UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of June 2015

Commission File Number: 1-14678

CANADIAN

IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court

Toronto,

Ontario

Canada M5L 1A2

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨

Form 40-F x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by

furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934: Yes ¨ No x

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

THIS REPORT ON FORM 6-K AND THE EXHIBITS HERETO SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE AS EXHIBITS TO CANADIAN IMPERIAL BANK OF

COMMERCE’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-202584) AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

Exhibits are filed herewith in connection with the issuance of $2,891,000 aggregate principal

amount of Buffered Digital Notes due December 29, 2017 Linked to the Russell 2000® Index (the “Notes”) by Canadian Imperial Bank of Commerce (the “Bank”) pursuant to the

Bank’s shelf registration statement on Form F-3 (File No. 333-202584):

EXHIBITS

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to the validity of the Notes under New York law. |

|

|

| 5.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters under Canadian and Ontario law. |

|

|

| 8.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to certain matters of United States federal income taxation. |

|

|

| 8.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters of Canadian federal income taxation. |

|

|

| 23.1 |

|

Consent of Mayer Brown LLP (included in Exhibits 5.1 and 8.1 above). |

|

|

| 23.2 |

|

Consent of Blake, Cassels & Graydon LLP (included in Exhibits 5.2 and 8.2 above). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

| Date: June 30, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ David G. Dickinson |

|

|

|

|

|

|

Name: |

|

David G. Dickinson |

|

|

|

|

|

|

Title: |

|

Vice-President, Treasury Financing |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to the validity of the Notes under New York law. |

|

|

| 5.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters under Canadian and Ontario law. |

|

|

| 8.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to certain matters of United States federal income taxation. |

|

|

| 8.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters of Canadian federal income taxation. |

|

|

| 23.1 |

|

Consent of Mayer Brown LLP (included in Exhibits 5.1 and 8.1 above). |

|

|

| 23.2 |

|

Consent of Blake, Cassels & Graydon LLP (included in Exhibits 5.2 and 8.2 above). |

Exhibit 5.1

Mayer Brown LLP

71 South Wacker Drive

Chicago,

Illinois 60606

Main Tel (312) 782-0600

Main Fax (312) 701-7711

www.mayerbrown.com

June 30, 2015

Canadian Imperial Bank of Commerce

Commerce Court

Toronto, Ontario

Canada M5L1A2

| |

Re: |

Canadian Imperial Bank of Commerce |

| |

|

Registration Statement on Form F-3 |

Dear Sirs:

We have represented Canadian Imperial Bank of Commerce, a bank organized under the Bank Act (Canada) (the “Bank”), in connection

with the issuance and delivery of $2,891,000 aggregate principal amount of Buffered Digital Notes due December 29, 2017 Linked to the Russell 2000® Index (the “Notes”). The Bank filed with the Securities and Exchange Commission a

registration statement on Form F-3 (File No. 333-202584) (the “Registration Statement”) under the Securities Act of 1933 (the “Act”) that was declared effective on April 30, 2015, relating to, among other things, the

proposed offer and sale of up to $2,000,000,000 aggregate initial offering price of senior debt securities. The Notes are being issued pursuant to the indenture, dated as of September 15, 2012 (the “Indenture”), between the Bank and

Deutsche Bank Trust Company Americas (the “Trustee”).

In connection with our representation, we have examined the corporate

records of the Bank, including its bye-laws and other corporate records and documents and have made such other examinations as we consider necessary to render this opinion.

Based upon the foregoing, it is our opinion that the Notes, assuming that each of the Indenture and the Notes have been duly authorized,

executed and delivered by the Bank, in each case insofar as the laws of Canada and Ontario are concerned, that the Indenture has been duly authorized, executed and delivered by the Trustee and that the Notes have been authenticated by the Trustee in

accordance with the terms of the Indenture and paid for by the purchasers thereof, constitute valid and binding obligations of the Bank, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general

applicability relating to or affecting creditors’ rights and to general equity principles and are entitled to the benefits of the Indenture.

Mayer Brown LLP operates in combination with other Mayer Brown entities with offices in Europe and Asia

and is associated with Tauil & Chequer Advogados, a Brazilian law partnership.

CIBC

June 30,

2015

Page 2

We are admitted to practice in

the States of Illinois and New York and our opinions expressed herein are limited solely to the Federal laws of the United States of America and the laws of the States of Illinois and New York, and we express no opinion herein concerning the laws of

any other jurisdiction. With respect to all matters of the laws of Canada and Ontario, we understand that you are relying upon the opinion, dated the date hereof, of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, and our

opinion is subject to the same assumptions, qualifications and limitations with respect to such matters as are contained in such opinion of Blake, Cassels & Graydon LLP.

In rendering the foregoing opinion, we are not passing upon, and assume no responsibility for, any disclosure in the Registration Statement or

any related prospectus or other offering material regarding the Bank or the Notes or their offering and sale.

The opinions and statements

expressed herein are as of the date hereof. We assume no obligation to update or supplement this opinion letter to reflect any facts or circumstances that may hereafter come to our attention or any changes in applicable law which may hereafter

occur.

We hereby consent to this filing of this opinion as an exhibit to a Form 6-K to be incorporated by reference in the Registration

Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

Very truly yours,

/s/ Mayer Brown LLP

Exhibit 5.2

June 30, 2015

Canadian Imperial Bank of Commerce

Commerce Court

Toronto, Ontario, Canada M5L1A2

| RE: |

Canadian Imperial Bank of Commerce |

Issue of Buffered Digital Notes

Ladies and Gentlemen:

We have acted as Canadian special

counsel to Canadian Imperial Bank of Commerce (the “Bank”) in connection with the issuance of US$2,891,000 aggregate principal amount of Buffered Digital Notes due December 29, 2017 Linked to the Russell 2000® Index (the

“Notes”), as described in the Bank’s Pricing Supplement with respect to the Notes dated June 25, 2015 (the “Pricing Supplement”), to the Prospectus Supplement dated April 30, 2015 and the Prospectus

dated April 30, 2015 contained in the Registration Statement on Form F-3, File No. 333-202584 (the “Registration Statement”).

For the purposes of our opinions below, we have examined such statutes, public and corporate records, opinions, certificates and other

documents, and considered such questions of law, as we have considered relevant and necessary as a basis for the opinions hereinafter set forth. In such examination we have assumed the genuineness of all signatures and the authenticity of all

documents submitted to us as originals, and the conformity to original documents of all documents submitted to us as certified or photostatic, portable document format or electronic copies or facsimiles. For the purposes of the opinions expressed

herein, we have, without independent investigation or verification, assumed that the indenture between the Bank and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”) dated September 15, 2012 (the

“Indenture”) has been duly authorized, executed and delivered by, and constitutes, a legal, valid and binding obligation of, each party thereto other than the Bank.

The opinions contained herein are limited to matters governed by the laws of the Province of Ontario and the federal laws of Canada applicable

therein. Such opinions are expressed with respect to the laws of the Province of Ontario in effect on the date of this opinion and we do not accept any responsibility to take into account or inform the addressees, or any other person authorized to

rely on this opinion, of any changes in law, facts or other developments subsequent to this date that do or may affect the opinions we express, nor do we have any obligation to advise you of any other change in any matter addressed in this opinion

or to consider whether it would be appropriate for any other person other than the addressees to rely on our opinion.

|

|

|

|

|

Page

2

|

With

respect to the incorporation and governance of the Bank as a Schedule I bank under the Bank Act (Canada) (the “Bank Act”) referred to in paragraph 1 below, we have relied, without independent investigation or verification,

exclusively upon a Certificate of Confirmation dated June 30, 2015 issued by the Office of the Superintendent of Financial Institutions and the Secretary’s Certificate (as defined herein) as reconfirmed by the Secretary of the Bank on June 29,

2015, which we have assumed continues to be accurate on the date hereof.

With respect to the authorization and execution of the Notes

referred to in paragraph 2 below, we have relied upon the Certificate of the Secretary of the Bank dated April 30, 2015 (the “Secretary’s Certificate”), as reconfirmed by the Secretary of the Bank on June 29, 2015, which

we have assumed continues to be accurate on the date hereof.

We express no opinion with respect to:

| |

(a) |

the effect of any provision of the Indenture, which purports to allow the severance of invalid, illegal or unenforceable provisions or restrict their effect; |

| |

(b) |

the validity, binding nature or enforceability of any provision of the Indenture which suggests that modifications, amendments or waivers that are not in writing will not be effective; |

| |

(c) |

the enforceability of any provision of the Indenture that purports to waive or limit rights or defences of a party; |

| |

(d) |

the enforceability of, nor as to the manner in which a court in the Province of Ontario would interpret and apply any provision which refers to, incorporates by reference or requires compliance with, any law, statute,

rule or regulation of any jurisdiction other than Ontario and the federal laws of Canada applicable therein; |

| |

(e) |

the enforceability of any provision of any agreement which purports to provide that any portion of an agreement or a provision thereof which is unenforceable may be severed without affecting the enforceability of the

remaining provisions; |

| |

(f) |

the effectiveness of provisions which purport to relieve a person from a liability, obligation or duty otherwise owed or required by law; and |

| |

(g) |

the availability of any equitable remedy, including those of specific performance and injunction, which remedies are only available in the discretion of a court of competent jurisdiction and/or authority.

|

Based and relying upon and subject to the qualifications set forth herein, we are of the opinion that:

| |

1. |

The Bank is a bank amalgamated under and governed by the Bank Act and has the corporate power to execute, deliver and perform its obligations under the Indenture, and has the corporate power to create, issue, sell and

deliver the Notes; |

| |

2. |

The Notes have been duly authorized and executed and, assuming they have been authenticated by the Trustee in accordance with the Indenture and delivered against payment therefor, to the extent that delivery and

validity of the Notes are matters governed by the laws of the Province of Ontario or the federal laws of Canada applicable therein, are delivered and are binding obligations of the Bank enforceable in accordance with their terms. |

|

|

|

|

|

Page

3

|

The

opinion set forth in paragraph 2 above as to the enforceability of the Notes is subject to and may be limited by the following qualifications:

| |

(i) |

general principles of equity, including the principle of granting equitable remedies such as specific performance and injunctive relief, are subject to the discretion exercisable by a court of competent authority and/or

jurisdiction; |

| |

(ii) |

enforceability may be limited by bankruptcy, insolvency, winding-up, liquidation or other similar laws of general application affecting the enforcement of creditors’ rights generally (including the provisions of

the Bank Act respecting such matters); |

| |

(iii) |

the enforcement of any rights against the Bank under the Indenture with respect to indemnity or contribution may be limited by applicable law and may not be ordered by a court on the grounds of public policy and may,

therefore, not be available in any particular instance; |

| |

(iv) |

a court in the Province of Ontario may decline to enforce provisions in any document which purport to allow a determination, calculation or certificate of a party thereto as to any matter provided for therein to be

final, conclusive or binding upon any other party thereto if such determination is found to be inaccurate on its face or to have been reached or made on any arbitrary or fraudulent; |

| |

(v) |

notwithstanding any provision of the Notes or the Indenture, the rate at which interest is payable on any judgment obtained in respect of any obligation contained in the Notes may be limited by the Interest Act (Canada)

or similar provincial legislation to a rate which is less than the rate stipulated in the Notes; |

| |

(vi) |

any requirement that interest (as defined in the Criminal Code (Canada)) be paid, or which results in receipt by the lender of such interest, at a rate in excess of 60% per annum may contravene Section 347 of

the Criminal Code (Canada) and may not be enforceable |

| |

(vii) |

enforceability of the Indenture or a provision of the Indenture may be subject to the provisions of the Limitations Act, 2002 (Ontario), and we express no opinion as to whether a court may find any provision of

the Indenture to be unenforceable on the basis that such provision is an attempt to vary or exclude a limitation period under such Act; and |

| |

(viii) |

pursuant to the Currency Act (Canada), a judgment by a court in any province in Canada may be awarded in Canadian currency only and such judgment may be based on a rate of exchange which may be the rate in

existence on a day other than the day of payment of such judgment. |

|

|

|

|

|

Page

4

|

The

opinions expressed herein are provided solely for the benefit of the addressee in connection with the issuance of the Notes and are not to be transmitted to any other person, nor are they to be relied upon by any other person or for any other

purpose or referred to in any public document or filed with any government agency or other person without our prior express consent. The opinions expressed herein may be relied upon by Mayer Brown LLP for the purposes of its opinion dated the date

hereof addressed to the Bank with respect to the subject matter hereof.

We hereby consent to the filing of this opinion as an exhibit to

a Form 6-K to be incorporated by reference in the Registration Statement filed by the Bank with the Securities and Exchange Commission. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is

required under Section 7 of the United States Securities Act of 1933, as amended, or the rules and regulations promulgated thereunder.

Yours very

truly,

/s/ Blake, Cassels & Graydon LLP

Exhibit 8.1

Mayer Brown LLP

71 South Wacker Drive

Chicago,

Illinois 60606

Main Tel (312) 782-0600

Main Fax (312) 701-7711

www.mayerbrown.com

June 30, 2015

Canadian Imperial Bank of Commerce

Commerce Court

Toronto, Ontario

Canada M5L1A2

| |

Re: |

Canadian Imperial Bank of Commerce |

Registration Statement on Form F-3

Dear Sirs:

We have represented Canadian

Imperial Bank of Commerce, a bank organized under the Bank Act (Canada) (the “Bank”), in connection with the issuance and delivery of $2,891,000 aggregate principal amount of Buffered Digital Notes due December 29, 2017 Linked to the

Russell 2000® Index (the “Notes”), as described in the Pricing Supplement dated June 25, 2015 (the “Pricing Supplement”), related to the Prospectus Supplement dated April 30, 2015 and the Prospectus dated

April 30, 2015 contained in or deemed to be part of the Registration Statement on Form F-3 (File No. 333-202584) of the Bank (the “Registration Statement”).

We hereby confirm to you that the statements of U.S. tax law set forth under the heading “Certain U.S. Federal Income Tax

Considerations” in the Pricing Supplement constitute a fair and accurate summary of the material United States tax consequences of owning the Notes, subject to the limitations and exceptions set forth in the Pricing Supplement.

The opinions and statements expressed herein are as of the date hereof. We assume no obligation to update or supplement this opinion letter to

reflect any facts or circumstances that may hereafter come to our attention or any changes in applicable law which may hereafter occur.

Mayer Brown LLP operates in combination with other Mayer Brown entities with offices in Europe and Asia

and is associated with Tauil & Chequer Advogados, a Brazilian law partnership.

CIBC

June 30,

2015

Page 2

We hereby consent to this

filing of this opinion as an exhibit to a Form 6-K to be incorporated by reference in the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7

of the Act.

|

|

|

| Very truly yours, |

|

|

|

|

| /s/ Mayer Brown LLP |

|

|

Exhibit 8.2

June 30, 2015

Canadian

Imperial Bank of Commerce

Commerce Court

Toronto, Ontario,

Canada M5L 1A2

| RE: |

Canadian Imperial Bank of Commerce |

Issue of Buffered Digital Notes

Ladies and Gentlemen:

We have acted as Canadian special

counsel to Canadian Imperial Bank of Commerce (the “Bank”) in connection with the issuance of US$2,891,000 aggregate principal amount of Buffered Digital Notes due December 29, 2017 Linked to the Russell 2000® Index (the

“Notes”), as described in the Bank’s Pricing Supplement with respect to the Notes dated June 25, 2015 (the “Pricing Supplement”), to the Prospectus Supplement dated April 30, 2015 and the Prospectus

dated April 30, 2015 contained in the Registration Statement on Form F-3, File No. 333-202584 (the “Registration Statement”). Subject to the qualifications, assumptions, limitations and understandings set out therein, the

statements as to matters of the federal laws of Canada set forth under the heading “Certain Canadian Federal Income Tax Consequences” in the Pricing Supplement are an accurate summary, in all material respects, as at the date

hereof, of the principal Canadian federal income tax considerations generally applicable to holders of Notes, as applicable, described therein.

We hereby consent to the filing of this opinion as an exhibit to a Form 6-K of the Bank filed with the Securities and Exchange Commission and

thereby incorporated by reference into the Bank’s Registration Statement. In giving such consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as

amended, or the rules and regulations promulgated thereunder.

Very truly yours,

/s/ Blake, Cassels & Graydon LLP

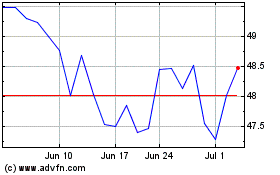

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

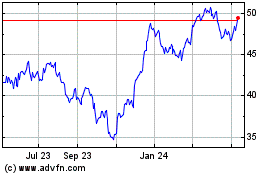

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024