Hot Stocks to Watch in the U.S. and Canada

January 27 2017 - 9:40AM

Dow Jones News

Among the companies with shares expected to trade actively in

Friday's session are Air Products & Chemicals Inc. (APD),

Honeywell International Inc. (HON) and Colgate-Palmolive Co.

(CL).

Air Products lowered its fiscal 2017 outlook amid political

uncertainty in the U.S. and Europe as the industrial-gas company

reported lower-than-expected first quarter earnings. Shares fell

5.07% $141.27 in premarket trading.

Honeywell posted an organic revenue decline and a smaller profit

in its latest quarter as expenses rose. Shares fell 0.73% to

$117.11 premarket.

Colgate-Palmolive posted a bigger-than-expected decline in sales

in the final quarter of the year, as the consumer-products giant

said it contended with worsening foreign-exchange challenges that

continue to pressure the top line. Share fell 5.04% to $64.80

premarket.

American Airlines Group Inc.'s (AAL) fourth-quarter revenue rose

1.7%, and a much-watched industry metric measuring airline

performance turned positive for the first time since 2014. Shares

rose 2.32% to $50.74 premarket.

Drugmaker AbbVie Inc. (ABBV) posted higher revenue, but profit

fell in its latest quarter as expenses rose and its smaller drugs

posted sales below Wall Street expectations. Shares fell 0.62% to

$60.89 premarket.

General Dynamics Corp. (GD) said its fourth-quarter earnings

rose as sales increased across the company's portfolio. Shares rose

0.68% to $178.50 premarket.

Chevron Corp. (CVX) swung to a profit in the latest quarter as

the company slashed expenses amid a tough pricing environment.

E*Trade Financial Corp.'s (ETFC) fourth-quarter profit rose 43%,

driven by a surge in trading activity. The online brokerage's

results beat Wall Street's expectations.

Google parent Alphabet Inc.'s (GOOG) fourth-quarter profit rose

8.3%, but it still fell short of analysts' expectations on a

higher-than-expected tax adjustment.

Intel Corp.'s (INTC) quarterly profit slipped 1.4% despite solid

sales, as the company invested heavily to maintain leadership in

microprocessors for personal computers and for servers used in

giant data centers.

Microsoft Corp. (MSFT) posted big quarterly gains in its

web-based, on-demand computing business, solidifying its spot as

the stiffest competitor to Amazon.com Inc.'s market-leading cloud

unit.

An increase in online sales during the holidays helped push

PayPal Holdings Inc.'s (PYPL) fourth-quarter revenue up 17%,

executives said. The payments company, spun off from eBay Inc.

(EBAY) in 2015, said it added more accounts in the most recent

period than it had in two years, bringing total active accounts to

197 million.

Starbucks Corp. (SBUX) cut its revenue target for the year and

reported lower-than-expected revenue for the December quarter. The

company blamed the latest miss on its mobile order app, which was

intended to reduce cash register lines. Instead, Starbucks

Operating Chief Kevin Johnson said, the lines have just shifted to

the pickup counter. Mr. Johnson, who is slated to succeed Howard

Schultz as chief executive in April, said long waits have driven

away customers.

Swift Transportation Co.'s (SWFT) revenue fell in the most

recent quarter, the seventh straight decline, as a freight market

downturn continues to take a toll on the trucking company, driving

down profit and revenue for the year.

Two days after U.S. President Donald Trump called for an

expedited review of the Keystone XL pipeline project, TransCanada

(TRP, TRP.T) has reapplied for a permit from the State Department.

TransCanada initially applied for the permit, which is needed for

oil pipelines to cross an international border into the US, in 2008

and again in 2012. The project, a flashpoint in the global debate

over climate change and fossil fuels, would also need approval from

Nebraska authorities.

VMware Inc.'s (VMW) strong performance, beating both quarterly

and annual earnings estimates, shows the company is dealing well

with tectonic change, including new parent company Dell

Technologies Inc. (DVMT) and the industry's accelerating move to

the cloud. VMware's so-called hybrid-cloud approach centers on

making it easier for customers to run computing tasks both in their

VMW-equipped data centers and on partner clouds.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

January 27, 2017 09:25 ET (14:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

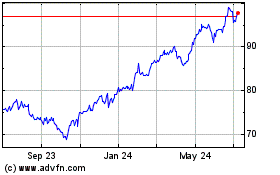

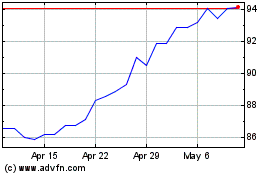

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024