Ontario Teachers Fund: Supports TMX/LSE Planned Merger

March 17 2011 - 4:43PM

Dow Jones News

Ontario Teachers' Pension Plan, one of the country's largest

pension funds, said Thursday it supports TMX Group Inc.'s (X.T)

planned merger with the London Stock Exchange Group PLC

(LSE.LN),joining the fray over the proposed deal as some of

Canada's biggest financial players line up for and against it.

In a release on its Website, Ontario Teachers', which oversees

more than C$100 billion in assets but doesn't own shares in either

exchange operator, said the proposed merger will generate lower

trading costs, and provide Canadian companies with greater access

to investors in Europe and the Middle East. The pension plan said

approval of the deal should ensure that publicly traded companies

in Canada remain subject to Canadian regulatory oversight.

TMX needs approval from the federal government as well as from

the securities commissions of Ontario, Quebec, Alberta and British

Columbia. Last week, senior executives at the brokerage units of

three of Canada's biggest banks - Toronto-Dominion Bank (TD),

Canadian Imperial Bank of Commerce (CM) and National Bank of Canada

(NA.T), publicly opposed the transaction in an open letter. They

argued the transatlantic tie-up would hurt the ability of small-

and mid-sized exploration, technology and manufacturing companies

to raise money because the merged exchange would focus less on this

segment. The Ontario government is expected to release its

recommendation on the proposed merger by the end of this month.

TMX and LSE executives have defended the deal as a way of adding

scale amid a global rush among international exchanges to

consolidate.

Ontario Teachers' said the government risks damaging the

country's reputation internationally and isolating Canada's capital

markets if it blocks the deal.

"Should Canadian governments treat foreign investors less

favourably than domestic investors, it will be viewed by other

countries as parochial at best, and at worst as protectionist; and

we may lose access to foreign investment opportunities on behalf of

our beneficiaries, Ontario's teachers," the pension plan said in

its statement.

It also noted that TMX is better off playing a meaningful role

in a "larger global exchange," given Canada represents less than 3%

of the total global market capital.

TMX "risks becoming irrelevant entirely if it cannot compete in

the global market place through a merger with other exchanges," the

pension fund said.

Ontario Teachers' decision comes as Ontario Municipal Employees

Retirement System, or OMERS, another large pension plan based in

Ontario, is studying the proposed merger. Last month, the pension

plan's Chief Executive Michael Nobrega said he personally supported

the deal. OMERs oversees about C$53.3 billion in assets.

-By Ben Dummett; Dow Jones Newswires; 416-306-2024;

ben.dummett@dowjones.com

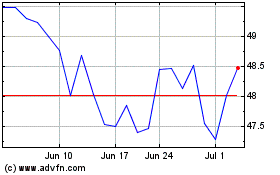

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

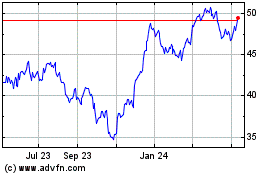

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024