UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 OR

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): May 1, 2015

THE CLOROX

COMPANY

(Exact name of registrant

as specified in its charter)

________________

| Delaware |

|

1-07151 |

|

31-0595760 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

| incorporation) |

|

|

|

Identification No.) |

1221 Broadway, Oakland,

California 94612-1888

(Address of principal executive offices) (Zip

code)

(510)

271-7000

(Registrant's

telephone number, including area code)

Not

applicable

(Former name or

former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to

Rule 425 Under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c)) |

Item 2.02 Results of Operations and Financial

Condition

On May 1, 2015, The Clorox

Company issued a press release announcing its financial results for its third

quarter ended March 31, 2015. The full text of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01 Regulation FD

Disclosure

Attached hereto as Exhibit

99.2 and incorporated herein by reference is supplemental financial

information.

Item 9.01 Financial

Statements and Exhibits

(d) Exhibits

| Exhibit |

|

Description |

| 99.1 |

|

Press Release

dated May 1, 2015 of The Clorox Company |

| 99.2 |

|

Supplemental

information regarding financial results |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

THE CLOROX

COMPANY |

| |

| |

| Date:

May 1, 2015 |

By:

|

|

/ s/ Laura Stein |

|

|

|

Executive Vice

President – |

|

|

|

General

Counsel |

THE CLOROX COMPANY

FORM 8-K

INDEX TO EXHIBITS

| Exhibit |

Description |

| 99.1 |

Press Release

dated May 1, 2015 of The Clorox Company |

| 99.2 |

Supplemental

information regarding financial results |

| PRESS RELEASE |

|

| |

The Clorox Company Reports 3 Percent Sales

Growth in Q3; Updates Fiscal Year 2015 Outlook for Sales and EPS

OAKLAND, Calif., May 1, 2015 – The Clorox

Company (NYSE:CLX) today reported sales growth of 3 percent and a decrease of 5

percent diluted net earnings per share (EPS) from continuing operations for its

third quarter, which ended March 31, 2015. On a currency-neutral basis, sales

grew 5 percent.

“I’m pleased we delivered strong results

in the third quarter, allowing us to raise our fiscal year sales outlook and

update our EPS outlook,” said Chief Executive Officer Benno Dorer. “All U.S.

segments contributed to sales growth, and sales for International grew strongly

on a currency-neutral basis. Importantly, our continued incremental investments

in demand building, including meaningful innovation, are paying off, as we saw

the highest market share growth in about four years.

“In addition, the company delivered gross

margin expansion in the quarter, demonstrating that we’re on track with our

strategy to deliver growth profitably through strong cost savings programs and

price increases.

“As we look to the remainder of the year and into fiscal 2016,

I believe we have the right plans in place to address the challenges we continue

to anticipate, including increasingly unfavorable foreign currencies and slowing

international economies.”

All results in this press release are reported on a

continuing operations basis, unless otherwise stated. As previously announced,

Corporación Clorox de Venezuela S.A. (Clorox Venezuela) discontinued operations

effective Sept. 22, 2014. For the current and year-ago quarters, the results

from Clorox Venezuela are now included in discontinued operations in the

company’s financial statements. Some information in this release is reported on

a non-GAAP basis. See “Non-GAAP Financial Information” below and the tables

toward the end of this press release for more information and reconciliations of

key third-quarter results to the most directly comparable financial measures

calculated in accordance with generally accepted accounting principles in the

U.S. (GAAP).

Fiscal Third-Quarter

Results

Following is a summary of key

third-quarter results. All comparisons are with the third quarter of fiscal year

2014, unless otherwise stated.

| * |

$1.08 diluted EPS (5%

decrease) |

| * |

1% volume growth |

| * |

3% sales

growth |

In the third quarter, Clorox delivered

earnings from continuing operations of $144 million, or $1.08 diluted EPS,

compared to $151 million, or $1.14 cents diluted EPS, in the year-ago quarter.

Third-quarter results reflected higher performance-based incentive compensation

costs as the company anticipates exceeding its annual incentive targets; whereas

in the prior-year, earnings benefitted from a 12-cent impact when the company

fell significantly below these targets.

The impact of incentive compensation costs is

reflected in selling and administrative expenses, cost of products sold, and

research and development on the income statement. Third-quarter diluted EPS was

also negatively impacted by higher manufacturing and logistics costs, increased

investments in total demand-building programs and the impact of unfavorable

foreign currency exchange rates. These factors were partially offset by higher

sales, as well as the benefit of cost savings and price increases. Third-quarter

commodity costs were flat.

In the third quarter, sales grew 3 percent, reflecting the benefit of price increases, favorable mix and assortment and higher volume. These factors were partially offset by 2 percentage points of unfavorable foreign currency exchange rates and 1 percentage point of increased trade promotion spending. Volume for the third quarter increased 1 percent, reflecting growth in the Cleaning, Lifestyle and International segments.

The company’s third-quarter gross margin

increased 110 basis points to 43.2 percent, reflecting the benefits of cost

savings and price increases, favorable mix and assortment and flat commodity

costs. These factors were partially offset by higher manufacturing and logistics

costs and higher incentive compensation costs.

Fiscal year-to-date net cash provided by

continuing operations was $481 million, compared with $444 million in the

year-ago period, an increase of 8 percent. Contributing factors include lower

incentive compensation and tax payments in the current period, as well as the

initial funding of the company’s non-qualified deferred compensation plan in the

year-ago period. These benefits were partially offset by $25 million in payments

to settle interest-rate hedges related to the company's issuance of long-term

debt in December 2014. The company continues to use its cash flow to invest in

its business, maintain debt leverage within its targeted range and return excess

cash to stockholders through dividends and share repurchases. Fiscal-year-to

date, the company has repurchased about 1.5 million shares of its common stock

at a cost of approximately $158 million.

Discontinued

Operations

In the third quarter, the company

recognized $30 million of previously unrecognized tax benefits in discontinued

operations upon the expiration of the applicable statute of limitations.

Recognition of these previously disclosed tax benefits had no impact on the

company’s cash flows or earnings from continuing operations.

Key Segment Results

Following is a summary of key

third-quarter results from continuing operations by reportable segment. All

comparisons are with the third quarter of fiscal year 2014, unless otherwise

stated.

Cleaning

(Laundry, Home Care, Professional

Products)

| ● |

1% volume growth |

| ● |

1% sales growth |

| ● |

8% pretax earnings

growth |

Volume growth in the segment was driven

primarily by gains in Home Care, reflecting double-digit volume growth of

Clorox® disinfecting wipes behind increased merchandising support and

product innovation, as well as record shipments of toilet cleaners. Laundry

volume results reflected lower shipments of Green Works® laundry

detergent and lower shipments of Clorox bleach primarily due to the impact of

the recent price increase. Home Care and Laundry grew market share in total,

with gains across multiple brands. Pretax earnings growth reflected higher

volume, as well as the benefit of cost savings and price increases, partially

offset by an increase in demand-building investments.

Household

(Bags and Wraps, Charcoal, Cat

Litter)

| ● |

Flat volume |

| ● |

5% sales growth |

| ● |

34% pretax earnings

growth |

Segment volume results reflected

double-digit growth in Charcoal on top of high single-digit growth in the

year-ago quarter. Charcoal’s strong results were driven primarily by increased

merchandising support in anticipation of the grilling season. Offsetting factors

include decreased shipments in Bags & Wraps, primarily due to the impact of

price increases and lower shipments in Cat Litter, largely due to continuing

competitive activity. The variance between volume and sales results was due

primarily to the benefit of price increases in Bags & Wraps. Pretax earnings growth

reflected higher

sales, significant cost savings and the benefit of price increases. These

factors were partially offset by higher logistics costs and an increase in

demand-building investments.

Lifestyle

(Dressings and Sauces, Water Filtration,

Natural Personal Care)

| ● |

2% volume growth |

| ● |

3% sales growth |

| ● |

6% pretax earnings

growth |

Volume results in the segment were driven

by gains in Natural Personal Care, largely due to product innovation in Burt’s

Bees® lip and face-care products, including lip crayons and Renewal

face products. Dressings and Sauces also grew volume primarily from increased

distribution of Hidden Valley® dry mixes and dips. These results were

partially offset by lower shipments in Water Filtration due to continued

competitive activity and category softness.

Pretax earnings growth reflected lower commodity

costs, higher volume and the benefit of cost savings, partially offset by higher

manufacturing and logistics and an increase in demand-building

investments.

International

(All countries outside of the

U.S.)

| ● |

1% volume growth |

| ● |

Flat sales (10% growth,

currency-neutral basis) |

| ● |

26% pretax earnings decrease |

The segment’s volume growth reflected

gains in Mexico and Canada, partially offset by lower shipments in Argentina and

Asia. Segment sales reflected the impact of unfavorable foreign currency

exchange rates across most countries, offset by the benefit of price increases,

favorable mix and assortment and higher volume. On a currency-neutral basis,

segment sales grew 10 percent. Pretax earnings decreased $6 million primarily

due to increases in selling and administrative expenses, driven by inflation and

higher performance-based incentive compensation costs; the impact of unfavorable

foreign currency exchange rates; higher manufacturing and logistics costs; and

higher commodity costs. These factors were partially offset by the benefit of

price increases, favorable mix and assortment and the benefit of cost

savings.

Clorox Updates Outlook for Fiscal Year

2015

| ● |

1% to 2% sales growth

(previously about 1% sales growth) |

| ● |

EBIT margin about flat

(unchanged) |

| ● |

$4.45

to $4.55 diluted EPS range (previously $4.40 to

$4.55) |

The company now anticipates fiscal-year

2015 sales to grow in the range of 1 percent to 2 percent. Clorox’s updated

sales outlook reflects stronger results through the third quarter and more than

2 percentage points of impact from unfavorable foreign currency exchange rates.

Other moderating factors include slowing economies in international markets and

an increase in trade-promotion spending to drive the company’s core business and

trial of new products in a highly competitive environment.

Clorox continues to anticipate moderate

gross margin expansion in fiscal year 2015, reflecting the benefit of cost

savings and price increases. The company continues to anticipate commodity costs

to be about flat due to energy cost declines. Offsetting factors to gross margin

expansion include higher logistics costs, as well as the aforementioned increase

in trade-promotion spending.

Clorox continues to anticipate EBIT margin

to be about flat for fiscal year 2015, reflecting moderate gross margin

expansion, offset by higher performance-based incentive compensation costs. The

company’s fiscal-year EBIT margin also reflects higher demand-building

investments.

Clorox continues to anticipate its

effective fiscal year 2015 tax rate to be about 34 percent.

Net of all these factors, Clorox now

anticipates fiscal year 2015 diluted EPS from continuing operations in the range

of $4.45 to $4.55.

For More Detailed Financial Information

Visit the Investors: Financial Reporting:

Financial Results section of the company’s website at TheCloroxCompany.com for the following:

| * |

Combined financial tables that include the schedules below |

| * |

Supplemental unaudited condensed volume and sales growth information |

| * |

Supplemental unaudited condensed gross margin driver information |

| * |

Supplemental unaudited reconciliation of

certain non-GAAP financial information, including earnings from continuing

operations before interest and taxes (EBIT) and earnings from continuing

operations before interest, taxes, depreciation and amortization

(EBITDA) |

| * |

Supplemental balance sheet and cash flow

information and free cash flow reconciliation (unaudited) |

| * |

Supplemental price-change

information |

Note: Percentage and basis-point changes

noted in this press release are calculated based on rounded numbers.

Supplemental materials are available in the Investors: Financial Reporting:

Financial Results section of the company’s website at TheCloroxCompany.com.

The Clorox Company

The Clorox Company is a leading

multinational manufacturer and marketer of consumer and professional products

with about 7,700 employees worldwide and fiscal year 2014 sales of $5.5 billion.

Clorox markets some of the most trusted and recognized consumer brand names,

including its namesake bleach and cleaning products; Pine-Sol®

cleaners; Liquid Plumr® clog removers; Poett® home care

products; Fresh Step® cat litter; Glad® bags, wraps and

containers; Kingsford® charcoal; Hidden Valley® and KC

Masterpiece® dressings and sauces; Brita® water-filtration

products and Burt’s Bees® natural personal care products. The company

also markets brands for professional services, including Clorox

Healthcare®, HealthLink®, Aplicare® and

Dispatch® infection control products for the healthcare industry.

More than 80 percent of the company's brands hold the No. 1 or No. 2 market

share positions in their categories. Clorox's commitment to corporate

responsibility includes making a positive difference in its communities. In

fiscal year 2014, The Clorox Company and The Clorox Company Foundation

contributed more than $16 million in combined cash grants, product donations,

cause marketing and employee volunteerism. For more information, visit

TheCloroxCompany.com.

Forward-Looking

Statements

This press release contains

"forward-looking statements" within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended, and such forward-looking statements involve risks and uncertainties.

Except for historical information, matters discussed above, including statements

about future volume, sales, costs, cost savings, earnings, cash flows, plans,

objectives, expectations, growth, or profitability, are forward-looking

statements based on management's estimates, assumptions and projections. Words

such as "could," "may," "expects," "anticipates," "targets," "goals,"

"projects," "intends," "plans," "believes," "seeks," "estimates," and variations

on such words, and similar expressions, are intended to identify such

forward-looking statements. These forward-looking statements are only

predictions, subject to risks and uncertainties, and actual results could differ

materially from those discussed above. Important factors that could affect

performance and cause results to differ materially from management's

expectations are described in the sections entitled "Risk Factors" in the

company's Annual Report on Form 10-K for the fiscal year ended June 30, 2014,

and "Management's Discussion and Analysis of Financial Condition and Results of

Operations" in Exhibit 99.2 of the Company’s Current Report on Form 8-K filed on

December 4, 2014, as updated from time to time in the company's SEC filings.

These factors include, but are not limited to: risks related to international

operations, including political instability; government-imposed price controls

or other regulations; foreign currency exchange rate controls, including

periodic changes in such controls, fluctuations and devaluations; labor unrest

and inflationary pressures, particularly in Argentina and other challenging

markets; risks related to the possibility of nationalization, expropriation of

assets, or other government action in foreign jurisdictions; risks related to

the Company’s discontinuation of operations in Venezuela; intense competition in

the company's markets; changes in the company’s leadership; worldwide, regional

and local economic conditions and financial market volatility; volatility and

increases in commodity costs such as resin, sodium hypochlorite and agricultural

commodities and increases in energy, transportation or other costs; the ability

of the company to drive sales growth, increase price and market share, grow its

product categories and achieve favorable product and geographic mix; dependence

on key customers and risks related to customer consolidation and ordering

patterns; costs resulting from government regulations; the ability of the

company to successfully manage global political, legal, tax and regulatory

risks, including changes in regulatory or administrative activity; supply

disruptions and other risks inherent in reliance on a limited base of suppliers;

the ability of the company to implement and generate anticipated cost savings

and efficiencies; the success of the company's business strategies; the impact

of product liability claims, labor claims and other legal proceedings, including

in foreign jurisdictions and the company's litigation related to its

discontinued operations in Brazil; the ability of the company to develop and

introduce commercially successful products; risks relating to acquisitions, new

ventures and divestitures and associated costs, including the potential for

asset impairment charges, related to, among others, intangible assets and

goodwill; risks related to reliance on information technology systems, including

potential security breaches, cyber attacks or privacy breaches that result in

the unauthorized disclosure of consumer, customer, employee or company

information, or service interruptions; the company's ability to attract and

retain key personnel; the company's ability to maintain its business reputation

and the reputation of its brands; environmental matters including costs

associated with the remediation of past contamination and the handling and/or

transportation of hazardous substances; the impact of natural disasters,

terrorism and other events beyond the company's control; the company's ability

to maximize, assert and defend its intellectual property rights; any

infringement or claimed infringement by the company of third-party intellectual

property rights; the effect of the company's indebtedness and credit rating on

its operations and financial results; the company's ability to maintain an

effective system of internal controls; uncertainties relating to tax positions,

tax disputes and changes in the company's tax rate; the accuracy of the

company's estimates and assumptions on which its financial statement projections

are based; the company's ability to pay and declare dividends or repurchase its

stock in the future; and the impacts of potential stockholder

activism.

The company's forward-looking statements

in this press release are based on management's current views and assumptions

regarding future events and speak only as of their dates. The company undertakes

no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, except as

required by the federal securities laws.

Non-GAAP Financial

Information

This press release contains non-GAAP

financial information relating to sales growth, diluted EPS and EBIT margin. The

company has included reconciliations of these non-GAAP financial measures to the

most directly comparable financial measure calculated in accordance with GAAP.

See the end of this press release for these reconciliations.

The company disclosed these non-GAAP

financial measures to supplement its consolidated financial statements presented

in accordance with GAAP. These non-GAAP financial measures exclude certain items

that are included in the company’s results reported in accordance with GAAP,

including income taxes, interest income, interest expense and foreign exchange

impact. The exclusion of foreign exchange impact is also referred to as

currency-neutral. Management believes these non-GAAP financial measures provide

useful additional information to investors about trends in the company’s

operations and are useful for period-over-period comparisons. These non-GAAP

financial measures should not be considered in isolation or as a substitute for

the comparable GAAP measures. In addition, these non-GAAP measures may not be

the same as similar measures provided by other companies due to potential

differences in methods of calculation and items being excluded. They should be

read in connection with the company’s consolidated financial statements

presented in accordance with GAAP.

Media Relations

Aileen Zerrudo (510) 271-3075,

aileen.zerrudo@clorox.com

Kathryn Caulfield (510) 271-7209,

kathryn.caulfield@clorox.com

Investor Relations

Landon Dunn (510) 271-7256,

landon.dunn@clorox.com

Steve Austenfeld (510) 271-2270,

steve.austenfeld@clorox.com

For recent presentations made by company

management and other investor materials, visit Investor Events on the company’s

website.

Condensed Consolidated Statements of

Earnings (Unaudited)

Dollars in millions,

except per share amounts

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

3/31/2015 |

|

3/31/2014 |

|

3/31/2015 |

|

3/31/2014 |

| Net sales |

|

$ |

1,401 |

|

|

$ |

1,366 |

|

|

$ |

4,098 |

|

|

$ |

4,017 |

|

| Cost of products sold |

|

|

796 |

|

|

|

791 |

|

|

|

2,343 |

|

|

|

2,303 |

|

| Gross profit |

|

|

605 |

|

|

|

575 |

|

|

|

1,755 |

|

|

|

1,714 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and administrative

expenses |

|

|

206 |

|

|

|

178 |

|

|

|

577 |

|

|

|

568 |

|

| Advertising costs |

|

|

124 |

|

|

|

120 |

|

|

|

372 |

|

|

|

362 |

|

| Research and development costs |

|

|

34 |

|

|

|

28 |

|

|

|

97 |

|

|

|

90 |

|

| Interest expense |

|

|

25 |

|

|

|

25 |

|

|

|

77 |

|

|

|

77 |

|

| Other income, net |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

- |

|

|

|

(4 |

) |

| Earnings from continuing operations before income

taxes |

|

|

217 |

|

|

|

226 |

|

|

|

632 |

|

|

|

621 |

|

| Income taxes on continuing

operations |

|

|

73 |

|

|

|

75 |

|

|

|

215 |

|

|

|

213 |

|

| Earnings from continuing operations |

|

|

144 |

|

|

|

151 |

|

|

|

417 |

|

|

|

408 |

|

| Earnings (losses) from discontinued

operations, net of tax |

|

|

30 |

|

|

|

(14 |

) |

|

|

(28 |

) |

|

|

(20 |

) |

| Net earnings |

|

$ |

174 |

|

|

$ |

137 |

|

|

$ |

389 |

|

|

$ |

388 |

|

| |

| Net earnings (losses) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

1.09 |

|

|

$ |

1.16 |

|

|

$ |

3.20 |

|

|

$ |

3.15 |

|

|

Discontinued operations |

|

|

0.22 |

|

|

|

(0.11 |

) |

|

|

(0.22 |

) |

|

|

(0.16 |

) |

| Basic net earnings

per share |

|

$ |

1.31 |

|

|

$ |

1.05 |

|

|

$ |

2.98 |

|

|

$ |

2.99 |

|

| |

| Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

1.08 |

|

|

$ |

1.14 |

|

|

$ |

3.14 |

|

|

$ |

3.10 |

|

|

Discontinued operations |

|

|

0.22 |

|

|

|

(0.10 |

) |

|

|

(0.21 |

) |

|

|

(0.16 |

) |

| Diluted

net earnings per share |

|

$ |

1.30 |

|

|

$ |

1.04 |

|

|

$ |

2.93 |

|

|

$ |

2.94 |

|

| |

| Weighted average shares outstanding (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

131,833 |

|

|

|

129,318 |

|

|

|

130,566 |

|

|

|

129,743 |

|

|

Diluted |

|

|

134,115 |

|

|

|

131,555 |

|

|

|

133,090 |

|

|

|

132,004 |

|

Reportable Segment

Information

(Unaudited)

Dollars in

millions

|

|

|

|

|

|

|

|

|

|

|

Earnings (Losses) from

Continuing Operations |

| Third

Quarter |

|

Net Sales |

|

Before Income Taxes |

|

|

Three Months Ended |

|

|

|

|

Three Months Ended |

|

|

|

|

|

3/31/15 |

|

3/31/14 |

|

% Change (1) |

|

3/31/15 |

|

3/31/14 |

|

% Change (1) |

| Cleaning Segment

|

|

$ |

442 |

|

$ |

437 |

|

1

|

% |

|

$ |

100 |

|

|

$ |

93 |

|

|

8% |

|

| Household Segment |

|

|

451 |

|

|

428 |

|

5 |

% |

|

|

102 |

|

|

|

76 |

|

|

34% |

|

| Lifestyle Segment

|

|

|

243 |

|

|

237 |

|

3 |

% |

|

|

71 |

|

|

|

67 |

|

|

6% |

|

| International Segment |

|

|

265 |

|

|

264 |

|

0 |

% |

|

|

17 |

|

|

|

23 |

|

|

-26% |

|

| Corporate |

|

|

- |

|

|

- |

|

- |

|

|

|

(73 |

) |

|

|

(33 |

) |

|

121%

|

|

| Total Company |

|

$ |

1,401 |

|

$ |

1,366 |

|

3 |

% |

|

$ |

217

|

|

|

$ |

226

|

|

|

-4% |

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (Losses) from

Continuing Operations |

| Year-to-Date |

|

Net Sales |

|

Before Income Taxes |

|

|

Nine Months Ended |

|

|

|

|

Nine Months Ended |

|

|

|

| |

|

3/31/15 |

|

3/31/14 |

|

% Change (1) |

|

3/31/15 |

|

3/31/14 |

|

% Change (1) |

| Cleaning Segment

|

|

$ |

1,359 |

|

$ |

1,348 |

|

1 |

% |

|

$ |

331 |

|

|

$ |

325 |

|

|

2% |

|

| Household Segment |

|

|

1,214 |

|

|

1,152 |

|

5 |

% |

|

|

205 |

|

|

|

169 |

|

|

21% |

|

| Lifestyle Segment

|

|

|

705 |

|

|

692 |

|

2 |

% |

|

|

200 |

|

|

|

189 |

|

|

6% |

|

| International Segment |

|

|

820 |

|

|

825 |

|

-1 |

% |

|

|

67 |

|

|

|

87 |

|

|

-23%

|

|

| Corporate |

|

|

- |

|

|

- |

|

- |

|

|

|

(171 |

) |

|

|

(149 |

) |

|

15% |

|

| Total Company |

|

$ |

4,098 |

|

$ |

4,017 |

|

2 |

% |

|

$ |

632 |

|

|

$ |

621 |

|

|

2% |

(2) |

| (1) |

Percentages based on rounded

numbers. |

| (2) |

The decrease was primarily due to higher performance-based

incentive compensation expenses compared to lower incentive compensation

expenses in the prior year when the company fell significantly below its

incentive targets |

Condensed Consolidated Balance

Sheets

Dollars in millions

|

3/31/2015 |

|

6/30/2014 |

|

3/31/2014 |

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

$ |

378 |

|

|

$ |

329 |

|

|

$ |

364 |

|

| Receivables,

net |

|

528 |

|

|

|

546 |

|

|

|

551 |

|

| Inventories,

net |

|

440 |

|

|

|

386 |

|

|

|

447 |

|

| Other current

assets |

|

149 |

|

|

|

134 |

|

|

|

158 |

|

| Total

current assets |

|

1,495 |

|

|

|

1,395 |

|

|

|

1,520 |

|

| |

| Property, plant and equipment, net |

|

917 |

|

|

|

977 |

|

|

|

970 |

|

| Goodwill |

|

1,067 |

|

|

|

1,101 |

|

|

|

1,096 |

|

| Trademarks,

net |

|

535 |

|

|

|

547 |

|

|

|

547 |

|

| Other intangible assets, net |

|

52 |

|

|

|

64 |

|

|

|

67 |

|

| Other

assets |

|

162 |

|

|

|

174 |

|

|

|

174 |

|

| Total assets |

$ |

4,228 |

|

|

$ |

4,258 |

|

|

$ |

4,374 |

|

| |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

| Notes and loans

payable |

$ |

70 |

|

|

$ |

143 |

|

|

$ |

394 |

|

| Current maturities of

long-term debt |

|

300 |

|

|

|

575 |

|

|

|

575 |

|

| Accounts

payable |

|

397 |

|

|

|

440 |

|

|

|

388 |

|

| Accrued

liabilities |

|

533 |

|

|

|

472 |

|

|

|

481 |

|

| Income taxes

payable |

|

- |

|

|

|

8 |

|

|

|

- |

|

| Total

current liabilities |

|

1,300 |

|

|

|

1,638 |

|

|

|

1,838 |

|

| Long-term

debt |

|

1,796 |

|

|

|

1,595 |

|

|

|

1,595 |

|

| Other liabilities |

|

733 |

|

|

|

768 |

|

|

|

764 |

|

| Deferred income

taxes |

|

97 |

|

|

|

103 |

|

|

|

124 |

|

| Total

liabilities |

|

3,926 |

|

|

|

4,104 |

|

|

|

4,321 |

|

| |

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

159 |

|

|

|

159 |

|

|

|

159 |

|

| Additional

paid-in capital |

|

762 |

|

|

|

709 |

|

|

|

699 |

|

| Retained earnings |

|

1,832 |

|

|

|

1,739 |

|

|

|

1,667 |

|

| Treasury

shares |

|

(1,970 |

) |

|

|

(2,036 |

) |

|

|

(2,054 |

) |

| Accumulated other comprehensive net losses |

|

(481 |

) |

|

|

(417 |

) |

|

|

(418 |

) |

| Stockholders’

equity |

|

302 |

|

|

|

154 |

|

|

|

53 |

|

| Total liabilities and stockholders’ equity |

$ |

4,228 |

|

|

$ |

4,258 |

|

|

$ |

4,374 |

|

The tables below present the

reconciliation of non-GAAP financial measures to the most directly comparable

financial measures calculated in accordance with GAAP and other supplemental

information. See “Non-GAAP Financial Information” above for further information

regarding the company’s use of non-GAAP financial measures.

The reconciliations below are on a

continuing operations basis

Third-Quarter and Fiscal Year-to-Date

Sales Growth Reconciliation

|

|

Q3 |

|

Q3 |

|

Q3 YTD |

|

Q3 YTD |

|

|

Fiscal |

|

Fiscal |

|

Fiscal |

|

Fiscal |

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

| Total Sales Growth –

GAAP |

|

2.6% |

|

-1.9% |

|

2.0% |

|

0.2% |

| Less: Foreign exchange |

|

-2.0 |

|

-2.9 |

|

-2.3 |

|

-2.1 |

| Currency Neutral Sales Growth -

Non-GAAP |

|

4.6% |

|

1.0% |

|

4.3% |

|

2.3% |

The reconciliations below for fiscal

year 2014 are provided as a reference point for the fiscal year 2015 outlook,

and reflect the reclassification of Clorox Venezuela to discontinued operations

in Q1FY15.

Fiscal Year EBIT Margin(1)

Reconciliation

|

|

FY |

|

|

Fiscal |

|

|

2014 |

| Earnings from continuing operations |

|

$ |

884 |

| before income taxes – GAAP |

|

|

|

| |

| Interest Income |

|

|

-3 |

| Interest Expense |

|

|

103 |

| |

| EBIT (1)

– Non-GAAP |

|

$ |

984 |

| |

| Net Sales |

|

$ |

5,514 |

| EBIT margin(1) –

Non-GAAP |

|

|

17.8% |

(1) EBIT represents earnings from

continuing operations before interest and taxes. EBIT margin is the ratio of

EBIT to net sales.

For Gross Margin Drivers, please

refer to the Supplemental Information: Gross Margin Driver page in the Financial

Results section of the company’s website TheCloroxCompany.com.

|

|

| The Clorox Company

|

Supplemental Unaudited Condensed Information – Volume Growth

Reportable

Segment |

% Change vs. Prior Year |

|

| FY14(1) |

FY15(1) |

Major Drivers of Change |

| Q1 |

Q2 |

Q3 |

Q4 |

FY |

Q1 |

Q2 |

Q3 |

YTD |

|

| Cleaning |

0% |

3% |

-5% |

0% |

-1% |

-1% |

3% |

1% |

1% |

Q3 volume

increase driven by higher shipments in Home Care, primarily from

Clorox® Disinfecting Wipes,

several new product launches and Clorox® toilet

cleaners, partially offset by lower shipments of Green Works®

laundry detergent, as well as Clorox® bleach primarily due to the recent price

increase. |

| Household |

2% |

-1% |

5% |

-2% |

1% |

4% |

3% |

0% |

2% |

Q3 volume is

flat reflecting higher shipments in Kingsford® Charcoal, offset by lower shipments

in Bags and Wraps, primarily due to price increases, and Cat

Litter. |

| Lifestyle |

4% |

-1% |

-1% |

2% |

1% |

0% |

5% |

2% |

2% |

Q3 volume

increase driven by higher shipments of Burt’s Bee’s® lip and face care products and Hidden

Valley® salad dressings, partially offset by lower shipments of

Brita® products. |

| International |

1% |

3% |

1% |

2% |

2% |

5% |

5% |

1% |

4% |

Q3 volume

increase driven by higher shipments in Mexico and Canada, partially offset

by lower shipments in Argentina and Asia. |

| Total Company |

1% |

1% |

0% |

0% |

1% |

1% |

4% |

1% |

2% |

|

Supplemental Unaudited

Condensed Information – Sales Growth

Reportable

Segment |

% Change vs. Prior Year |

|

| FY14(1) |

FY15(1) |

Major Drivers of Change |

| Q1 |

Q2 |

Q3 |

Q4 |

FY |

Q1 |

Q2 |

Q3 |

YTD |

|

| Cleaning |

1% |

2% |

-4% |

-1% |

0% |

-2% |

3% |

1% |

1% |

Q3 variance

between volume and sales was flat. |

| Household |

5% |

-1% |

4% |

-2% |

1% |

5% |

5% |

5% |

5% |

Q3 variance

between volume and sales driven by the benefit of price increases in Bags

and Wraps. |

| Lifestyle |

5% |

0% |

-3% |

2% |

1% |

-1% |

4% |

3% |

2% |

Q3 variance

between volume and sales driven by favorable mix and

assortment. |

| International |

-2% |

1% |

-6% |

-6% |

-3% |

0% |

-2% |

0% |

-1% |

Q3 variance

between volume and sales driven by unfavorable foreign currency exchange

rates, partially offset by the benefit of price increases and favorable

mix and assortment. |

| Total Company |

2% |

0% |

-2% |

-2% |

0% |

1% |

3% |

3% |

2% |

|

| (1) |

Volume growth and sales growth

percentage changes for the International reportable segment and Total Company

reflect the reclassification of Clorox

Venezuela to discontinued operations effective Q1 fiscal 2015 for all periods

presented. |

|

|

| The Clorox

Company |

Supplemental Unaudited

Condensed Information –

Gross

Margin

Drivers

The table below provides details on the drivers of gross margin change

versus the prior year.

|

Gross Margin Change vs. Prior Year (basis

points) |

| Driver |

FY14 |

FY15 |

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

Q1 |

Q2 |

Q3 |

| Cost

Savings |

+180 |

+150 |

+140 |

+110 |

+140 |

+120 |

+130 |

+170 |

| Price

Changes |

+80 |

+70 |

+80 |

+80 |

+80 |

+90 |

+100 |

+140 |

| Market

Movement (commodities) |

-110 |

-140 |

-120 |

-110 |

-120 |

-40 |

-90 |

- |

| Manufacturing & Logistics |

-140 |

-120 |

-120 |

-240 |

-160 |

-170 |

-90 |

-120 |

| All

other(1) |

-10 |

-20 |

-10 |

-10 |

-10 |

-70 |

-40 |

-80 |

Impact of Clorox Venezuela

reclassification

to discontinued

operations(2) |

+30 |

+10 |

- |

+40 |

+20 |

- |

- |

- |

| Change vs prior year |

+30 |

-50 |

-30 |

-130 |

-50 |

-70 |

+10 |

+110 |

| Gross Margin (%) |

43.5% |

42.4% |

42.1% |

42.9% |

42.7% |

42.8% |

42.5% |

43.2% |

| (1) |

In Q3 of

fiscal year 2015, ‘All other’ includes about -60bps for higher

performance-based incentive compensation costs vs. the year-ago

quarter. |

| (2) |

Other than

the impact of the Clorox Venezuela reclassification, none of the fiscal

year 2013 and 2014 gross margin drivers have changed; all effects of the

Clorox Venezuela reclassification to discontinued operations are reflected

in this line. |

|

| The Clorox

Company |

Supplemental Information – Balance

Sheet

(Unaudited)

As of March

31, 2015

(Adjusted to reflect Clorox

Venezuela reclassified to discontinued operations)

Working Capital Update

|

Q3 |

|

|

|

|

|

FY 2015

($ millions) |

FY 2014

($ millions) |

Change

($ millions) |

Days(5)

FY

2015 |

Days(5)

FY

2014 |

Change |

| Receivables, net |

$528 |

$551 |

-$23 |

32 |

35 |

-3 |

| Inventories |

$440 |

$447 |

-$7 |

50 |

52 |

-2 |

| Accounts

payable (1) |

$397 |

$388 |

$9 |

44 |

44 |

0 |

| Accrued

liabilities |

$533 |

$481 |

$52 |

|

|

|

| Total WC

(2) |

$187 |

$287 |

-$100 |

|

|

|

| Total WC

% net sales (3) |

3.3% |

5.3% |

|

|

|

|

| Average

WC (2) |

$203 |

$304 |

-$101 |

|

|

|

| Average

WC % net sales (4) |

3.6% |

5.6% |

|

|

|

|

Receivables,

net: Decrease driven primarily by

timing of sales and unfavorable foreign exchange rates.

Accrued

liabilities: Increase driven

primarily by year over year higher performance-based incentive compensation

costs.

| (1) |

Days of

accounts payable is calculated as follows: average accounts payable /

[(cost of products sold + change in inventory) / 90]. |

| (2) |

Working

capital (WC) is defined in this context as current assets minus current

liabilities excluding cash and short-term debt, based on end of period

balances. Average working capital represents a two-point average of

working capital. |

| (3) |

Represents

working capital at the end of the period divided by annualized net sales

(current quarter net sales x

4). |

| (4) |

Represents

a two-point average of working capital divided by annualized net sales

(current quarter net sales x

4). |

| (5) |

Days

calculations based on a two-point average. |

Supplemental Information – Cash

Flow

(Unaudited)

For the quarter ended March

31, 2015

Capital expenditures for the

third quarter were $23 million versus $24 million in the year-ago quarter.

Depreciation and amortization for the third quarter was $41 million versus $43

million in the year ago quarter.

Net cash provided by continuing operations in

the third quarter was $214 million, or 15 percent of sales.

|

| The Clorox

Company |

Supplemental Unaudited Condensed

Information

Fiscal Year to Date Free Cash Flow

Reconciliation

|

|

Q3

Fiscal

YTD

2015 |

|

Q3

Fiscal

YTD

2014 |

| Net cash provided by continuing operations –

GAAP |

|

$481 |

|

$444 |

| Less: Capital

expenditures |

|

83 |

|

87 |

| Free cash flow – non-GAAP (1) |

|

$398 |

|

$357 |

| Free cash flow as a percent of sales – non-GAAP

(1) |

|

9.7% |

|

8.9% |

| Net

sales |

|

$4,098 |

|

$4,017 |

| (1) |

In

accordance with the SEC's Regulation G, this schedule provides the

definition of certain non-GAAP measures and the reconciliation to the most

closely related GAAP measure. Management uses free cash flow and free cash

flow as a percent of sales to help assess the cash generation ability of

the business and funds available for investing activities, such as

acquisitions, investing in the business to drive growth, and financing

activities, including debt payments, dividend payments and share

repurchases. Free cash flow does not represent cash available only for

discretionary expenditures, since the Company has mandatory debt service

requirements and other contractual and non-discretionary expenditures. In

addition, free cash flow may not be the same as similar measures provided

by other companies due to potential differences in methods of calculation

and items being excluded. |

|

| The Clorox

Company |

Supplemental unaudited reconciliation

of earnings from continuing operations before income taxes to EBIT(1)(3)

and EBITDA (2)(3)

(Adjusted to reflect Clorox

Venezuela reclassified to discontinued operations)

Dollars in millions and

percentages based on rounded numbers

|

|

FY 2014 |

|

|

FY 2015 |

| |

|

|

|

|

|

Q1

|

|

Q2 |

|

Q3 |

|

Q4 |

|

FY |

|

|

Q1 |

|

Q2 |

|

Q3 |

|

|

9/30/13 |

|

12/31/13 |

|

3/31/14 |

|

6/30/14 |

|

6/30/14 |

|

|

9/30/14 |

|

12/31/14 |

|

3/31/15 |

| Earnings from continuing operations |

|

$ |

211 |

|

|

$ |

184 |

|

$ |

226 |

|

|

$ |

263 |

|

|

$ |

884 |

|

|

|

$ |

218 |

|

|

$ |

197 |

|

|

$ |

217 |

|

| before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

(1 |

) |

|

|

- |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(1 |

) |

| Interest

expense |

|

|

26 |

|

|

|

26 |

|

|

25 |

|

|

|

26 |

|

|

|

103 |

|

|

|

|

26 |

|

|

|

26 |

|

|

|

25 |

|

| EBIT (1)(3) |

|

|

236 |

|

|

|

210 |

|

|

250 |

|

|

|

288 |

|

|

|

984 |

|

|

|

|

243 |

|

|

|

222 |

|

|

|

241 |

|

| EBIT margin (1)(3) |

|

|

17.6% |

|

|

|

16.1% |

|

|

18.3% |

|

|

|

19.2% |

|

|

|

17.8% |

|

|

|

|

18.0% |

|

|

|

16.5% |

|

|

|

17.2% |

|

| Depreciation

and amortization |

|

|

43 |

|

|

|

45 |

|

|

43 |

|

|

|

46 |

|

|

|

177 |

|

|

|

|

43 |

|

|

|

42 |

|

|

|

41 |

|

| EBITDA (2)(3) |

|

$ |

279 |

|

|

$ |

255 |

|

$ |

293 |

|

|

$ |

334 |

|

|

$ |

1,161 |

|

|

|

$ |

286 |

|

|

$ |

264 |

|

|

$ |

282 |

|

| EBITDA margin (2)(3) |

|

|

20.8% |

|

|

|

19.5% |

|

|

21.4% |

|

|

|

22.3% |

|

|

|

21.1% |

|

|

|

|

21.2% |

|

|

|

19.6% |

|

|

|

20.1% |

|

| Net

sales |

|

$ |

1,343 |

|

|

$ |

1,308 |

|

$ |

1,366 |

|

|

$ |

1,497 |

|

|

$ |

5,514 |

|

|

|

$ |

1,352 |

|

|

$ |

1,345 |

|

|

$ |

1,401 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total debt

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$2,313 |

|

|

|

|

$2,224 |

|

|

|

$2,672 |

|

|

|

$2,166 |

|

| Debt to EBITDA (3)(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

1.9 |

|

|

|

2.3 |

|

|

|

1.9 |

|

| (1) |

EBIT (a

non-GAAP measure) represents earnings from continuing operations before

income taxes (a GAAP measure), excluding interest income and interest

expense, as reported above. EBIT margin is the ratio of EBIT to net

sales. |

| (2) |

EBITDA (a

non-GAAP measure) represents earnings from continuing operations before

income taxes (a GAAP measure), excluding interest income, interest

expense, depreciation and amortization, as reported above. EBITDA margin

is the ratio of EBITDA to net sales. |

| (3) |

In

accordance with the SEC's Regulation G, this schedule provides the

definition of certain non-GAAP measures and the reconciliation to the most

closely related GAAP measure. Management believes the presentation of

EBIT, EBIT margin, EBITDA, EBITDA margin and debt to EBITDA provides

additional useful information to investors about current trends in the

business. |

| (4) |

Total debt

represents the sum of notes and loans payable, current maturities of

long-term debt, and long-term debt. |

| (5) |

Debt to

EBITDA (a non-GAAP measure) represents total debt divided by EBITDA for

the trailing four quarters. The Company calculates debt to Consolidated

EBITDA for compliance with its debt covenants using Consolidated EBITDA

for the trailing four quarters, as contractually defined. |

| |

| The Clorox

Company |

|

| Updated: 5-1-15 |

|

U.S. Retail Pricing Actions from

CY2009 - CY2015

| Brand /

Product |

|

Average Price

Change |

|

Effective

Date |

| Home Care |

|

|

|

|

|

|

| Green Works® cleaners |

|

|

-7

to -21% |

|

|

May

2010 |

| Formula 409® |

|

|

+6% |

|

|

August 2011 |

| Clorox Clean-Up® cleaners |

|

|

+8% |

|

|

August 2011 |

| Clorox® Toilet Bowl Cleaner |

|

|

+5% |

|

|

August 2011 |

| Liquid-Plumr® products |

|

|

+5% |

|

|

August 2011 |

| Pine-Sol® cleaners |

|

|

|

|

|

|

| Clorox Clean-Up®, Formula 409®, |

|

|

+17% |

|

|

April 2012 |

| and Clorox® Disinfecting Bathroom spray

cleaners |

|

|

+5% |

|

|

March 2013 |

| Green Works® cleaners |

|

|

+21% |

|

|

July 2014 |

| Laundry |

|

|

|

|

|

|

| Green Works® liquid detergent |

|

|

approx. -30% |

|

|

May 2010 |

| Clorox® liquid bleach |

|

|

+12% |

|

|

August 2011 |

| Clorox 2® stain fighter and color

booster |

|

|

+5% |

|

|

August 2011 |

| Clorox® liquid bleach |

|

|

+7% |

|

|

February 2015 |

| Glad |

|

|

|

|

|

|

| GladWare® disposable containers |

|

|

-7% |

|

|

April 2009 |

| Glad® trash bags |

|

|

-7% |

|

|

May 2009 |

| Glad® trash

bags |

|

|

+5% |

|

|

August 2010 |

| Glad® trash bags |

|

|

+10% |

|

|

May 2011 |

| Glad® wraps |

|

|

+7% |

|

|

August 2011 |

| Glad® food bags |

|

|

+10% |

|

|

November 2011 |

| GladWare® disposable containers |

|

|

+8% |

|

|

July 2012 |

| Glad® trash bags |

|

|

+6% |

|

|

March 2014 |

| Glad® ClingWrap |

|

|

+5% |

|

|

March 2014 |

| Glad® trash bags |

|

|

+6% |

|

|

November 2014 |

| Glad® wraps |

|

|

+5% |

|

|

January 2015 |

| Litter |

|

|

|

|

|

|

| Cat

litter |

|

|

-8

to -9% |

|

|

March 2010 |

| Cat litter |

|

|

+5% |

|

|

May 2012 |

| Food |

|

|

|

|

|

|

| Hidden Valley Ranch® salad dressing |

|

|

+7% |

|

|

August 2011 |

| Charcoal |

|

|

|

|

|

|

| Charcoal and lighter fluid |

|

|

+7 to +16% |

|

|

January 2009 |

| Charcoal and lighter fluid |

|

|

+8

to 10% |

|

|

January 2012 |

| Charcoal |

|

|

+6% |

|

|

December 2012 |

| Brita |

|

|

|

|

|

|

| Brita® pitchers |

|

|

+3% |

|

|

August 2011 |

| Brita® pitchers and filters |

|

|

+5% |

|

|

July 2012 |

| Natural Personal Care |

|

|

|

|

|

|

| Burt’s Bees® lip balm |

|

|

+10% |

|

|

July 2013 |

| |

|

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

| ● |

Individual SKUs vary within the

range. |

| ● |

This

communication reflects pricing actions on primary items, and does not

reflect pricing actions on our Professional Products

business. |

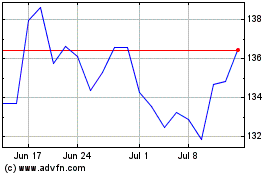

Clorox (NYSE:CLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

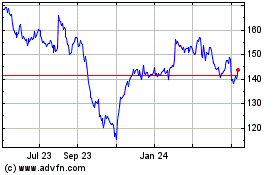

Clorox (NYSE:CLX)

Historical Stock Chart

From Apr 2023 to Apr 2024