By John W. Miller And Juliet Samuel

The mining dividend party is over.

For more than a decade, as the China-led commodity boom drove

profits at miners around the world, seemingly never-ending generous

dividends helped to attract investors. Between 2012 and 2014, for

example, Phoenix-based Freeport-McMoRan Inc., the U.S.'s biggest

miner, paid out $4.7 billion in dividends, according to securities

filings.

But Anglo-American PLC's announcement Tuesday that it would

slash its dividend as part of a downsizing reaffirmed a new

investment reality during what is proving to be a deep and lasting

downturn for commodities' producers. With Chinese demand slowing

and profits sliding, companies are putting their own survival

before the short-term interests of their shareholders.

Already this year, Freeport McMoRan Inc., Glencore PLC, Cliffs

Natural Resources Inc., First Quantum Minerals Ltd., Peabody Energy

Corp., Teck Resources Ltd. and Vale SA have cut dividends, citing

lower commodity prices.

Many investors are getting spooked. Matthew Tillett, a

London-based fund manager at Allianz Global Investors, said the

share prices of many miners have fallen in part because investors

no longer expect a steady dividend. "People don't believe these

dividends," he said. "If I'm buying these companies, I'm not buying

them for the dividend. I'm buying them because I think they're

undervalued."

To be sure, there are exceptions. BHP Billiton, Ltd. and Rio

Tinto Group have kept their dividends, partly because of an

Australian tax break, analysts said.

Some investors also say gutting dividends to pay off debt is

common sense. "I think companies would be wise to cut dividends,"

Evy Hambro told delegates at the Mines and Money conference in

London last week. "In general, the absence of cash flow will put

pressure on dividends," said Mr. Hambro, who runs BlackRock Inc.'s

$3.5 billion World Mining Fund.

Investors also said the dividend cuts and other facets of the

mining slowdown are forcing stock buyers to be more selective. "You

now have to pick more carefully as you wait out the cycle," said

Olivier Tielens, a Brussels-based private mining investor and

consultant.

Mr. Tillett, the Allianz fund manager, said he is considering

buying shares in Antofagasta PLC, a Chilean copper producer with

mines, and First Quantum Minerals Ltd., a Canadian copper producer,

because the price of copper is more likely to rise than other

commodities like iron ore.

The run-up in commodity prices spurred mining companies to adopt

and increase dividends to attract investors who placed a priority

on steady payouts, fund managers said.

In 2011, gold miners Newmont Mining Corp. and Eldorado Gold

Corp. announced dividends that would increase as the gold price

rose. That approach was aimed at making their shares more appealing

to investors who, during good times, increasingly favored

exchange-traded funds tied to the performance of the metal price.

Such funds allow investors to benefit from a rising metal price

without taking on the operational and geopolitical risk that comes

with a miner's stock.

But the flurry of dividend cuts exposes the risks investors face

betting on producers paying out a steady income stream when cash

flow is subject to sharp moves in commodity prices. "A lot of times

(the strategy) didn't seem to fit, and I think you are seeing that

come home to roost," said Greg Eckel, a portfolio manager at Morgan

Meighen & Associates in Toronto.

One of the most generous payers has been Freeport, which is the

biggest U.S. mining company by market value. But after paying out

$4.7 billion between 2012 and 2014, it will distribute a fraction

of that this year. In March, Freeport said it would pay a cash

dividend of $0.05 per share, down from a previous rate of $0.3125

per share "in response to the impact of lower commodity prices."

Freeport said its board "reviews its financial policy on an ongoing

basis and has a long-standing practice of distributing cash to

shareholders."

Anglo followed suit on Tuesday, saying it would cut 85,000 jobs,

radically downsize and suspend its dividend payments for the second

half of 2015. The dividend cut, which is expected to save $1.7

billion through 2016, was reported last week by The Wall Street

Journal.

"No ones likes to suspend a dividend," said CEO Mark Cutifani.

"We think it's the right thing to do to make sure the company

remains in good shape."

Anglo's biggest investor said it understood.

"Dividend is only payable when the business is generating free

cash," said Fidelis Madavo, an executive at South Africa's

state-owned Public Investment Corporation Ltd., Anglo's largest

shareholder. When a business is in trouble, "I would not expect

management to pay dividend with one hand and ask for money with the

other hand," he added. "We are a pension fund, we like dividends

[but] we don't like dividends at any cost."

Alex MacDonald, Scott Patterson and Ben Dummett contributed to

this article.

Write to John W. Miller at john.miller@wsj.com and Juliet Samuel

at juliet.samuel@wsj.com

(END) Dow Jones Newswires

December 08, 2015 16:13 ET (21:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

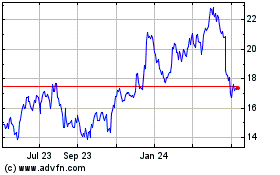

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

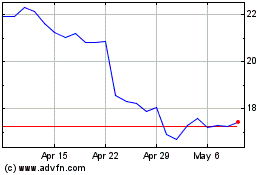

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Apr 2023 to Apr 2024