Colgate-Palmolive Plans Ad Push to Stoke Sales -- 2nd Update

January 27 2017 - 4:25PM

Dow Jones News

By Sharon Terlep and Anne Steele

Colgate-Palmolive Co. executives promised to ramp up advertising

this year to combat lackluster sales, as the toothpaste and

consumer-products maker battles weak demand at home and abroad.

On a conference call Friday afternoon, Colgate executives said

they are now targeting the low end of their 4% to 7% range for 2017

organic sales growth, which excludes acquisitions and currency

swings. Organic sales rose 1.5% in the fourth quarter.

Shares of the company slumped 5.6% in Friday afternoon

trading.

Executives said fourth-quarter sales were hurt by a series of

developments, including a disagreement with a retailer in France,

India's decision to take bank notes out of circulation and weakness

in its Hill's pet food business.

"As we move into 2017, I think it's safe to say that the

uncertainty continues and indeed, there is likelihood of more

events unpredicted occurring as the year unfolds," Chief Executive

Ian Cook said.

However, Mr. Cook said the New York-based company would increase

advertising, both in absolute dollars and as a percentage of sales,

to help drive growth. "We are not going to reduce our investments

in advertising to deliver a quarterly number," he said.

In 2016, Colgate spent $1.43 billion in advertising, or about

9.4% of net sales, compared with $1.49 billion the year before.

Rivals Procter & Gamble Co., Unilever PLC and Kimberly-Clark

are also struggling to boost sales, as they battle fluctuating

exchange rates and sluggish demand for household staples.

Mr. Cook said he didn't think the recent weakness was caused by

an underlying change in consumer habits. "They don't go away from

the he behavior of brushing their teeth," he said. "They will

exhaust pantry inventory, which is to say, if people have more than

one tube of toothpaste at home they may try and stretch that tube

before they reload their own pantry. "

For the December quarter, Colgate-Palmolive reported a profit of

$606 million, or 68 cents a share, compared with a loss of $458

million, or 51 cents, a year earlier.

Revenue fell 4.6% to $3.72 billion. Foreign-exchange rates hurt

sales by 1.5% in the fourth quarter, while world-wide unit volume

fell 5.5%.

North American sales were flat, while Latin American sales, the

company's largest segment, slumped 11%. Sales in Europe and Asia

slipped 7.5% and 4%, respectively, while sales in Africa and

Eurasia edged 1.5% lower.

Write to Sharon Terlep at sharon.terlep@wsj.com and Anne Steele

at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 27, 2017 16:10 ET (21:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

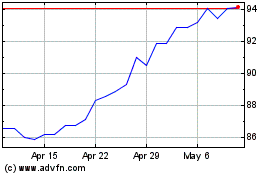

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

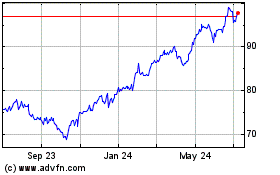

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024