Colgate-Palmolive Revenue Declines

July 28 2016 - 9:20AM

Dow Jones News

Colgate-Palmolive Co.'s revenue slid more than expected in the

most recent quarter, as foreign currency headwinds dragged down

results, particularly in Latin America.

The company, which makes its namesake toothpaste and dish soap,

does most of business abroad and has struggled with the stronger

U.S. dollar, making products more expensive to overseas

consumers.

Chief Executive Ian Cook pointed to strong organic sales growth

"in the face of continued challenging macroeconomic conditions

worldwide."

However, he said macroeconomic conditions and foreign-exchange

volatility remain challenging looking ahead, and the company

expects a low- to mid-single-digit sales decline for the year. The

company continues to expect adjusted per-share earnings to be flat

with 2015.

In all for the June quarter, Colgate earned $600 million, or 67

cents a share, up from $574 million, or 63 cents a share, a year

earlier. Excluding certain items, earnings were flat at 70 cents a

share, just above analysts' expectations for 69 cents a share,

according to Thomson Reuters.

Revenue fell 5.4% to $3.85 billion in the quarter, just below

analysts' estimates for $3.86 billion. Stripping out currency

fluctuations, acquisitions, divestments and the impact of the

deconsolidation of Colgate's Venezuelan operations, the top line

grew 4.5% organically.

Sales in Latin America—which make up nearly a quarter of the

company's revenue—fell 17%, sales in Asia Pacific were down 7%, and

sales in Africa/Eurasia slipped 6%. Sales rose 2% in North America

and edged up 0.5% in Europe.

Gross margin widened to 59.9% from 58.2%.

Shares, inactive premarket, have risen 10% this year.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 28, 2016 09:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

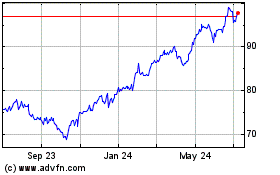

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

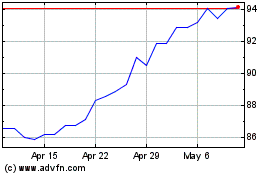

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024