UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month July 2015

Commission File

Number: 1-14678

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court,

Toronto, Ontario, Canada M5L 1A2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g 3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g3-2(b): ________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

|

| Date: July 20, 2015 |

|

|

|

By: |

|

/s/ Michelle Caturay |

|

|

|

|

Name: |

|

Michelle Caturay |

|

|

|

|

Title: |

|

Vice-President, Corporate Secretary and Associate General

Counsel |

Exhibit 99.1

Code of Ethics for Directors

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

2 |

|

Table of Contents

|

|

|

|

|

| 1. Introduction |

|

|

3 |

|

| 1.1. Application |

|

|

3 |

|

| 1.2. Following these principles |

|

|

3 |

|

| 1.3. Other requirements |

|

|

3 |

|

| 1.4. Waivers |

|

|

3 |

|

| 1.5. Revisions |

|

|

3 |

|

| 1.6. Breach of CIBC’s principles or policies |

|

|

3 |

|

| 1.7. Reporting violations |

|

|

4 |

|

| 2. General Conduct |

|

|

4 |

|

| 2.1. Upholding the law |

|

|

4 |

|

| 2.2. Honesty and integrity |

|

|

5 |

|

| 2.3. Full and Fair Disclosure |

|

|

5 |

|

| 2.4. Harassment and Discrimination |

|

|

5 |

|

| 3. Conflict of Interest |

|

|

6 |

|

| 3.1. Gifts, benefits and entertainment |

|

|

6 |

|

| 3.1.1. Travel and accommodations |

|

|

7 |

|

| 3.1.2. Gifts, benefits and entertainment that exceed a nominal value |

|

|

7 |

|

| 3.2. Personal borrowing and lending |

|

|

7 |

|

| 3.3. Community activity |

|

|

7 |

|

| 3.3.1. Non-profit organizations |

|

|

7 |

|

| 3.3.2. Political activity |

|

|

8 |

|

| 3.4. Business activities outside of CIBC |

|

|

8 |

|

| 3.5. Purchasing and selling assets and services |

|

|

9 |

|

| 4. Confidentiality and Privacy |

|

|

10 |

|

| 4.1. Confidentiality |

|

|

10 |

|

| 4.1.1. Guidelines for protecting confidential information |

|

|

10 |

|

| 4.1.2. Privacy of customer information |

|

|

11 |

|

| 4.2. Electronic Communication |

|

|

11 |

|

| 4.3. Inside information and personal securities trading |

|

|

12 |

|

| 4.3.1. Definition of inside information |

|

|

12 |

|

| 4.3.2. Restrictions when inside information is held |

|

|

12 |

|

| 4.3.3. Personal securities trading |

|

|

12 |

|

| 4.4. Anti-competitive practices |

|

|

13 |

|

| 4.4.1. Anti-competitive behavior |

|

|

13 |

|

| 4.4.2. Fair competition |

|

|

13 |

|

| 4.5. Maintaining records |

|

|

14 |

|

| 5. Protecting CIBC’s Assets |

|

|

14 |

|

| 5.1. CIBC’s assets |

|

|

14 |

|

| 5.2. Internal and regulatory investigations |

|

|

14 |

|

| 5.3. Annual Attestation |

|

|

15 |

|

| 6. Process Review |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

3 |

|

1. Introduction

1.1. Application

This Code of Ethics for Directors (“Code”) of Canadian Imperial Bank of Commerce (“CIBC”) applies to all members of the Board of

Directors. The principles outlined in this document are intended to:

| |

• |

|

codify a standard of conduct by which all directors are expected to abide; |

| |

• |

|

protect the business interests of CIBC; |

| |

• |

|

maintain CIBC’s reputation for integrity; and |

| |

• |

|

foster compliance with applicable legal and regulatory obligations. |

The principles in the Code are the individual and collective responsibility of all directors.

1.2. Following these principles

The principles in

this Code require a consistent and high standard of ethical conduct for all directors.

Directors must act, and must be seen by CIBC’s

employees, customers, regulators, communities and shareholders (“stakeholders”) to be acting, in accordance with these principles.

1.3. Other

requirements

This Code outlines basic principles that apply generally to directors of CIBC. In addition, the Board has adopted various

mandates, policies and procedures applicable to specific topics and activities with which directors are also expected to comply.

1.4. Waivers

From time to time, a situation may arise that warrants a waiver of one or more provisions of this Code. A director who believes that a waiver may be

appropriate should first consult with the Chair of the Board or the General Counsel or Chief Auditor of CIBC. However, a waiver may only be granted by the Board of Directors or a Committee of the Board of Directors and must be disclosed promptly as

required by law and/or stock exchange requirements.

1.5. Revisions

This Code will be revised from time to time to reflect changing legal, regulatory and ethical standards. The current version of this Code is available

both on the Board of Director’s website, CIBC Today and CIBC.com.

1.6. Breach of CIBC’s principles or policies

Directors must be seen by stakeholders to be honest and above reproach at all times. In order to uphold our commitments to our stakeholders, CIBC will

act to protect CIBC’s image and reputation and avoid possible legal penalties.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

4 |

|

Any violation of this Code or applicable laws and regulations, including the requirements set out in this

Code, may require your resignation from the board and may also result in civil criminal or regulatory action.

Any director who, during the course

of his or her duties for CIBC, has:

| |

• |

|

engaged in criminal activities; |

| |

• |

|

allowed a situation causing a material conflict of interest to arise; |

| |

• |

|

knowingly breached his or her obligations with regard to the use or disclosure of confidential information; |

| |

• |

|

intentionally permitted the input of inaccurate information into CIBC’s books and records; |

| |

• |

|

knowingly accepted improper documentation; and/or |

| |

• |

|

knowingly misrepresented or omitted, or permitted others to misrepresent or omit, material facts about CIBC to others; |

will face disciplinary action, which might include having to resign from the Board of Directors, even where there is no loss to CIBC. Further,

regulatory and/or public disclosure may be required.

1.7. Reporting violations

Our success in upholding our commitments also relies on directors reporting facts and incidents that may involve a breach of these principles.

A director must promptly report any activities or practices (by himself, herself or others) if the director has good reason to believe any part of the

principles in this Code has been violated. Failure to report may result in disciplinary action, which might include having to resign from the Board.

A director may report any suspicious request, activity or practice to the Chair of the Board or to the General Counsel or Chief Auditor of CIBC.

Directors may also report concerns regarding accounting, internal accounting controls or auditing matters through procedures established by the Audit Committee of the Board of Directors for the confidential, anonymous handling of such concerns.

Should a director report suspicious activities or practices, the report will be treated confidentially to the extent possible and consistent with

CIBC’s responsibility to address the issue raised. No Director, officer or employee of CIBC is subject to retaliation for reporting suspicious activity in good faith. Without limiting the generality of the foregoing, no director of CIBC may

attempt to intimidate or retaliate (directly or indirectly) against another director who makes such a report. An offending director will face disciplinary action for taking such retaliatory action, which might include having to resign from the

Board.

2. General Conduct

2.1. Upholding the law

CIBC is subject to numerous laws and regulations in jurisdictions in which we carry on business which have an impact on the products and services we are

able to offer and the ways in which we offer them. Violation of the law can affect CIBC’s reputation and our ability to carry on business.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

5 |

|

Many of the requirements in this Code involve legal and regulatory obligations that apply to CIBC, its

directors and all of its employees. In some cases, a breach of those obligations may result in penalties to CIBC, its directors and its employees, including fines and/or imprisonment.

Complying with the requirements of this Code will assist directors in following the law. Directors who want more information or clarification of the

laws and regulations that apply to them may contact CIBC’s General Counsel or consult with any independent outside counsel engaged by the Board of Directors or CIBC for this purpose.

2.2. Honesty and integrity

The financial services

industry in which CIBC operates is built on the highest level of trust. Integrity is a cornerstone of our business. Directors must act honestly and fairly and exhibit high ethical standards in their dealings with all stakeholders. Engaging in

dishonest or unethical activity negatively affects CIBC. It erodes client trust and may weaken our reputation within the community.

Involvement or

even attempted involvement in dishonest activity is unacceptable and may result in disciplinary action, which might include having to resign from the Board of Directors. Further, regulatory and/or public disclosure may be required.

2.3. Full and Fair Disclosure

All directors involved

in reviewing or approving information for inclusion in any reports or documents which CIBC is required to file with any governmental or regulatory agency or any public communications are responsible for satisfying themselves that CIBC employees who

are responsible for preparing and/or providing such information have implemented procedures designed to confirm that (i) information provided is complete, accurate and current, (ii) reports and documents are prepared in conformity with all

regulatory requirements and filed in a timely manner, and (iii) disclosure in reports and documents that CIBC files with, or submits to, regulators as well as in public communications made by CIBC, is full, fair, accurate and timely.

If a Director becomes aware of a materially inaccurate or misleading statement in a public communication, that director must report it immediately to

the Chair of the Board, or the General Counsel or the Chief Auditor of CIBC. Making false or misleading statements to external auditors can be a criminal act that can result in severe penalties. No director may directly or indirectly take any action

to fraudulently influence, coerce, manipulate or mislead CIBC’s independent external auditors for the purpose of rendering CIBC’s financial statements misleading.

2.4. Harassment and Discrimination

All individuals

should be treated fairly, equitably, with decency and with the utmost of respect. Harassment or discrimination of any sort is strictly prohibited.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

6 |

|

3. Conflict of Interest

Conflicts can occur between the interests of

directors and CIBC. Concern over conflicts of interest (or the appearance of conflicts) is the source of many of the principles outlined in this Code.

Directors must take care to ensure that they identify and avoid any situation of actual or apparent conflict of interest, whether the situation involves

the director directly or a member of his or her immediate family.

Even when a director believes that his or her actions would not be influenced,

the director must take steps to guard against even the appearance of a conflict. In resolving conflicts, directors must subordinate their personal interests to those of CIBC.

A director should seek the advice of the Chair of the Board or the General Counsel or Chief Auditor of CIBC with any questions or concerns and must

immediately disclose any material transaction or relationship that reasonably could be expected to give rise to an apparent or actual conflict.

3.1. Gifts,

benefits and entertainment

On occasion, existing or potential customers or suppliers of CIBC may want to give a director a gift, or benefit,

or provide entertainment. In some circumstances, accepting them will not raise a conflict of interest. However, gifts, benefits and entertainment may also be seen by others to be a bribe or an inducement that clouds objective and fair business

decisions.

Directors should consider the following before giving or accepting a gift, benefit or entertainment to or from an existing or potential

customer, supplier or employee of CIBC:

| |

• |

|

Is the gift or benefit of nominal value? |

| |

• |

|

Is the cost of entertainment, including meals and/or social activities, within normal business practices? |

| |

• |

|

Is it given or received in return for recommending that CIBC engage in a specific transaction with an existing or potential customer or supplier?

|

| |

• |

|

Is it given or received in return for the referral of business to or from CIBC? |

| |

• |

|

If knowledge of the situation were to become public, would it adversely affect CIBC’s reputation? |

Further, a director may

not give or receive a gift, benefit or entertainment when he/she knows that doing so will violate the business practices of the other party.

As

used in this section, “benefit” means any offer made and accepted that provides the recipient with a benefit or advantage, such as a discount from a customer or supplier, that is being offered because of the Director’s relationship

with CIBC.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

7 |

|

| |

3.1.1. |

Travel and accommodations |

Directors generally may not accept travel and accommodations offered purely for their personal use because of their relationship with

CIBC. This means, for example, that a director may not accept free use of a vacation condominium for an immediate family member from an existing or potential customer or supplier of CIBC. The Chair of the Board or the General Counsel or Chief

Auditor of CIBC must approve any exceptions.

If it is in the interests of both CIBC and a customer or supplier, and if the director

obtains prior approval as noted above, it may be permissible to accept partial payment from a customer or supplier for travel and accommodation to a business function. Customer or supplier payment of travel expenses for an immediate family member is

not permitted.

| |

3.1.2. |

Gifts, benefits and entertainment that exceed a nominal value |

Directors may encounter a situation where refusal of a gift, benefit or entertainment of more than a nominal value may jeopardize

CIBC’s relationship with a customer or supplier. In this situation, a director must consult the Chair of the Board or the General Counsel or Chief Auditor of CIBC on whether the gift, benefit or entertainment can be accepted.

3.2. Personal borrowing and lending

Borrowing from or

lending personal funds to an existing or potential customer or supplier of CIBC can be seen as a conflict of interest, even though the actions of the director may be sincere. This action could affect a director’s image and objectivity in

performing his or her duties on behalf of CIBC.

A director must not use his or her relationship with CIBC to borrow from or lend personal funds or

other personal property to any customer or supplier with whom CIBC has an ongoing or potential relationship of which the director is aware, or use this relationship so that others related to the director or under that director’s control can do

so. This does not apply if the customer or supplier is a financial intermediary such as a department store or other financial institution and the director borrows on market terms.

Unless exceptional circumstances exist, directors should neither borrow from nor lend personal funds to another director or to an employee of CIBC, and,

in any case, must avoid borrowing or lending which could give rise to a conflict of interest.

3.3. Community activity

| |

3.3.1. |

Non-profit organizations |

As an active member of the community, CIBC recognizes that donations are a big part of support for non-profit organizations, including

the causes that CIBC supports as an organization. However, directors must be aware that given their senior roles with CIBC, in some cases, generating donations can suggest to existing or potential CIBC customers or suppliers that they have an

obligation to support a non-profit organization in order to maintain or initiate a relationship with CIBC. Similarly, soliciting donations from a fellow director or employee of

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

8 |

|

CIBC may impair working relationships if the individual feels obligated to contribute.

Accordingly, directors may personally promote charitable causes as long as they make it clear that they are acting on behalf of the

charity, that there is no obligation to contribute, and that lack of support for a cause will not result in any adverse consequences to a relationship with or at CIBC.

To this end, directors should avoid using CIBC e-mail systems for the purpose of soliciting donations or contributions.

| |

3.3.2. |

Political activity |

It is the responsibility of directors making political contributions in their personal capacity to familiarize themselves with all

regulatory restrictions and procedures applicable to them.

Since political views are highly personal, CIBC does not support

political activities on CIBC premises or which use CIBC facilities – such as seeking political donations, campaigning or actively promoting political activities – unless authorized by the Chief Executive Officer. Further, directors should

never use their position to compel other directors or CIBC employees to make a political contribution or to attempt to influence any vote or political activity.

3.4. Business activities outside of CIBC

As a general

rule, CIBC expects its directors to avoid any outside activity, employment, position, association or investment that might interfere or appear to interfere with the independent exercise of a director’s judgment regarding the best interests of

CIBC.

Examples of outside business activities which may involve a conflict of interest are those that:

| |

• |

|

affect the objectivity and independence of the performance of a director’s duties and responsibilities for CIBC; |

| |

• |

|

conflict with the time required to complete a director’s duties for CIBC; |

| |

• |

|

involve the use of any information about CIBC or its customers, suppliers or employees; |

| |

• |

|

involve accepting an opportunity to engage in a business activity or to make an investment of which a director becomes aware either (i) in connection

with his or her functions at CIBC or (ii) through the use of corporate information or property, if the opportunity is one that the director should reasonably believe would be of interest to CIBC or one that the person offering the opportunity

to a director expects to be offered to CIBC first; |

| |

• |

|

place the director in a position that gives the appearance that he or she represents CIBC when, in fact, this is not the case; or |

| |

• |

|

imply that CIBC endorses a particular product, service or company. |

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

9 |

|

A director is encouraged to discuss any outside business activity with the Chair of the Board or the

General Counsel or the Chief Auditor of CIBC before he or she becomes involved, to ensure there is no conflict of interest (actual, perceived or potential). If this activity involves another business organization engaged primarily in banking,

securities or other financial services or if there is any concern about a possible conflict, a director must obtain the prior written approval of the General Counsel before he or she proceeds.

Similarly, directors must obtain the prior written approval of the General Counsel before acquiring stock or a financial interest in any business

organization engaged primarily in providing banking, securities or other financial services, except (i) where a Director’s investment transactions are handled on a fully discretionary basis by a third party not related to the director with

the understanding that neither the director nor an immediate family member participates in the investment decisions or is informed in advance of transactions, and (ii) for stock ownership or a financial interest in a publicly owned company

where the director does not have a controlling interest. A “controlling interest” is one which enables a director to direct or cause the direction of the management or policies of an organization through ownership of securities, by

contract or otherwise.

Directors must alert and resolve any new conflicts that arise through an activity with the Chair of the Board or the General

Counsel or the Chief Auditor as necessary.

CIBC reserves the right to (i) require a director to limit or resign his or her outside position or

(ii) limit or restrict a director’s investment including, but not limited to, a reduction in or divestiture of his or her interest, at any time when continued participation could give rise to a conflict or the appearance of a conflict of

interest or when necessary to resolve any regulatory issues. If a conflict or appearance of a conflict cannot be resolved, the director may be required to resign from the Board.

3.5. Purchasing and selling assets and services

When

directors personally – or immediate family members – purchase assets or services of customers, suppliers or CIBC, it may create the appearance that favourable terms have been obtained because of the director’s position with CIBC.

The following situations may present conflicts of interest, and directors are encouraged to discuss any potential activity with the Chair of the Board

or the General Counsel or Chief Auditor of CIBC before proceeding:

| |

• |

|

personally purchasing assets or services from CIBC customers or suppliers; |

| |

• |

|

personally, or through immediate family members or persons acting on their behalf, purchasing assets of CIBC, unless the purchase is made on market terms;

|

| |

• |

|

selling personal assets or services (directly or indirectly) to CIBC, its customers or suppliers; |

| |

• |

|

personally (directly or indirectly) engaging in transactions involving assets or services of a customer whom they know has an ongoing CIBC relationship

|

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

10 |

|

| |

(this does not apply to directors conducting transactions with a business customer in the normal course of the customer’s business); |

| |

• |

|

personally (directly or indirectly) engaging in transactions involving assets on which they know CIBC is realizing a security interest; or

|

| |

• |

|

purchasing (or recommending a purchase to someone else of) real estate, securities or a business that a director knows, through his or her duties for CIBC,

that CIBC or another party is considering or might be interested in purchasing. |

4. Confidentiality and Privacy

4.1. Confidentiality

In the financial services

industry, confidentiality is fundamental. Our customers trust CIBC with their confidential information, as do our colleagues and suppliers. To preserve and protect that trust, and to meet legal requirements, each director has a duty to preserve and

protect confidential information. A Director’s duty regarding confidentiality continues even after they no longer serve on the Board of CIBC.

The duty of confidentiality extends to information not only about CIBC but also about CIBC’s:

| |

• |

|

customers, including persons who apply for products and services; |

| |

• |

|

suppliers, including proprietary information owned by suppliers. |

A Director’s duty applies to all information about CIBC’s business, including marketing plans, agreements, customer lists, databases, trade

secrets, intellectual property as well as information about competitive and strategic matters, and material, non-public information such as information about CIBC’s current or projected earnings and new business initiatives.

Directors must preserve the confidentiality of customer, employee, supplier and CIBC information, and access information only when they have been

authorized to do so and there is a valid business reason.

| |

4.1.1. |

Guidelines for protecting confidential information |

Safeguarding confidential information is important whether it be on CIBC property, in a home office or in transit. When in doubt about

how to handle confidential information, a director should seek guidance from the General Counsel of CIBC before using or disclosing it.

Directors must take all reasonable steps to protect confidential information, including the following:

| |

• |

|

controlling access to confidential information; |

| |

• |

|

exercising care when discussing confidential information with other directors, employees of CIBC, and other third parties (including family members and

friends); |

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

11 |

|

| |

• |

|

not discussing confidential information in public places, such as airplanes, elevators and restaurants; |

| |

• |

|

keeping documents involving CIBC away from areas where they can be lost, stolen or viewed by individuals without a need to know, and taking steps to secure

sensitive information when it is unattended; |

| |

• |

|

safeguarding documents being taken away from CIBC premises; |

| |

• |

|

being aware that conversations on cellular phones and communications over the internet may not be confidential and acting accordingly; |

| |

• |

|

ensuring the correct fax number or e-mail address of recipients is used when sending a communication, using a secure fax line where appropriate and obtaining

appropriate authority from the individual to communicate electronically; |

| |

• |

|

adhering to CIBC policies or guidelines on records management; |

| |

• |

|

not leaving computers and personal computing devices such as iPads unattended and accessible to individuals without a need to know, and logging off computers

and personal computing devices such as iPads when not in use; and |

| |

• |

|

not sharing confidential information about CIBC with companies that are, or may be, seeking to provide products or services to CIBC, except as required in

any bidding process after authorization from CIBC. |

| |

4.1.2. |

Privacy of customer information |

CIBC’s privacy standards are a commitment to protect and preserve the privacy of our customers.

Directors may not disclose CIBC customer information to anyone outside of CIBC unless the General Counsel has been consulted and

authorized disclosure.

Directors should presume that information about a CIBC customer and information received from them is

confidential unless the customer indicates otherwise. This includes information about whether or not an individual or business is a customer of CIBC. Even seemingly trivial information like this may be important to a customer or may indirectly

convey important confidential information.

4.2. Electronic Communication

CIBC reserves the right to access, store and monitor the use of CIBC‘s network and computing facilities and voicemail system and to restrict use

without prior notice. Directors must exercise good judgment when using these electronic channels whether personally or for CIBC purposes.

Directors

may not use CIBC’s facilities to access, download, or distribute information that may be considered offensive, unethical or discriminatory or that could harm CIBC’s reputation.

Directors may use CIBC’s computer resources only if the use is in accordance with CIBC’s policies that govern their use.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

12 |

|

Directors must not give out their passwords to access bank systems, except as required for business

continuity or other security reasons. Directors are accountable for all activity carried out under their ID’s or passwords.

4.3. Inside information and

personal securities trading

In the course of his or her service on the Board of CIBC, a director may come into possession of non-public

information (often referred to as “inside information”). When handling this information, the requirements outlined below should be followed strictly. Mishandling inside information could result in conviction for an offence under the laws

of most jurisdictions. Possible penalties include substantial fines, return of any profits earned as a result of use of such information and/or imprisonment. Breaching these requirements may also subject CIBC and/or the director to civil liability,

which also carries monetary penalties.

| |

4.3.1. |

Definition of inside information |

Inside information is material, non-public information about a public company. “Material” means that the information would

reasonably be expected to have a significant effect on the market price of the securities or would likely influence a person’s decision to buy or sell securities of that company or another public company. Information ceases to be inside

information only when it has been widely disclosed to the public or is no longer material.

Inside information may be about CIBC,

its subsidiaries, customers, suppliers or any other public company. It can include information about a possible take-over or merger, issuance of securities, change in dividends, litigation, product innovation, change in operating results,

refinancing, forecasts or a change in executive management. It can also include information about one company that may affect the price of securities of another company.

| |

4.3.2. |

Restrictions when inside information is held |

If a director has inside information about a public company, the director must not deal, execute or recommend transactions in any

securities of that company or a related company on behalf of anyone. This includes, without limitation, transactions for the director, CIBC, another director, a friend, a relative or a company in which the director has an interest.

A director must not procure, influence or counsel any person or company to recommend, deal or execute transactions in securities about

which the director has inside information.

When dealing with inside information, directors should exercise caution with voice mail

or e-mail messages to ensure that confidentiality is preserved. When using e-mail, directors should assess whether encryption or other protection is warranted under the circumstances.

| |

4.3.3. |

Personal securities trading |

Directors must recognize and avoid any conflict of interest in their personal securities trading.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

13 |

|

Generally, a director may not personally trade in or advise others regarding trading in

securities of CIBC or another company in which the director has direct or indirect access to confidential or inside information as a result of his or her role at CIBC.

Directors, as insiders of CIBC, are prohibited from any dealing in CIBC’s securities except during specified “open

window” periods. In addition, directors may be restricted from buying or selling CIBC securities even during an “open window” period, if, for example, a material, nonpublic transaction is under consideration.

Directors of CIBC are prohibited under the Bank Act (Canada) from selling, directly or indirectly, securities issued by CIBC or its

affiliates that are not owned or fully paid for. They are also prohibited from buying or selling a call or a put option in respect to securities issued by CIBC or its affiliates.

Directors should presume that any non-public information they know about CIBC is inside information when entering into a personal

securities transaction. If this information could in any way be material, the director must not trade.

In order to facilitate

compliance with these restrictions, directors must pre-clear all personal transactions in CIBC securities initiated by them through the Office of the Corporate Secretary and comply with any other policies relating to trading by directors.

4.4. Anti-competitive practices

| |

4.4.1. |

Anti-competitive behavior |

Competition fosters a fair and effective financial services industry. To ensure fair competition, it is CIBC’s policy not to

participate in any behaviour that will unduly lessen competition.

Accordingly, directors are expected to comply with competition

legislation and may not, on behalf of CIBC, agree with other financial institutions or businesses to (i) fix interest rates, prices, charges or types of services or (ii) avoid competing for customers in particular product categories or

geographic markets.

Competition guidelines are very complex and there are certain exceptions to these general principles regarding

anti-competitive activity. Should a director have any concerns about proposed dealings with competitors of CIBC, he or she should contact the General Counsel.

CIBC does not communicate, acquire or use trade secrets of others, unless it has acquired the legal rights to do so. Accordingly,

directors may not engage in illegal or unethical activities to gain proprietary information for CIBC, such as inducing an employee of a competitor to provide confidential information or inducing another director or employee of CIBC to engage in such

activity.

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

14 |

|

4.5. Maintaining records

Complete and accurate records help CIBC maintain and build customer and employment relationships and manage its business within appropriate risk

management guidelines. Without them, the integrity of CIBC’s business may be compromised, as well as the trust of CIBC’s stakeholders.

Directors must:

| |

• |

|

exercise care and diligence in following applicable record-keeping policies and procedures relating to the records of CIBC; |

| |

• |

|

never make or knowingly permit the making of false or misleading entries in CIBC’s books and records; and |

| |

• |

|

never destroy, alter or falsify or knowingly permit the destruction, alteration or falsification of, any records relating to CIBC, its directors, employees

and/or customers, that are potentially relevant to a violation of law or any litigation or pending, threatened or foreseeable government or judicial investigation or proceeding. |

5. Protecting CIBC’s Assets

5.1. CIBC’s assets

Any products or information revealed to a director and materials obtained by a director in the course of his or her role at CIBC constitute the property

of CIBC. This includes products, proposals, transactions, applications, customer lists, records, contact information, marketing materials, pricing information, business plans, legal and regulatory inquiries and actions, and other items or

information that a director is exposed to in the course of his or her role as a director of CIBC (hereafter referred to as “Property”). A director is expected to return all Property to CIBC at the conclusion of his or her term as director

or when otherwise requested to do so by CIBC, and thereafter, to refrain from using or disseminating such Property. CIBC reserves and expects to pursue its rights vigorously with respect to the retrieval of Property or any unauthorized use of

Property.

5.2. Internal and regulatory investigations

To uphold CIBC’s commitment to stakeholders, it is necessary for CIBC at times to conduct internal investigations for various reasons, including, to

comply with regulatory requests.

Directors are required to cooperate with Internal Audit, Corporate Security, Finance, Human Resources, Legal,

Compliance and other areas of CIBC as well as CIBC’s external auditors which audit, test or investigate issues within CIBC. Such cooperation includes attending all necessary meetings and accurately and fully answering all questions. In

connection with such an investigation, directors:

| |

• |

|

are prohibited from obstructing, delaying or preventing such an investigation; and |

| |

• |

|

may not discuss with employees or other directors of CIBC or a third party (other than outside counsel engaged by CIBC in connection with such an

|

|

|

|

|

|

|

|

|

|

Code of Ethics for Directors |

|

|

15 |

|

| |

investigation) the fact that CIBC, a director or an employee of CIBC is subject to an investigation, without the prior consent of the General Counsel. |

No director may attempt to retaliate or take other adverse action against another director or an employee of CIBC who provides information or assistance

in an investigation of violations of securities or antifraud laws.

Directors

will be required to attest annually to their familiarity with and adherence to the principles of the Code.

6. Process Review

The Code of Ethics for Directors was last

revised and approved by the Board on May 28, 2015.

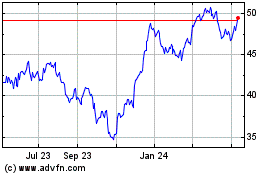

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

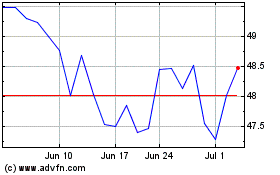

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024