, Disability or Retirement) before the Determination Date (or if earlier, a Change of Control), the Award Recipient will forfeit all of the SELTPP Units subject to this Award and the corresponding Dividend Equivalents that have not been paid as of the date of the Separation from Service unless the Committee determines otherwise. |

| |

11. | No Right to Continued Employment. Nothing in the Plan or this Agreement shall confer on the Award Recipient any right to continue in the employment of the Company or its Affiliates for any given period or on any specified terms nor in any way affect the Company’s or its Affiliates’ right to terminate the Award Recipient’s employment without prior notice at any time for any reason or for no reason. |

| |

12. | Transferability. Unless otherwise determined by the Committee, the SELTPP Units subject to this Award (including, without limitation, Dividend Equivalents) may not be assigned, alienated, pledged, attached, sold or otherwise transferred or encumbered by the Award Recipient otherwise than by will or by the laws of intestacy, and any such purported assignment, alienation, pledge, attachment, sale, transfer or encumbrance shall be void and unenforceable against the Company or any Subsidiary or Affiliate; provided, however, that the designation of a beneficiary shall not constitute an assignment, alienation, pledge, attachment, sale, transfer or encumbrance. |

| |

13. | Administration; Amendment. This Award has been made pursuant to a determination by the Committee and/or the Board of Directors of the Company, and the Committee shall have plenary authority to interpret, in its sole and absolute discretion, any provision of this Agreement and to make any determinations necessary or advisable for the administration of this Agreement. All such interpretations and determinations shall be final and binding on all persons, including the Company, the Award Recipient, his or her beneficiaries and all other interested parties. Subject to the terms of the Plan, this Agreement may be amended, in whole or in part, at any time by the Committee; provided, however, that no amendment to this Agreement may adversely affect the Award Recipient’s rights under this Agreement without the Award Recipient's consent except such an amendment made to cause the Award to comply with applicable law, stock exchange rules or accounting rules. |

| |

14. | Binding Nature of Plan. The Award is subject to the Plan. The Award Recipient agrees to be bound by all terms and provisions of the Plan and related administrative rules and procedures, including, without limitation, terms and provisions and administrative rules and procedures adopted and/or modified after the granting of the Award. In the event any provisions hereof are inconsistent with those of the Plan, the provisions of the Plan shall control, except to the extent expressly modified herein pursuant to authority granted under the Plan. |

| |

15. | Compliance with Laws and Regulations. The Award and the obligation of the Company to deliver the Settlement Shares subject to the Award are subject to compliance with all applicable laws, rules and regulations, to receipt of any approvals by any government or regulatory agency as may be required, and to any determinations the Company may make regarding the application of all such laws, rules and regulations. |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

| |

16. | Notices. Any notice to the Company under this Agreement shall be in writing to the following address or facsimile number: Human Resources - Executive Compensation, Comerica Incorporated, 1717 Main Street, MC 6515, Dallas, TX 75201; Facsimile Number: 214-462-4430. The Company will address any notice to the Award Recipient to his or her current address according to the Company’s personnel files. All written notices provided in accordance with this paragraph 16 shall be deemed to be given when (a) delivered to the appropriate address(es) by hand or by a nationally recognized overnight courier service (costs prepaid); (b) sent by facsimile to the appropriate facsimile number, with confirmation by telephone of transmission receipt; or (c) received by the addressee, if sent by U.S. mail to the appropriate address or by Company inter-office mail to the appropriate mail code. Either party may designate in writing some other address or facsimile number for notice under this Agreement. |

| |

17. | Withholding. The Award Recipient authorizes the Company to withhold from his or her compensation, including the SELTPP Units granted hereunder and the Settlement Shares issuable hereunder, to satisfy any income and employment tax withholding obligations in connection with this Award. No later than the date as of which an amount first becomes includible in the gross income of the Award Recipient for Federal income tax purposes with respect to any Settlement Shares subject to this Award, the Award Recipient shall pay to the Company, or make arrangements satisfactory to the Company regarding the payment of, all Federal, state and local income and employment taxes that are required by applicable laws and regulations to be withheld with respect to such amount. The Award Recipient agrees that the Company may delay delivery of the Settlement Shares until proper payment of such taxes has been made by the Award Recipient. The Award Recipient shall, to the extent permitted by law, have the right to satisfy the statutory minimum tax withholding obligations in connection with the Award by authorizing the Company to withhold from the Settlement Shares otherwise issuable to the individual pursuant to the settlement of the Award, a number of shares having a Fair Market Value, as of the Tax Withholding Date, which will satisfy the statutory minimum amount of the withholding tax obligation. Further, unless determined otherwise by the Committee, the Award Recipient may satisfy such obligations under this paragraph 17 by any method authorized under Section 9 of the Plan. |

| |

18. | Section 409A of the Code. To the extent that any Award is construed to be non-qualified deferred compensation subject to Section 409A of the Code, this Agreement and all of the terms and conditions of the Award shall be operated, administered and construed so as to comply with the requirements of Section 409A of the Code. This Agreement shall be subject to amendment, with or without advance notice to the Award Recipient, and on a prospective or retroactive basis, including, but not limited to, amendment in a manner that adversely affects the rights of the Award Recipient, to the extent necessary to effect compliance with Section 409A of the Code; provided, however, that the Company shall have no liability whatsoever for or in respect of any decision to take action to attempt to so comply with Section 409A of the Code, any omission to take such action or for the failure of any such action taken by the Company to so comply. |

| |

19. | Recoupment. In addition to the cancellation provisions of paragraphs 5 and 9, SELTPP Units granted pursuant to this Agreement shall be subject to the terms of the recoupment (clawback) policy adopted by the Company as in effect from time to time, as well as any recoupment/forfeiture provisions required by law and applicable to the Company or its subsidiaries, including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; provided, however, to the extent permitted by applicable law, the Company’s recoupment (clawback) policy shall have no application to this Award following a Change of Control of the Company. |

| |

20. | Voluntary Participation. Participation in the Plan is voluntary. The value of the Award is an extraordinary item of compensation outside the scope of the Award Recipient’s employment contract, if any. As such, the Award is not part of normal or expected compensation for purposes of calculating any severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments. |

| |

21. | Force and Effect. The various provisions of this Agreement are severable in their entirety. Any judicial or legal determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions. |

| |

22. | Successors. This Agreement shall be binding upon and inure to the benefit of the successors of the respective parties. |

| |

23. | Applicable Law. The validity, construction and effect of this Agreement and any rules and regulations relating to this Agreement shall be determined in accordance with the laws of the State of Delaware, unless preempted by federal law, and also, consistent with paragraph 18 above, in accordance with Section 409A of the Code and any interpretive authorities promulgated thereunder. |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

IN WITNESS WHEREOF, this Agreement has been executed by an appropriate officer of Comerica Incorporated and by the Award Recipient, both as of the day and year first above written.

|

| | |

By: __________________________ | __________________________ | __________________________ |

Name: | XXXXXXX | Employee ID Number |

Title: | Employee | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Senior Executive Long-Term Performance Restricted Stock Unit Award Agreement

SCHEDULE A

Adjusted ROCE Goal

At the beginning of the Performance Period (but no later than 90 days following the first day of the Performance Period), the Committee will approve a three-year average Adjusted ROCE performance goal for the Performance Period (the “Adjusted ROCE Goal”). Such Adjusted ROCE Goal shall be based on the following formula:

|

| | |

Year 1 Adjusted ROCE + Year 2 Adjusted ROCE + Year 3 Adjusted ROCE | = | Three-year Average Adjusted ROCE Performance |

3 |

Following the Performance Period, on the Determination Date, the Committee shall certify the Three-year Average Adjusted ROCE Performance and determine the appropriate Achievement Factor pursuant to the following grid:

|

| |

Three-year Average Adjusted ROCE Performance | Achievement Factor |

Threshold | 50% |

Target | 100% |

Maximum | 150% |

The level of achievement for purposes of determining the Achievement Factor will be interpolated linearly for Three-year Average Adjusted ROCE Performance between threshold and target Adjusted ROCE performance and between target and maximum Adjusted ROCE performance. If threshold Adjusted ROCE performance is not achieved, the entire Award will be forfeited. In no event may the Achievement Factor be greater than 150%.

TSR Modifier

In addition to the Adjusted ROCE Goal, the Company’s Relative TSR for the Performance Period (the “TSR Modifier”) will also be measured. The TSR Modifier will reduce the Achievement Factor by 10 percentage points if the Company ranks in the bottom quartile. The resulting percentage is referred to as the “Payout Percentage.”

For example: 110% Achievement Factor – 10% (Bottom Quartile TSR Performance) = 100% Payout Percentage

Final Award Number

The Final Award Number shall be equal to the product (rounded down to the nearest whole number) of (a) the Target SELTPP Award multiplied by (b) the Payout Percentage.

Definitions:

“Adjusted ROCE” means the return on common equity calculated based on net income less preferred stock dividends, as adjusted to reflect the after-tax impact of any adjustments related to a change in accounting principle, items that are deemed to be both unusual in nature and infrequently occurring under ASU 2015-1 and are also disclosed as such in the Company’s financial statements, merger/acquisition charges, and restructuring charges incurred during the year, if applicable.

“Relative TSR” means the Company’s Total Shareholder Return, as compared to the KBW Bank Index Total Shareholder Return. For this purpose the Total Shareholder Return shall be computed by Bloomberg.

“Total Shareholder Return” means the total shareholder return of the Company over the Performance Period as computed by Bloomberg.

COMERICA INCORPORATED

NON-QUALIFIED STOCK OPTION AGREEMENT

THIS AGREEMENT, dated as of GRANT DATE (the “Grant Date”) is between Comerica Incorporated (the “Company”) and NAME (the “Optionee”). Unless otherwise defined herein, capitalized terms used herein are defined in the Comerica Incorporated 2006 Long-Term Incentive Plan, as amended and/or restated from time to time (the “Plan”). A copy of the Plan will be provided to the Optionee upon request.

WITNESSETH:

1. Grant of Option. Pursuant to the provisions of the Plan, the Company hereby awards the Optionee, subject to the terms and conditions of the Plan (incorporated herein by reference), and subject further to the terms and conditions in this Agreement, the right and option to purchase from the Company, all or any part of an aggregate of XXX shares (the "Shares") of common stock ($5.00 par value per Share) of the Company at the purchase price of $XX.XX per Share (the "Option").

2. Expiration Date. The Option shall expire on EXPIRATION DATE (the “Expiration Date”), unless it is cancelled and/or forfeited earlier in accordance with the provisions of the Plan or this Agreement.

3. Vesting of the Option. Except as otherwise provided in the Plan or this Agreement, 25% of the Shares covered by this Option shall become vested and exercisable on the first anniversary of the Grant Date, and 25% shall become vested and exercisable on each of the subsequent three anniversaries of the first vesting date, provided that the Optionee is employed by the Company on each such applicable vesting date. Any fraction of a Share that becomes vested and exercisable on any date will be rounded down to the next lowest whole number, with any such fraction added to the portion of the Option (if any) becoming vested and exercisable on the following vesting date.

4. Special Vesting and Forfeiture Terms.

| |

a) | Forfeiture Resulting From Acts Occurring During the Grant Year. Notwithstanding any other provision of the Agreement, if it shall be determined at any time subsequent to the Grant Date that Optionee has, during the calendar year in which the Grant Date occurs (the “Grant Year”), (i) failed to comply with Company policies and procedures, including the Code of Business Conduct and Ethics or the Senior Financial Officer Code of Ethics (if applicable), (ii) violated any law or regulation, (iii) engaged in negligent or willful misconduct, (iv) engaged in activity resulting in a significant or material Sarbanes-Oxley control deficiency, or (v) demonstrated poor risk management or lack of judgment in discharge of Company duties, and such failure, violation, misconduct, activity or behavior (1) demonstrates an inadequate sensitivity to the inherent risks of Optionee’s business line or functional area, and (2) results in, or is reasonably likely to result in, a material adverse impact (whether financial or reputational) on the Company or Optionee’s business line or functional area, all or part of the Option granted under the Agreement that has not yet become vested at the time of such determination may be cancelled and, if so cancelled will not become exercisable. “Inadequate sensitivity” to risk is demonstrated by imprudent activities that subject the Company to risk outcomes in future periods, including risks that may not be apparent at the time the activities are undertaken. |

| |

b) | Forfeiture of Option for Acts Occurring in Years other than the Grant Year. Notwithstanding any other provisions of the Agreement, if the Optionee receives one or more equity Awards in any calendar years other than the Grant Year (an “Other Grant Year”) pursuant to an Award Agreement that contains a clause substantially similar to paragraph (a) above, and it shall be determined that Optionee, as a result of risk-related behavior, should be subject to the forfeiture of all or part of any such Award granted in such Other Grant Year in accordance with the terms of such clause, then the unvested portion of the Option granted under this Agreement shall be subject to forfeiture to the extent necessary to equal the Unsatisfied Forfeiture Value (as defined below). The term “Unsatisfied Forfeiture Value” shall mean the value (as determined by the Committee in its absolute discretion) of any portion of the Award determined by the Committee to be subject to forfeiture with respect to the Other Grant Year (without regard to whether or not some portion thereof has already vested) that has in fact vested prior to such determination by the Committee. All or a portion of the Option granted under this Agreement that has not yet become vested shall be subject to forfeiture in order to satisfy as much as possible of the Unsatisfied Forfeiture Value, and the valuation of the Option for such purpose shall be determined in the absolute discretion of the Committee. |

| |

5. | Exercise of the Option. To the extent vested, this Option may be exercised at any time prior to its Expiration Date, cancellation or forfeiture, as follows: |

| |

a) | Upon the Optionee's Termination of Employment for any reason other than Retirement, Disability or death, the then vested portion of this Option shall be exercisable until the earlier of (i) the 90th day after the Optionee’s Termination of Employment and (ii) the Option Expiration Date, and to the extent not exercised prior to such date, this Option will be cancelled. Any portion of this Option that is not vested on the date of Termination of Employment for any reason other than Retirement, Disability or death will be cancelled effective as of the date of Termination of Employment. |

| |

b) | Upon the Optionee's Termination of Employment due to Retirement, except as otherwise provided in paragraph 5(d) below, this Option will continue to vest and become exercisable in accordance with paragraph 3 above, and any vested portion of this Option as of the date of Termination (or that vests thereafter in accordance with the foregoing) shall remain exercisable until the Expiration Date. |

| |

c) | Upon the Optionee’s Termination of Employment due to Disability, this Option, to the extent vested at the date of the Optionee’s Termination of Employment, will continue to be exercisable until the earlier of (i) the third anniversary of the Optionee’s Termination of Employment and (ii) the Option Expiration Date, and to the extent not exercised prior to such date, this Option will be cancelled. Any portion of this Option that is not vested on the date of Termination of Employment due to Disability will be cancelled effective as of the date of Termination of Employment. |

| |

d) | Upon the Optionee’s death (whether during employment with the Company or during any applicable post-termination exercise period), this Option, to the extent vested at the date of the Optionee’s death, will continue to be exercisable by the Beneficiary(ies) of the Optionee until the earlier of (i) the first anniversary of the Optionee’s death and (ii) the Option Expiration Date (subject to any shortening of the Expiration Date due to the Optionee’s Disability or Termination of Employment for any other reason, in each case, prior to the Optionee’s death). Any portion of this Option that is not vested on the date of the Optionee’s death (whether during employment with the Company or during any applicable post-termination exercise period) will be cancelled effective as of the date of death. |

Notwithstanding the foregoing or anything in this Agreement to the contrary, this Option shall be 100% fully vested and immediately exercisable upon the occurrence of a Change of Control of the Company (unless the Option was cancelled, forfeited or expired prior to the Change of Control).

The Optionee shall initiate the exercise of the vested portion of this Option by following the notice process established by the Company for such purpose, and shall therein specify the number of Shares being exercised, the purchase price per share and the Grant Date. Any such notice of exercise shall be accompanied by payment of the aggregate purchase price for such Shares. The Optionee shall, to the extent permitted by law, have the right to pay the exercise price by authorizing the Company to withhold from the Shares otherwise issuable to the Optionee upon exercise of the Option, a number of Shares having a Fair Market Value, as of the date of exercise, which will satisfy the full exercise price.

As a condition to exercising this Option in whole or in part, the Optionee will pay, or make provisions satisfactory to the Company for payment of, any Federal, state and local taxes required to be withheld in connection with such exercise. The Optionee shall, to the extent permitted by law, have the right to satisfy the statutory minimum tax withholding obligations in connection with such exercise by authorizing the Company to withhold from the Shares otherwise issuable to the Optionee upon exercise of the Option, a number of Shares having a Fair Market Value, as of the Tax Withholding Date, which will satisfy the statutory minimum amount of the withholding tax obligation.

6. Cancellation of Option. The Committee has the right to cancel all or any portion of the Option granted herein in accordance with Section 4 of the Plan if the Committee determines in good faith that the Optionee has done any of the following: (i) committed a felony; (ii) committed fraud; (iii) embezzled;(iv) disclosed confidential information or trade secrets; (v) was terminated for Cause; (vi) engaged in any activity in competition with the business of the Company or any Subsidiary or Affiliate of the Company; or (vii) engaged in conduct that adversely affected the Company.

The Delegate shall have the power and authority to suspend the vesting of and the right to exercise all or any portion of the Option, whether vested or not vested, granted under this Agreement if the Delegate makes in good faith the determination described in the preceding sentence. Any such suspension of an Option shall remain in effect until the suspension shall be presented to and acted on by the Committee at its next meeting. This paragraph 6 shall have no application following a Change of Control of the Company.

7. Compliance With Laws and Regulations. This Option and the obligation of the Company to sell and deliver the Shares hereunder shall be subject to all applicable laws, rules and regulations, and to such approvals by any government or regulatory agency as may be required.

8. Optionee Bound By Plan. The Optionee agrees to be bound by all terms and provisions of this Agreement and of the Plan, including terms and provisions adopted after the granting of this Option but prior to the complete exercise of the Option. In the event any provisions hereof are inconsistent with those of the Plan, the provisions of the Plan shall control. By accepting the Option or exercising any portion of it, the Optionee signifies his or her understanding of the terms and conditions of this Agreement and the Plan.

9. Notices. Any notice to the Company under this Agreement shall be in writing to the following address or facsimile number: Human Resources - Executive Compensation, Comerica Incorporated, 1717 Main Street, MC 6515, Dallas, TX 75201; Facsimile Number: 214-462-4430. The Company will address any notice to the Optionee to the Optionee's current address according to the Company's personnel files. All written notices provided in accordance with this paragraph shall be deemed to be given when (a) delivered to the appropriate address(es) by hand or by a nationally recognized overnight courier service (costs prepaid); (b) sent by facsimile to the appropriate facsimile number(s), with confirmation by telephone of transmission receipt; or (c) received by the addressee(s), if sent by U.S. mail to the appropriate address or by Company inter-office mail to the appropriate mail code. Either party may designate in writing some other address or facsimile number for notice under this Agreement.

10. Nontransferability. This Option shall not be transferable other than by will or by the laws of intestacy; provided, however, that the Optionee may, in the manner established by the Committee, designate a Beneficiary to exercise the rights of the Optionee and to receive any property distributable with respect to the Option upon the death of the Optionee. During the lifetime of the Optionee, the Option shall be exercisable only by the Optionee, or, if permissible under applicable law, by the Optionee's guardian or legal representative. The Option and any rights under it may not be pledged, alienated, attached or otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance thereof contrary to the Plan or this Agreement shall be void and unenforceable against the Company or any Affiliate.

11. Force and Effect. The various provisions of this Agreement are severable in their entirety. Any judicial or legal determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

12. Successors. This Agreement shall be binding upon and inure to the benefit of the successors of the respective parties.

13. No Right to Continued Employment. Nothing in the Plan or this Agreement shall confer on the Optionee any right to continue in the employment of the Company or its Affiliates or in any way affect the Company's or its Affiliates' right to terminate the Optionee’s employment without prior notice at any time for any reason or for no reason.

14. Voluntary Participation. Participation in the Plan is voluntary. The value of the Option is an extraordinary item of compensation outside the scope of the Optionee’s employment contract, if any. As such, the Option is not part of normal or expected compensation for purposes of calculating any severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments.

15. Recoupment. In addition to the cancellation provisions of paragraphs 4 and 6, this Award shall be subject to the terms of the recoupment (clawback) policy adopted by the Company as in effect from time to time, as well as any recoupment/forfeiture provisions required by law and applicable to the Company or its subsidiaries, including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; provided, however, to the extent permitted by applicable law, the Company’s recoupment (clawback) policy shall have no application to this Award following a Change of Control of the Company.

IN WITNESS WHEREOF, Comerica Incorporated has caused this Agreement to be executed by an appropriate officer and the Optionee has executed this Agreement, both as of the day and year first above written.

COMERICA INCORPORATED

|

| | |

By: __________________________ | __________________________ | __________________________ |

Name: | XXXXXXX | Employee ID Number |

Title: | Employee | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

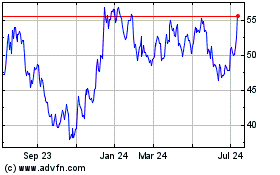

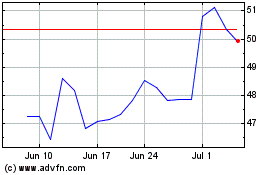

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024