Current Report Filing (8-k)

February 08 2016 - 7:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2016

Cliffs Natural Resources Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Ohio | | 1-8944 | | 34-1464672 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| |

200 Public Square, Suite 3300 Cleveland, Ohio | | | | 44114-2315 |

(Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code:

(216) 694-5700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On February 7, 2016, Cliffs Natural Resources Inc. issued a news release. A copy of the news release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

|

| | |

| | |

Exhibit Number | | Description |

| |

99.1 | | Cliffs Natural Resources Inc. published a news release on February 7, 2016 captioned, “Cliffs Natural Resources Inc. to Settle Pending Class Action Lawsuit” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | Cliffs Natural Resources Inc. |

| | | |

Date: | February 8, 2016 | By: | /s/ James D. Graham |

| | | Name: James D. Graham |

| | | Title: Executive Vice President, Chief Legal Officer & Secretary |

EXHIBIT INDEX

|

| | |

| | |

Exhibit Number | | Description |

| |

99.1 | | Cliffs Natural Resources Inc. published a news release on February 7, 2016 captioned, “Cliffs Natural Resources Inc. to Settle Pending Class Action Lawsuit” |

NEWS RELEASE

Cliffs Natural Resources Inc. to Settle Pending Class Action Lawsuit

CLEVELAND - Feb. 7, 2016 - Cliffs Natural Resources Inc. (NYSE: CLF) today announced that the Company has reached agreements in principle to settle both the putative federal securities class action pending in the United States District Court for the Northern District of Ohio, and the combined shareholder derivative actions pending in the Court of Common Pleas of Cuyahoga County, Ohio. The lawsuits were brought against the Company and/or a number of its former directors and officers in 2014 before the change of control which occurred coincident with the July 2014 annual shareholder meeting. These lawsuits were based, among other things, on the alleged dissemination of false or misleading information by the previous management and previous board of directors regarding the Company’s former Bloom Lake mine in Canada, the impact of those operations on the Company’s financial outlook, including the sustainability of the common stock dividend, and alleged failures to maintain internal controls and appropriately oversee and manage the development of the Bloom Lake mining operation.

The settlement agreements contain no admission of liability or wrongdoing and include a full release of all defendants in connection with the allegations made in the lawsuits. The settlements are subject to definitive documentation, shareholder notice, and court approval.

The settlement of these lawsuits will have no impact on the Company’s financial position or operations. The agreement in the securities action provides for a settlement payment to the class of $84,000,000, the totality of which will be paid by the Company's third party insurance carriers. Under the terms of the settlement for the derivative actions, the Company has agreed to adopt a number of changes to its corporate governance policies, protocols and practices. In addition, the Company's insurance carriers will pay $775,000 for plaintiff's attorneys' fees and costs, subject to court approval.

About Cliffs Natural Resources Inc.

Cliffs Natural Resources Inc. is a leading mining and natural resources company in the United States. The Company is a major supplier of iron ore pellets to the North American steel industry from its mines and pellet plants located in Michigan and Minnesota. Cliffs also operates an iron ore mining complex in Western Australia. Driven by the core values of safety, social, environmental and capital stewardship, Cliffs' employees endeavor to provide all stakeholders operating and financial transparency. News releases and other information on the Company are available at http://www.cliffsnaturalresources.com.

Forward-Looking Statements

This release contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. As a general matter, forward-looking statements relate to anticipated trends and expectations rather than historical matters. Forward-looking statements are subject to uncertainties and factors relating to Cliffs’ operations and business environment that are difficult to predict and may be beyond our control. Such uncertainties and factors may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These statements speak only as of the date of this release, and we undertake no ongoing obligation, other than that imposed by law, to update these statements. Uncertainties and risk factors that could affect Cliffs’ future performance and cause results to differ from the forward-looking statements in this release include, but are not limited to: trends affecting our financial condition, results of operations or future prospects, particularly the continued volatility of iron ore prices; availability of capital and our ability to maintain adequate liquidity, in particular considering borrowing base reductions from the sale of non-core assets such as North American Coal; continued weaknesses in global economic conditions, including downward pressure on prices caused by oversupply or imported products, including the impact of any reduced barriers to trade, reduced market demand and any change to the economic growth rate in China; our ability to reach agreement with our iron ore customers regarding any modifications to sales contract provisions, renewals or new arrangements; uncertainty relating to restructurings in the steel industry and/or affecting the steel industry; our ability to maintain appropriate relations with unions and employees and enter into or renew collective bargaining agreements on satisfactory terms; the impact of our customers reducing their steel production or using other methods to produce steel; our ability to successfully execute an exit option for our Canadian entities that minimizes the cash outflows and associated liabilities of such entities, including the Companies' Creditors Arrangement Act process; our ability to successfully identify and consummate any strategic investments and complete planned divestitures; our ability to successfully diversify our product mix and add new customers beyond our traditional blast furnace clientèle; the outcome of any contractual disputes with our customers, joint venture partners or significant energy, material or service providers or any other litigation or arbitration; the ability of our customers and joint venture partners to meet their obligations to us on a timely basis or at all; the impact of price-adjustment factors on our sales contracts; changes in sales volume or mix; our actual levels of capital spending; our actual economic iron ore reserves or reductions in current mineral estimates, including whether any mineralized material qualifies as a reserve; events or circumstances that could impair or adversely impact the viability of a mine and the carrying value of associated assets, as well as any resulting impairment charges; the results of prefeasibility and feasibility studies in relation to projects; impacts of existing and increasing governmental laws and regulation and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorization of, or from, any governmental or regulatory entity and costs related to implementing improvements to ensure compliance with regulatory changes; our ability to cost-effectively achieve planned production rates or levels; uncertainties associated with natural disasters, weather conditions, unanticipated geological conditions, supply or price of energy, equipment failures and other unexpected events; adverse changes in currency values, currency exchange rates, interest rates and tax laws; risks related to international operations; availability of capital equipment and component parts; the potential existence of significant deficiencies or material weakness in our internal control over financial reporting; problems or uncertainties with productivity, tons mined, transportation, mine-closure obligations or costs, environmental liabilities, employee-benefit costs and other risks of the mining industry; finalization of the settlements of the putative federal securities class action and the combined shareholder derivative actions, which remain subject to court approval; and the risk factors identified in Part I - Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2014. The information contained herein speaks as of the date of this release and may be superseded by subsequent events. Except as may be required by applicable securities laws, we do not undertake any obligation to revise or update any forward-looking statements contained in this release.

# # #

Contact:

Patricia Persico

Director, Global Communications

(216) 694-5316

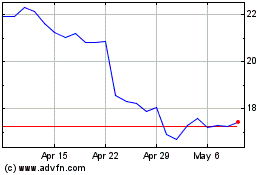

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Apr 2023 to Apr 2024