Report of Foreign Issuer (6-k)

August 27 2015 - 7:27AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of August, 2015

Commission File Number: 1-14678

CANADIAN

IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court

Toronto,

Ontario

Canada M5L 1A2

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨

Form 40-F x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by

furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934:

Yes ¨ No

x

If yes is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b): ¨

The information contained in this Form 6-K is incorporated by reference into the Registration Statement on

Form S-8 File Nos. 333-130283 and 333-09874, Form F-10 File No. 333-201259 and Form F-3 File No. 333-202584.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

|

| Date: August 27, 2015 |

|

|

|

By: |

|

/s/ Stephen Forbes |

|

|

|

|

Name: |

|

Stephen Forbes |

|

|

|

|

Title: |

|

Executive Vice-President |

Exhibit 12.1

Canadian Imperial Bank of Commerce

Computation of Ratio of Earnings to Fixed Charges

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months

Ended

July 31 |

|

|

Year Ended October 31 |

|

| |

|

2015 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

|

|

|

(C$ millions except ratios) |

|

|

|

|

| |

|

IFRS(1) |

|

|

Canadian GAAP |

|

| Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

3,299 |

|

|

|

3,805 |

|

|

|

3,933 |

|

|

|

3,932 |

|

|

|

4,063 |

|

|

|

4,032 |

|

| Fixed charges, excluding interest on deposits and secured borrowings |

|

|

612 |

|

|

|

887 |

|

|

|

875 |

|

|

|

1,147 |

|

|

|

1,175 |

|

|

|

906 |

|

| Interest capitalized |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

3,911 |

|

|

|

4,692 |

|

|

|

4,808 |

|

|

|

5,079 |

|

|

|

5,232 |

|

|

|

4,936 |

|

| Interest on deposits and secured borrowings |

|

|

2,310 |

|

|

|

3,337 |

|

|

|

3,679 |

|

|

|

3,630 |

|

|

|

2,787 |

|

|

|

2,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

6,221 |

|

|

|

8,029 |

|

|

|

8,487 |

|

|

|

8,709 |

|

|

|

8,019 |

|

|

|

7,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, excluding interest on deposits and secured borrowings |

|

|

446 |

|

|

|

679 |

|

|

|

676 |

|

|

|

947 |

|

|

|

962 |

|

|

|

699 |

|

| Interest component of rental expense(2) |

|

|

164 |

|

|

|

206 |

|

|

|

196 |

|

|

|

196 |

|

|

|

203 |

|

|

|

202 |

|

| Interest capitalized |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

2 |

|

| Amortization of subordinated indebtedness |

|

|

2 |

|

|

|

2 |

|

|

|

3 |

|

|

|

4 |

|

|

|

4 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

612 |

|

|

|

887 |

|

|

|

875 |

|

|

|

1,147 |

|

|

|

1,175 |

|

|

|

906 |

|

| Interest on deposits and secured borrowings |

|

|

2,310 |

|

|

|

3,337 |

|

|

|

3,679 |

|

|

|

3,630 |

|

|

|

2,787 |

|

|

|

2,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

2,922 |

|

|

|

4,224 |

|

|

|

4,554 |

|

|

|

4,777 |

|

|

|

3,962 |

|

|

|

3,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of Earnings to Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Excluding interest on deposits and secured borrowings |

|

|

6.39 |

|

|

|

5.29 |

|

|

|

5.49 |

|

|

|

4.43 |

|

|

|

4.45 |

|

|

|

5.45 |

|

| Including interest on deposits and secured borrowings |

|

|

2.13 |

|

|

|

1.90 |

|

|

|

1.86 |

|

|

|

1.82 |

|

|

|

2.02 |

|

|

|

2.30 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

2010 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP |

|

| Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,910 |

|

|

|

3,891 |

|

| Fixed charges, excluding interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,175 |

|

|

|

871 |

|

| Interest capitalized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,079 |

|

|

|

4,760 |

|

| Interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,787 |

|

|

|

2,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,866 |

|

|

|

6,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, excluding interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

962 |

|

|

|

664 |

|

| Interest component of rental expense(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

203 |

|

|

|

202 |

|

| Interest capitalized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

2 |

|

| Amortization of subordinated indebtedness |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,175 |

|

|

|

871 |

|

| Interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,787 |

|

|

|

2,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,962 |

|

|

|

3,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of Earnings to Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Excluding interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.32 |

|

|

|

5.46 |

|

| Including interest on deposits and secured borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.99 |

|

|

|

2.27 |

|

| 1) |

Under IFRS, interest on deposits comprises interest expense relating to deposits and secured borrowing liabilities. |

| 2) |

The interest component of rental expense is 30% of rent expense because it is the proportion deemed representative of the interest factor. |

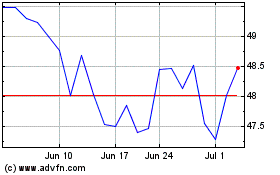

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

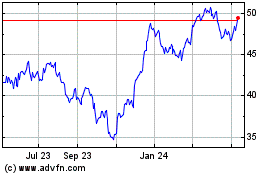

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024