Comerica Reports Profit Decline but Tops Expectations

October 16 2015 - 8:30AM

Dow Jones News

Comerica Inc. said profit slid 12% in its latest quarter, as the

Dallas-based lender continued to grapple with sharply lower oil

prices and saw expenses rise.

Still, per-share earnings beat Wall Street expectations.

The regional bank reported a profit of $136 million, down from

$154 million a year earlier. On a per-share basis, earnings dropped

to 74 cents from 82 cents. Analysts anticipated 70 cents in profit

per share, according to Thomson Reuters.

Comerica does a chunk of its business in Texas and lends to many

companies in the energy sector, which has been hit with sharply

lower oil prices. With about 8% of its portfolio tied to energy,

the lender in July said it was braced for potential credit losses

stemming from the oil price slide.

On Friday, Comerica said it set aside $26 million for those

potential losses. That amount is up from $5 million a year earlier,

but it is also down sharply from the $47 million second-quarter

provision.

Comerica classified about $25 million of energy-related loans as

nonaccrual in the quarter, meaning there is uncertainty about

whether they will be paid back on time. That number came down from

about $100 million in the previous quarter. Net loan charge-offs

remained low, but rose $20 million to $23 million.

Fee-based income helped offset some of the drag stemming from

oil and from low interest rates. Many banks have worked to amp up

fee-based businesses to help counter the effect of low rates.

Noninterest income rose about 22% to $264 million in the third

quarter. Comerica said it expects growth in card fees to support

noninterest income this year.

Meanwhile, the lender's net interest margin, a key metric of

lending profitability that is tied to rates, slid to 2.54% from

2.65% in the second quarter and 2.67% a year earlier.

In the face of low rates and low oil, Chief Executive Ralph Babb

said the lender continues to tightly manage expenses. But the

lender had warned that expenses would rise this year, thanks in

part to contractual changes to a card program that prompted an

accounting change, and noninterest expenses in the latest quarter

jumped 16% to $461 million.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 16, 2015 08:15 ET (12:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

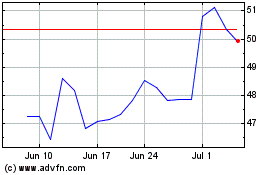

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

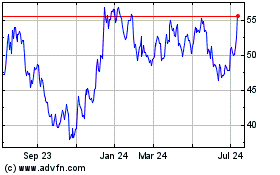

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024