IRC Ltd Seeking To Raise Up To US$512 Million In Hong Kong IPO - Term Sheet

September 20 2010 - 10:53PM

Dow Jones News

IRC Ltd., the non-precious metals division of London-listed

Russian miner Petropavlovsk PLC (POG.LN), is raising up to US$512

million ahead of a listing in Hong Kong on Oct. 14, according to a

term sheet seen by Dow Jones Newswires.

The roadshow began Tuesday, and the company has set a price

range of HK$2.2-HK$3.0 per share for the sale of 1.325 billion

shares in the IPO.

There is an overallotment option that would allow the sale of a

total of 1.523 billion shares that if exercised could raise up to

US$588.8 million for the company.

IRC will launch the sale of the IPO to Hong Kong retail

investors on Sept. 30 and will price the deal on Oct. 6.

MHL, a wholly owned unit of Asia Resources Fund, which is

managed by private equity firm General Enterprise Management

Services (International) Ltd., and CEF Holdings Ltd., a

joint-venture that is 50% owned by tycoon Li Ka-shing's Cheung Kong

(Holdings) Ltd. (0001.HK) and 50% owned by Toronto-headquartered

Canadian Imperial Bank of Commerce (CM), are cornerstone investors

and will invest a total of US$60 million in the IPO.

Bank of America Merrill Lynch, BOC International Holdings Ltd.,

and UBS AG are bookrunners on the deal.

-By Nisha Gopalan, Dow Jones Newswires; 852-2832-2343;

nisha.gopalan@dowjones.com

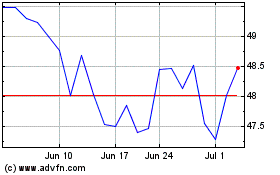

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

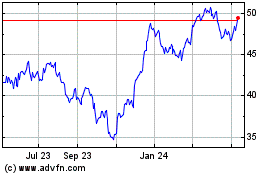

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024