Cliffs Natural Swings to Modest Profit

October 29 2015 - 9:30AM

Dow Jones News

Cliffs Natural Resources Inc. swung to a modest third-quarter

profit as the iron-ore miner benefited from its cost-cutting

efforts and a gain related to debt extinguishment that helped

offset slumping demand.

Shares rose 9.9% to $2.90 in recent premarket trading.

The Cleveland-based firm, one of the country's biggest mining

companies, has continued to streamline its operations with the hope

that iron-ore prices will recover in time to stave off

bankruptcy.

Chief Executive Lourenco Goncalves said in prepared remarks

Thursday that the company expects the domestic steel market will

improve next year as trade actions reduce pressure from imports and

help firm up steel prices.

Cliffs on Thursday lowered its 2015 capital spending plan to

between $85 million and $95 million, from its previous view for

between $100 million and $125 million. The company also reduced its

2015 overhead outlook by $10 million and now projects $110 million,

mostly driven by reduced head count and spending on external

services.

For the latest quarter, Cliffs reported that its overhead costs

declined 55% from a year earlier. The company noted that while part

of the decline was attributable to higher costs in the year-earlier

period stemming from a proxy contest and other items, overhead

costs also benefited from lower staff costs and spending for

outside services.

Overall, Cliffs reported a profit of $10.6 million, compared

with a year-earlier loss of $5.9 billion. On a per-share basis,

which reflects preferred dividend impacts, the per-share loss was

10 cents, compared with a per-share loss of $38.49 a year earlier.

Excluding a debt-extinguishment gain, year-earlier asset

write-downs and other items, the per-share loss from continuing

operations was 35 cents, compared with a year-earlier profit of 51

cents.

Revenue slumped 39% to $593 million.

Analysts polled by Thomson Reuters expected per-share loss of 23

cents and revenue of $592 million.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 09:15 ET (13:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

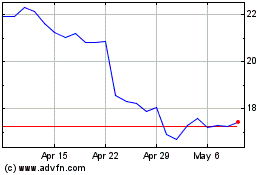

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Apr 2023 to Apr 2024