Strong Worldwide Organic Sales

Growth

Announces Accounting Change For Venezuelan

Operations

Colgate-Palmolive Company (NYSE:CL) today reported worldwide Net

sales of $3,899 million in fourth quarter 2015, a decrease of 7.5%

versus fourth quarter 2014. Global unit volume was even with the

year ago quarter. Excluding divested businesses, unit volume

increased 1.0%. Pricing increased 4.0% and foreign exchange was

negative 11.5%. Organic sales (Net sales excluding foreign

exchange, acquisitions and divestments) grew 5.0%.

Net income (loss) and Diluted earnings (loss) per share in

fourth quarter 2015 were $(458) million and $(0.51), respectively.

Net income (loss) in fourth quarter 2015 included a $1,058 million

($1.18 per diluted share) aftertax charge resulting from a change

in accounting for the Company’s Venezuelan operations (see

discussion later in this press release) and $55 million ($0.06 per

diluted share) of aftertax charges resulting from the

implementation of the Company’s Global Growth and Efficiency

Program (the “2012 Restructuring Program”) and a previously

disclosed competition law matter in Australia.

Net income and Diluted earnings per share in fourth quarter 2014

were $628 million and $0.68, respectively. Net income in fourth

quarter 2014 included $71 million ($0.08 per diluted share) of

aftertax charges resulting from the items described in Table 8.

Excluding the above noted items in both periods, Net income in

fourth quarter 2015 was $655 million, a decrease of 6% versus

fourth quarter 2014, and Diluted earnings per share in fourth

quarter 2015 was $0.73, a decrease of 4% versus fourth quarter

2014. On a currency-neutral basis and excluding the above noted

items in both periods, Diluted earnings per share increased double

digit.

Gross profit margin was 58.8% in fourth quarter 2015 versus

58.6% in fourth quarter 2014. Excluding the above noted items in

both periods, Gross profit margin was 59.0% in fourth quarter 2015,

an increase of 20 basis points versus the year ago quarter, as cost

savings from the Company’s funding-the-growth initiatives and the

2012 Restructuring Program and higher pricing, were partially

offset by higher costs, which included higher raw and packaging

material costs, driven by significant foreign exchange transaction

costs.

Selling, general and administrative expenses were 33.0% of Net

sales in fourth quarter 2015 versus 34.0% of Net sales in fourth

quarter 2014. Excluding the above noted items in both periods,

Selling, general and administrative expenses decreased by 100 basis

points to 32.5% of Net sales in fourth quarter 2015, due to

decreased advertising investment as a percentage of Net sales, in

part reflecting a shift in advertising investment to in-store

promotional activities. Worldwide advertising investment decreased

21% to $323 million versus the year ago quarter, largely reflecting

the impact of negative foreign exchange.

Operating profit (loss) decreased to $(139) million in fourth

quarter 2015 compared to $995 million in fourth quarter 2014.

Excluding the above noted items in both periods, Operating profit

(loss) decreased 6% to $1,015 million in fourth quarter 2015.

Operating profit margin was (3.6%) in fourth quarter 2015 versus

23.6% in fourth quarter 2014. Excluding the above noted items in

both periods, Operating profit margin was 26.0% in fourth quarter

2015, an increase of 40 basis points versus the year ago

quarter.

Net cash provided by operations for full year 2015 was $2,949

million compared to $3,298 million in full year 2014, primarily due

to lower operating earnings and higher payments related to income

taxes and a European competition law matter. Working capital as a

percentage of Net sales was 0.5% compared to 0.8% in the year ago

period. This decrease is primarily due to the exclusion of the

working capital of the Company’s Venezuelan operations as of

December 31, 2015.

For the full year 2015, worldwide Net sales were $16,034

million, a decrease of 7.0% versus full year 2014. Global unit

volume grew 1.5%, pricing increased 3.0% and foreign exchange was

negative 11.5%. Excluding divested businesses, unit volume

increased 2.0%. Organic sales grew 5.0%.

Net income and Diluted earnings per share for full year 2015

were $1,384 million and $1.52, respectively. Full year 2015 results

include an aftertax gain of $120 million ($0.13 per diluted share)

from the sale of the Company’s laundry detergent business in the

South Pacific and $1,292 million ($1.42 per diluted share) of

aftertax charges resulting from the change in accounting for the

Company’s Venezuelan operations, the implementation of the 2012

Restructuring Program, remeasurements resulting from effective

devaluations in Venezuela, a foreign competition law matter and a

foreign tax matter.

Net income and Diluted earnings per share for full year 2014

were $2,180 million and $2.36, respectively. As previously

disclosed, full year 2014 results included aftertax charges of $532

million ($0.57 per diluted share) resulting from the items

described in Table 9.

Excluding the items noted above in both periods, Net income for

full year 2015 decreased 6% versus full year 2014, and Diluted

earnings per share decreased 4% versus full year 2014. On a

currency-neutral basis and excluding the above noted items in both

periods, Diluted earnings per share increased double digit.

Gross profit margin was 58.6% for full year 2015 versus 58.5% in

full year 2014. Excluding the items noted above in both periods,

Gross profit margin was 58.7% in full year 2015, even with the full

year 2014 level, as cost savings from the Company’s

funding-the-growth initiatives and the 2012 Restructuring Program

and higher pricing, were offset by higher raw and packaging

material costs, driven by significant foreign exchange transaction

costs.

Venezuela

Effective December 31, 2015, the Company began accounting for

its Venezuelan operations using the cost method of accounting and

as a result its consolidated balance sheet no longer includes the

assets and liabilities of its Venezuelan operations. As a result of

this change in accounting, the Company recorded an aftertax charge

of $1,058 million ($1.18 per diluted share) in the fourth quarter

of 2015. The change in accounting reflects a significant decrease

in the availability of U.S. dollars together with other government

controls that the Company expects to continue for the foreseeable

future.

In future periods, the Company will no longer include the

results of its Venezuelan operations in its consolidated financial

statements and will include income relating to its Venezuelan

operations only to the extent it receives cash for sales of

inventory to its Venezuelan subsidiary or for dividends or

royalties remitted by the subsidiary.

Colgate has been operating in Venezuela for 72 years and the

Company expects its operations in Venezuela to continue to provide

Venezuelan consumers with the Company’s market leading brands.

Ian Cook, Chairman, President and Chief Executive Officer,

commented on the fourth quarter results and outlook for 2016,

excluding the 2015 and 2014 items noted above, “In the face of

continued challenging macroeconomic conditions worldwide, we are

pleased to have finished the year with another quarter of strong

organic sales growth, with every operating division

contributing.

“The 5.0% worldwide organic sales growth was led by emerging

markets where organic sales grew a robust 6.5%, despite economic

challenges in certain countries.

“Pleasingly, gross profit margin, operating profit margin and

net income as a percent to sales all increased versus the year ago

period.

“Colgate’s leading share of the global toothpaste market

increased to 44.7% year to date, up 0.5 share points versus the

year ago period. Our global leadership in manual toothbrushes also

strengthened with Colgate’s global market share in that category

reaching 34.7% year to date, up 1.0 share point versus the year ago

period.”

In closing, Mr. Cook commented, “As we look ahead, macroeconomic

conditions and foreign exchange volatility remain challenging.

Despite that, we anticipate another year of solid organic sales

growth in 2016 driven by a full new product pipeline across all

categories and geographies. Based on current spot rates, we are

planning for a year of gross margin expansion, and expect a low

single-digit earnings per share decline on a dollar basis,

excluding charges related to the 2012 Restructuring Program. This

earnings per share decline includes a $0.10 impact in 2016

resulting from the change in accounting for our Venezuelan

operations and reflects a double-digit increase on a

currency-neutral basis, excluding Venezuela from 2016 and 2015

results.”

At 11:00 a.m. ET today, Colgate will host a conference call to

elaborate on fourth quarter results. To access this call as a

webcast, please go to Colgate’s web site at

http://www.colgatepalmolive.com.

The following are comments about divisional performance for

fourth quarter 2015 versus the year ago period. See attached

Geographic Sales Analysis Percentage Changes and Segment

Information schedules for additional information on divisional net

sales and operating profit.

North America (20% of Company

Sales)

North America Net sales increased 1.0% in fourth quarter 2015.

Unit volume increased 2.0% with 0.5% higher pricing, while foreign

exchange was negative 1.5%. Organic sales increased 2.5% during the

quarter.

Operating profit in North America increased 15% in fourth

quarter 2015 to $275 million, or 430 basis points to 34.9% of Net

sales. This increase in Operating profit as a percentage of

Net sales was primarily due to an increase in Gross profit and a

decrease in Selling, general and administrative expenses, both as a

percentage of Net sales. This increase in Gross profit was

primarily driven by cost savings from the Company’s

funding-the-growth initiatives, partially offset by higher costs,

primarily driven by higher raw and packaging material costs. This

decrease in Selling, general and administrative expenses was

primarily due to decreased advertising investment and lower

overhead expenses.

In the U.S., new product launches are contributing to volume

growth. Market share gains year to date were seen in toothpaste,

manual toothbrushes, mouthwash, liquid hand soap, body wash, liquid

cleaners and fabric conditioners. Colgate’s share of the toothpaste

market strengthened to 35.3% year to date, up 0.3 share points

versus the year ago period, driven by strong sales of Colgate

Enamel Health, Colgate Optic White Platinum Express White, Colgate

Total Daily Repair and Tom’s of Maine toothpastes. In manual

toothbrushes, Colgate strengthened its brand market leadership in

the U.S. with its market share in that category at 41.2% year to

date, up 0.8 share points versus the year ago period. Strong sales

of Colgate 360° Enamel Health and Colgate 360° Optic White Platinum

manual toothbrushes contributed to volume growth in the

quarter.

Successful products driving volume growth in the U.S. in other

categories include Colgate Enamel Health, Colgate Total for Gum

Health and Colgate Kids mouthwashes, Softsoap Fragrant Foaming

Collection of liquid hand soaps, Softsoap Fresh & Glow and

Irish Spring Signature For Men body washes, Palmolive Soft Touch

Almond Milk and Blueberry dish liquid and Suavitel Fragrance Pearls

fabric conditioner.

Latin America (27% of Company

Sales)

Latin America Net sales decreased 12.0% in fourth quarter 2015.

Unit volume decreased 4.0% with 13.0% higher pricing, while foreign

exchange was negative 21.0%. Volume declines in Venezuela and

Brazil were partially offset by volume gains in Mexico. Organic

sales for Latin America increased 9.0%.

Operating profit in Latin America decreased 20% in fourth

quarter 2015 to $280 million, or 250 basis points to 26.7% of Net

sales. This decrease in Operating profit as a percentage of

Net sales was primarily due to a decrease in Gross profit,

partially offset by a decrease in Selling, general and

administrative expenses, both as a percentage of Net

sales. This decrease in Gross profit was primarily due to

higher raw and packaging material costs, driven by significant

foreign exchange transaction costs, and higher manufacturing costs

in Venezuela, which were partially offset by higher pricing and

cost savings from the Company’s funding-the-growth initiatives and

the 2012 Restructuring Program. This decrease in Selling, general

and administrative expenses was due to decreased advertising

investment, which was partially offset by higher overhead expenses

in Venezuela driven by the hyperinflationary environment.

Colgate strengthened its leadership in toothpaste throughout

Latin America during the quarter driven by market share gains in

Mexico, Brazil, Venezuela, Argentina, Chile, El Salvador, Honduras,

Nicaragua, Peru, Puerto Rico and Panama. Strong sales of Colgate

Total 12, Colgate Luminous White Instant and Colgate Total

Professional Breath Health toothpastes contributed to growth

throughout the region. Colgate’s leadership in the manual

toothbrush category continued throughout the region, driven by

strong sales of Colgate Slim Soft and Colgate Triple Action manual

toothbrushes.

Products in other categories contributing to growth throughout

the region include Colgate Plax Ice Infinity mouthwash, Protex

Complete 12 bar soap, Lady Speed Stick Powder Fresh and Speed Stick

Xtreme Tech deodorants, Suavitel Complete and Suavitel Aroma

Intense fabric conditioners, Axion Complete dish liquid and

Fabuloso Pure Cleaning liquid cleaner.

Europe/South Pacific (18% of Company

Sales)

Europe/South Pacific Net sales decreased 14.5% in fourth quarter

2015. Unit volume decreased 0.5% with 2.5% lower pricing, while

foreign exchange was negative 11.5%. Excluding the impact of the

divested laundry detergent business in the South Pacific, volume

increased 4.0% led by volume gains in France, Germany and

Australia. Organic sales for Europe/South Pacific increased

1.5%.

Operating profit in Europe/South Pacific decreased 10% in fourth

quarter 2015 to $177 million, while as a percentage of Net sales,

it increased 130 basis points to 26.4% of Net sales. This increase

in Operating profit as a percentage of Net sales was primarily due

to an increase in Gross profit and a decrease in Selling, general

and administrative expenses, both as a percentage of Net sales.

This increase in Gross profit as a percentage of Net sales was

driven by cost savings from the Company’s funding-the-growth

initiatives and the 2012 Restructuring Program, which were

partially offset by higher raw and packaging material costs, which

included foreign exchange transaction costs, and lower pricing due

to increased promotional activities. This decrease in Selling,

general and administrative expenses was primarily due to decreased

advertising investment, in part reflecting a shift in advertising

investment to in-store promotional activities, which was partially

offset by higher overhead expenses.

Colgate strengthened its oral care leadership in the

Europe/South Pacific region driven by toothpaste market share gains

in France, Ireland, Belgium, Switzerland, Poland, Czech Republic,

Croatia, Latvia, Lithuania and Slovenia. Successful premium

products contributing to volume gains include Colgate Max White

Expert White, elmex Sensitive Professional, Colgate Total Daily

Repair and Colgate Sensitive Pro-Relief Repair & Prevent

toothpastes. In the manual toothbrush category, Colgate Cavity

Protection and Colgate Slim Soft Charcoal manual toothbrushes

contributed to volume growth across the region.

Premium innovations contributing to volume growth in other

product categories include the Colgate ProClinical electric

toothbrush, the Sanex Advanced line of shower gels, deodorants,

hand creams and body lotions, Palmolive Aroma Sensations and

Palmolive Gourmet shower gels, Ajax All Usage Gel liquid and wipe

cleaners, Ajax Easy Rinse spray cleaner and Soupline Fruity

Sensations fabric conditioner.

Asia (15% of Company

Sales)

Asia Net sales decreased 5.0% during fourth quarter 2015. Unit

volume increased 2.5% with 0.5% lower pricing, while foreign

exchange was negative 7.0%. Volume gains were led by the Greater

China region and Thailand. Organic sales for Asia increased

2.0%.

Operating profit in Asia increased 3% in fourth quarter 2015 to

$184 million, or 260 basis points to 32.3% of Net sales. This

increase in Operating profit as a percentage of Net sales was due

to an increase in Gross profit and a decrease in Selling, general

and administrative expenses, both as a percentage of Net

sales. This increase in Gross profit was primarily due to cost

savings from the Company’s funding-the-growth initiatives,

partially offset by higher costs, primarily driven by raw and

packaging material costs, which included foreign exchange

transaction costs. This decrease in Selling, general and

administrative expenses was due to decreased advertising

investment, in part reflecting a shift in advertising investment to

in-store promotional activities.

Colgate continued its toothpaste leadership in Asia during the

quarter. Successful new products including Colgate 360° Gold

Ginseng, Colgate Sensitive Sensifoam, Colgate Active Salt Neem,

Colgate Max White Bamboo Charcoal, Colgate Power White Lemon Salt

and Darlie All Shiny White Multicare toothpastes contributed to

volume growth in the region.

Successful products contributing to volume growth in other

categories in the region include Colgate Optic White Toothbrush +

Built-In Whitening Pen, Colgate Natural Essence Lotus, Colgate 360°

Charcoal Gold and Darlie Charcoal manual toothbrushes, Colgate Plax

Bamboo Charcoal Mint mouthwash and Palmolive Naturals shampoo and

conditioner.

Africa/Eurasia (6% of Company

Sales)

Africa/Eurasia Net sales decreased 16.5% during fourth quarter

2015. Unit volume decreased 1.5% with 8.0% higher pricing, while

foreign exchange was negative 23.0%. Volume declines in Russia and

the Central Caucasus region were partially offset by volume gains

in South Africa and the Sub Saharan Africa region. Organic sales

for Africa/Eurasia increased 6.5%.

Operating profit in Africa/Eurasia decreased 14% in fourth

quarter 2015 to $50 million, while as a percentage of Net sales, it

increased 60 basis points to 20.5% of Net sales. This increase

in Operating profit as a percentage of Net sales was primarily due

to a decrease in Selling, general and administrative expenses,

partially offset by a decrease in Gross profit, both as a

percentage of Net sales. This decrease in Gross profit was

primarily due to higher costs, which included higher raw and

packaging material costs, driven by higher foreign exchange

transaction costs, which were partially offset by cost savings from

the Company’s funding-the-growth initiatives and higher

pricing. The decrease in Selling, general and administrative

expenses was due to decreased advertising investment, in part

reflecting a shift in advertising investment to in-store

promotional activities, which was partially offset by higher

overhead expenses.

Colgate continued its toothpaste leadership in Africa/Eurasia,

driven by market share gains in Israel, Jordan, Kenya, Kuwait,

Qatar, Russia, South Africa, Saudi Arabia, Uganda, Ukraine, Algeria

and Tunisia. Successful products contributing to growth in the

region include Colgate Total, Colgate Optic White Instant and

Colgate Maximum Cavity Protection plus Sugar Acid Neutralizer

toothpastes, Colgate Slim Soft Charcoal, Colgate Natural Extracts

and Colgate Zig Zag manual toothbrushes, Palmolive Gourmet Spa Mint

Shake, Palmolive Aroma Sensations and Palmolive Men Citrus Crush

shower gels and Protex Complete 12 bar soaps.

Hill’s Pet Nutrition (14% of Company

Sales)

Hill’s Net sales were even with fourth quarter 2014. Unit volume

increased 4.0% with 2.0% higher pricing, while foreign exchange was

negative 6.0%. Volume gains were led by the United States and

Western Europe. Hill’s organic sales increased 6.0%.

Hill’s Operating profit increased 6% in fourth quarter 2015 to

$162 million, or 150 basis points to 28.1% of Net sales. This

increase in Operating profit as a percentage of Net sales was due

to an increase in Gross profit and a decrease in Selling, general

and administrative expenses, which were partially offset by an

increase in Other (income) expense, net, all as a percentage of Net

sales. This increase in Gross profit was primarily due to cost

savings from the Company’s funding-the-growth initiatives and

higher pricing, which were partially offset by higher costs,

primarily driven by higher raw and packaging material costs, which

included higher foreign exchange transaction costs. This decrease

in Selling, general and administrative expenses was primarily due

to decreased advertising investment and lower overhead expenses.

This increase in Other (income) expense, net was in part due to the

expiration of a foreign sales tax exemption.

New product introductions driving volume growth in the U.S.

include Hill’s Prescription Diet Metabolic Plus Mobility and

Metabolic Plus Urinary, Hill’s Prescription Diet i/d Stress and i/d

Sensitive and Hill’s Science Diet Urinary Plus Hairball Control.

Successful products that also contributed to U.S. volume growth

included Hill’s Prescription Diet stews and Hill’s Science Diet

Perfect Weight Small Kibble.

New product introductions driving volume growth internationally

include Hill’s Ideal Balance, Hill’s Prescription Diet Metabolic

Plus Mobility, Metabolic Plus Urinary and c/d Multicare Urinary

Stress and Hill’s Science Diet Perfect Weight.

***

About Colgate-Palmolive: Colgate-Palmolive is a leading global

consumer products company, tightly focused on Oral Care, Personal

Care, Home Care and Pet Nutrition. Colgate sells its products in

over 200 countries and territories around the world under such

internationally recognized brand names as Colgate, Palmolive, Speed

Stick, Lady Speed Stick, Softsoap, Irish Spring, Protex, Sorriso,

Kolynos, elmex, Tom’s of Maine, Sanex, Ajax, Axion, Fabuloso,

Soupline and Suavitel, as well as Hill’s Science Diet, Hill’s

Prescription Diet and Hill’s Ideal Balance. For more information

about Colgate’s global business, visit the Company’s web site at

http://www.colgatepalmolive.com. To learn more about Colgate Bright

Smiles, Bright Futures® oral health education program, please visit

http://www.colgatebsbf.com. CL-E

The Company’s annual meeting of shareholders is currently

scheduled for Friday, May 6, 2016.

Market Share Information

Management uses market share information as a key indicator to

monitor business health and performance. References to market share

in this press release are based on a combination of consumption and

market share data provided by third-party vendors, primarily

Nielsen, and internal estimates. All market share references

represent the percentage of the dollar value of sales of our

products, relative to all product sales in the category in the

countries in which the Company competes and purchases data. The

Company measures year-to-date market shares from January 1 of the

relevant year through the most recent period for which market share

data is available, which typically reflects a lag time of one or

two months. The Company believes that the third-party vendors it

uses to provide data are reliable, but it has not verified the

accuracy or completeness of the data or any assumptions underlying

the data. In addition, market share information calculated by the

Company may be different from market share information calculated

by other companies due to differences in category definitions, the

use of data from different countries, internal estimates and other

factors.

Explanatory Note Regarding

Currency-Neutral Calculations

Diluted earnings per share growth for fourth quarter 2015, on a

currency-neutral basis, eliminates from Diluted earnings per share

growth (GAAP) the impact of the items described in Table 8 and the

period-over-period changes in foreign exchange rates in the

translation of local currency results into U.S. dollars.

Accordingly, for purposes of calculating Diluted earnings per share

growth for fourth quarter 2015, on a currency-neutral basis, fourth

quarter 2015 local currency results, which include the impact of

foreign currency transaction gains and losses, are translated into

U.S. dollars using average foreign exchange rates for fourth

quarter 2014.

Diluted earnings per share growth for full year 2015, on a

currency-neutral basis, eliminates from Diluted earnings per share

growth (GAAP) the impact of the items described in Table 9 and the

period-over-period changes in foreign exchange rates in the

translation of local currency results into U.S. dollars.

Accordingly, for purposes of calculating Diluted earnings per share

growth for full year 2015, on a currency-neutral basis, full year

2015 local currency results, which include the impact of foreign

currency transaction gains and losses, are translated into U.S.

dollars using 2014 average foreign exchange rates by quarter.

Management’s estimate of earnings per share growth on a

currency-neutral basis for full year 2016 eliminates from earnings

per share growth (GAAP) the impact of the items described in Table

9, the 2012 Restructuring Program, 2015 and 2016 Venezuela results

and period-over-period changes in foreign exchange rates in the

translation of local currency results into U.S. dollars.

Accordingly, for purposes of estimating earnings per share growth

for full year 2016, on a currency-neutral basis, estimated full

year 2016 local currency results, which include the impact of

foreign currency transaction gains and losses, are translated into

U.S. dollars using 2015 average foreign exchange rates by

quarter.

Cautionary Statement on Forward-Looking

Statements

This press release and the related webcast may contain

forward-looking statements. Such statements may relate, for

example, to sales or volume growth, organic sales growth, profit or

profit margin growth, earnings per share growth (including on a

currency neutral basis), financial goals, the impact of currency

devaluations, exchange controls, price controls and labor unrest,

cost-reduction plans including the 2012 Restructuring Program, tax

rates, new product introductions or commercial investment levels,

among other matters. These statements are made on the basis of our

views and assumptions as of this time and we undertake no

obligation to update these statements except as required by law. We

caution investors that any such forward-looking statements are not

guarantees of future performance and that actual events or results

may differ materially from those statements. Investors should

consult the Company’s filings with the Securities and Exchange

Commission (including the information set forth under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2014) for information about certain factors

that could cause such differences. Copies of these filings may be

obtained upon request from the Company’s Investor Relations

Department or on the Company’s web site at

http://www.colgatepalmolive.com.

Non-GAAP Financial Measures

The following provides information regarding the non-GAAP

financial measures used in this earnings release and/or the related

webcast:

This release discusses organic sales growth, which is Net sales

growth excluding the impact of foreign exchange, acquisitions and

divestments. Management believes this measure provides investors

with useful supplemental information regarding the Company’s

underlying sales trends by presenting sales growth excluding the

external factor of foreign exchange as well as the impact from

acquisitions and divestments. See “Geographic Sales Analysis

Percentage Changes” for the three and twelve months ended December

31, 2015 vs 2014 included with this release for a comparison of

organic sales growth to net sales growth in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”).

To supplement Colgate’s Condensed Consolidated Statements of

Income presented in accordance with GAAP, the Company has disclosed

non-GAAP measures of operating results that exclude certain items.

Worldwide Gross profit, Gross profit margin, Selling, general and

administrative expenses, Selling, general and administrative

expenses as a percentage of Net sales, Other (income) expense, net,

Operating profit, Operating profit margin, Net income attributable

to Colgate-Palmolive Company and Diluted earnings per common share

are discussed both as reported (on a GAAP basis) and, as

applicable, excluding the charge resulting from a change in

accounting for the Company’s Venezuelan operations, the gain on

sale of the Company’s laundry detergent business in the South

Pacific, charges related to the 2012 Restructuring Program, charges

related to the effective devaluations in 2014 and 2015 as a result

of the changes to Venezuela’s foreign exchange system, charges

related to foreign tax matters, costs related to the sale of land

in Mexico and charges related to foreign competition law matters

(non-GAAP). Management believes these non-GAAP financial measures

provide investors with useful supplemental information regarding

the performance of the Company’s ongoing operations. See “Non-GAAP

Reconciliations” for the three and twelve months ended December 31,

2015 and 2014 included with this release for a reconciliation of

these financial measures to the related GAAP measures.

The Company uses these financial measures internally in its

budgeting process and as factors in determining compensation. While

the Company believes that these financial measures are useful in

evaluating the Company’s business, this information should be

considered as supplemental in nature and is not meant to be

considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP. In

addition, these non-GAAP financial measures may not be the same as

similar measures presented by other companies.

The Company defines free cash flow before dividends as Net cash

provided by operations less Capital expenditures. As management

uses this measure to evaluate the Company’s ability to satisfy

current and future obligations, repurchase stock, pay dividends and

fund future business opportunities, the Company believes that it

provides useful information to investors. Free cash flow before

dividends is not a measure of cash available for discretionary

expenditures since the Company has certain non-discretionary

obligations such as debt service that are not deducted from the

measure. Free cash flow before dividends is not a GAAP measurement

and may not be comparable to similarly titled measures reported by

other companies. See “Condensed Consolidated Statements of Cash

Flows” for the twelve months ended December 31, 2015 and 2014 for a

comparison of free cash flow before dividends to Net cash provided

by operations as reported in accordance with GAAP.

(See attached tables for fourth quarter

results.)

Table 1

Colgate-Palmolive Company

Condensed Consolidated Statements of Income

For the Three Months Ended December 31, 2015 and 2014

(Dollars in Millions Except Per Share Amounts) (Unaudited)

2015 2014

Net sales $ 3,899 $ 4,221 Cost of sales 1,606 1,746

Gross profit 2,293 2,475 Gross profit margin 58.8 %

58.6 % Selling, general and administrative expenses 1,286

1,434 Other (income) expense, net 62 46 Charge for

Venezuela accounting change 1,084 - Operating profit (loss)

(139 ) 995 Operating profit margin (3.6 %) 23.6 %

Interest (income) expense, net 7 4 Income (loss) before

income taxes (146 ) 991 Provision for income taxes 275 325

Effective tax rate (188.4 %) 32.8 % Net income (loss)

including noncontrolling interests (421 ) 666 Less: Net

income attributable to noncontrolling interests 37 38 Net

income (loss) attributable to Colgate-Palmolive Company $ (458 ) $

628 Earnings (loss) per common share Basic $ (0.51 ) $ 0.69

Diluted (1) $ (0.51 ) $ 0.68 Average common shares

outstanding Basic 896.5 911.3 Diluted (1) 896.5 920.0 Note:

(1)The computation for Diluted (loss) per

common share for the three months ended December 31, 2015

excludes 6.6 million of incremental common

shares outstanding during the period as they are anti-dilutive.

Table 2

Colgate-Palmolive Company Condensed

Consolidated Statements of Income For the Twelve

Months Ended December 31, 2015 and 2014 (Dollars in

Millions Except Per Share Amounts) (Unaudited)

2015 2014

Net sales $ 16,034 $ 17,277 Cost of sales 6,635 7,168

Gross profit 9,399 10,109 Gross profit margin 58.6 % 58.5 %

Selling, general and administrative expenses 5,464 5,982

Other (income) expense, net 62 570 Charge for

Venezuela accounting change 1,084 - Operating profit 2,789

3,557 Operating profit margin 17.4 % 20.6 % Interest

(income) expense, net 26 24 Income before income taxes 2,763

3,533 Provision for income taxes 1,215 1,194

Effective tax rate 44.0 % 33.8 % Net income including

noncontrolling interests 1,548 2,339 Less: Net income

attributable to noncontrolling interests 164 159 Net income

attributable to Colgate-Palmolive Company $ 1,384 $ 2,180

Earnings per common share Basic $ 1.53 $ 2.38 Diluted $ 1.52 $ 2.36

Average common shares outstanding Basic 902.2 915.1 Diluted

909.7 924.3

Table 3

Colgate-Palmolive Company Condensed

Consolidated Balance Sheets As of December 31, 2015

and December 31, 2014 (Dollars in Millions)

(Unaudited) December 31,

December 31, 2015 2014 Cash and cash

equivalents $ 970 $ 1,089 Receivables, net 1,427 1,552 Inventories

1,180 1,382 Other current assets 807 840 Property, plant and

equipment, net 3,796 4,080 Other assets, including goodwill and

intangibles 3,778 4,516 Total assets $

11,958 $ 13,459 Total debt $ 6,571 $ 6,148

Other current liabilities 3,232 3,442 Other non-current liabilities

2,199 2,484 Total liabilities 12,002

12,074 Total Colgate-Palmolive Company shareholders' equity (299 )

1,145 Noncontrolling interests 255 240

Total liabilities and shareholders' equity $ 11,958 $ 13,459

Supplemental Balance Sheet Information Debt

less cash, cash equivalents and marketable securities* $ 5,499 $

4,859 Working capital % of sales 0.5 % 0.8 % * Marketable

securities of $102 and $200 as of December 31, 2015 and 2014,

respectively, are included in Other current assets.

Table 4

Colgate-Palmolive Company Condensed

Consolidated Statements of Cash Flows For the Twelve

Months Ended December 31, 2015 and 2014 (Dollars in

Millions) (Unaudited) 2015

2014

Operating Activities Net income

including noncontrolling interests $ 1,548 $ 2,339

Adjustments to reconcile net income

including noncontrolling interests to net cash provided by

operations:

Depreciation and amortization 449 442 Restructuring and termination

benefits, net of cash 69 64 Voluntary benefit plan contribution -

(2 ) Venezuela remeasurement charges 34 327 Charge for a foreign

tax matter - 66 Stock-based compensation expense 125 131 Gain on

sale of South Pacific laundry detergent business (187 ) - Charge

for Venezuela accounting change 1,084 - Deferred income taxes (51 )

18 Cash effects of changes in: Receivables (75 ) (109 ) Inventories

(13 ) (60 ) Accounts payable and other accruals (67 ) 57 Other

non-current assets and liabilities 33 25

Net cash provided by operations 2,949 3,298

Investing Activities

Capital expenditures (691 ) (757 ) Sale of property and non-core

products 9 24 Purchases of marketable securities and investments

(742 ) (340 ) Proceeds from sale of marketable securities and

investments 599 283 Proceeds from sale of South Pacific laundry

detergent business 221 - Payment for acquisitions, net of cash

acquired (13 ) (87 ) Reduction in cash due to Venezuela accounting

change (75 ) - Other 7 18 Net cash used

in investing activities (685 ) (859 )

Financing

Activities Principal payments on debt (9,181 ) (8,525 )

Proceeds from issuance of debt 9,602 8,960 Dividends paid (1,493 )

(1,446 ) Purchases of treasury shares (1,551 ) (1,530 ) Proceeds

from exercise of stock options and excess tax benefits 347

371 Net cash used in financing activities

(2,276 ) (2,170 ) Effect of exchange rate changes on Cash

and cash equivalents (107 ) (142 ) Net (decrease)

increase in Cash and cash equivalents (119 ) 127 Cash and cash

equivalents at beginning of the period 1,089

962 Cash and cash equivalents at end of the period $ 970

$ 1,089

Supplemental Cash Flow

Information Free cash flow before dividends (Net cash

provided by operations less Capital expenditures) Net cash provided

by operations $ 2,949 $ 3,298 Less: Capital expenditures

(691 ) (757 ) Free cash flow before dividends $ 2,258

$ 2,541 Income taxes paid $ 1,259 $ 1,009

Table 5

Colgate-Palmolive Company Segment

Information For the Three and Twelve Months Ended

December 31, 2015 and 2014 (Dollars in Millions)

(Unaudited) Three Months

Ended

December 31,

Twelve Months Ended

December 31,

2015 2014 2015 2014

Net Sales Oral, Personal and Home Care North America

$ 789 $ 780 $ 3,149 $ 3,124 Latin America 1,050 1,192 4,327 4,769

Europe/South Pacific 670 782 2,870 3,406 Asia 570 599 2,478 2,515

Africa/Eurasia 244 292 998

1,208 Total Oral, Personal and Home

Care 3,323 3,645 13,822 15,022 Pet Nutrition 576

576 2,212 2,255

Total Net Sales $ 3,899 $ 4,221 $

16,034 $ 17,277 Three Months Ended

December 31,

Twelve Months Ended

December 31,

2015 2014 2015 2014

Operating Profit (Loss) Oral, Personal

and Home Care North America $ 275 $ 239 $ 974 $ 926 Latin

America 280 348 1,209 1,279 Europe/South Pacific 177 196 750 877

Asia 184 178 753 736 Africa/Eurasia 50 58

178 235 Total Oral,

Personal and Home Care 966 1,019 3,864 4,053 Pet Nutrition

162 153 612 592 Corporate(1) (1,267 ) (177 )

(1,687 ) (1,088 )

Total Operating Profit

(Loss) $ (139 ) $ 995 $ 2,789 $ 3,557

Note: (1) Corporate operations includes costs related to

stock options and restricted stock units, research and development

costs, Corporate overhead costs, restructuring and related

implementation costs and gains and losses on sales of non-core

product lines and assets. Corporate Operating profit (loss)

for the three months ended December 31, 2015 includes a charge of

$1,084 related to a Venezuela accounting change, charges of $56

related to the 2012 Restructuring Program and a charge of $14 for a

foreign competition law matter. For the three months ended December

31, 2014, Corporate Operating profit (loss) included charges of $55

related to the 2012 Restructuring Program and a charge of $30 for a

foreign competition law matter. Corporate Operating profit

(loss) for the twelve months ended December 31, 2015 includes a

charge of $1,084 related to a Venezuela accounting change, charges

of $254 related to the 2012 Restructuring Program, charges of $34

related to the remeasurement of the Company's Venezuelan

subsidiary's local currency-denominated net monetary assets as a

result of effective devaluations, charges of $14 for foreign

competition law matters and a gain of $187 on the sale of the

Company's laundry detergent business in the South Pacific. For the

twelve months ended December 31, 2014, Corporate Operating profit

(loss) included charges of $286 related to the 2012 Restructuring

Program, a charge of $327 related to the remeasurement of the

Company's Venezuelan subsidiary's local currency-denominated net

monetary assets as a result of effective devaluations, a charge of

$41 for a foreign competition law matter and costs of $4 related to

the sale of land in Mexico.

Table 6

Colgate-Palmolive Company Geographic Sales

Analysis Percentage Changes For the Three Months

Ended December 31, 2015 vs 2014 (Unaudited)

COMPONENTS OF SALES CHANGE

Pricing

Coupons Sales

Consumer & Change Organic As

Reported Organic Ex-Divested Trade

Foreign

Region

As

Reported

Sales

Change

Volume

Volume

Volume

Incentives

Exchange

Total Company (7.5)% 5.0 % - % 1.0 % 1.0 % 4.0 %

(11.5)%

Europe/South Pacific (2) (14.5)% 1.5 %

(0.5)% 4.0 % 4.0 % (2.5)% (11.5)%

Latin America

(12.0)% 9.0 % (4.0)% (4.0)% (4.0)% 13.0 % (21.0)%

Asia (5.0)% 2.0 % 2.5 % 2.5 % 2.5 % (0.5)% (7.0)%

Africa/Eurasia (16.5)% 6.5 % (1.5)% (1.5)% (1.5)% 8.0 %

(23.0)%

Total International (11.5)% 5.5 % (1.5)% - %

- % 5.5 % (15.5)%

North America 1.0 % 2.5 % 2.0 % 2.0

% 2.0 % 0.5 % (1.5)%

Total CP Products (9.0)% 4.5 %

(0.5)% 0.5 % 0.5 % 4.0 % (12.5)%

Hill's - % 6.0 % 4.0

% 4.0 % 4.0 % 2.0 % (6.0)%

Emerging Markets

(1) (10.5)% 6.5 % (1.5)% (1.5)% (1.5)% 8.0 % (17.0)%

Developed Markets (4.5)% 3.0 % 1.5 % 3.5 % 3.5 % (0.5)%

(5.5)% Note: (1) Emerging Markets include Latin

America, Asia (excluding Japan), Africa/Eurasia and Central Europe.

(2)The sale of the Company's laundry

detergent business in the South Pacific was completed on August 31,

2015. The impact of the sale of the Company's laundry detergent

business in the South Pacific on three months sales and volume was

1.0% for the Total Company and 4.5% for Europe/South Pacific

region.

Table 7

Colgate-Palmolive Company Geographic Sales

Analysis Percentage Changes For the Twelve Months

Ended December 31, 2015 vs 2014 (Unaudited)

COMPONENTS OF SALES CHANGE

Pricing

Coupons Consumer & Change

Organic As Reported Organic Ex-Divested

Trade Foreign

Region

As

Reported

Sales

Change

Volume

Volume

Volume

Incentives

Exchange

Total Company (7.0)% 5.0 % 1.5 % 2.0 % 2.0 % 3.0 %

(11.5)%

Europe/South Pacific (2) (15.5)% 1.0 %

2.0 % 4.0 % 4.0 % (3.0)% (14.5)%

Latin America (9.5)%

9.5 % (1.0)% (1.0)% (1.0)% 10.5 % (19.0)%

Asia (1.5)%

2.5 % 4.0 % 3.5 % 4.0 % (1.0)% (4.5)%

Africa/Eurasia

(17.5)% 6.0 % (1.5)% (1.5)% (1.5)% 7.5 % (23.5)%

Total

International (10.5)% 5.5 % 1.0 % 1.5 % 1.5 % 4.0 % (15.5)%

North America 1.0 % 2.0 % 2.0 % 2.0 % 2.0 % - %

(1.0)%

Total CP Products (8.0)% 4.5 % 1.0 % 1.5 % 1.5

% 3.0 % (12.0)%

Hill's (2.0)% 6.0 % 3.5 % 3.5 % 3.5 %

2.5 % (8.0)%

Emerging Markets (1)

(8.5)% 7.0 % 1.0 % 1.0 % 1.0 % 6.0 % (15.5)%

Developed

Markets (6.0)% 2.5 % 2.0 % 3.0 % 3.0 % (0.5)% (7.5)%

Note:

(1) Emerging Markets include Latin

America, Asia (excluding Japan), Africa/Eurasia and Central

Europe.

(2)The sale of the Company's laundry

detergent business in the South Pacific was completed on August 31,

2015. The impact of the sale of the Company's laundry detergent

business in the South Pacific on twelve months sales and volume was

0.5% for the Total Company and 2.0% for Europe/South Pacific

region.

Table 8

Colgate-Palmolive Company Non-GAAP

Reconciliations For the Three Months Ended December

31, 2015 and 2014 (Dollars in Millions Except Per

Share Amounts) (Unaudited) Gross Profit

2015

2014 Gross profit, GAAP $ 2,293 $ 2,475 2012

Restructuring Program 9 6 Gross profit,

non-GAAP $ 2,302 $ 2,481

Basis Point

Gross Profit Margin 2015 2014 Change

Gross profit margin, GAAP 58.8 % 58.6 % 20 2012 Restructuring

Program 0.2 % 0.2 % Gross profit margin,

non-GAAP 59.0 % 58.8 % 20

Selling, General and Administrative Expenses 2015

2014 Selling, general and administrative expenses, GAAP $

1,286 $ 1,434 2012 Restructuring Program (20 ) (20 )

Selling, general and administrative expenses, non-GAAP $ 1,266

$ 1,414

Basis Point Selling, General

and Administrative Expenses as a Percentage of Net Sales

2015 2014 Change Selling, general and

administrative expenses as a percentage of Net sales, GAAP 33.0 %

34.0 % (100 ) 2012 Restructuring Program (0.5 %) (0.5

%) Selling, general and administrative expenses as a

percentage of Net sales, non-GAAP 32.5 % 33.5 % (100

)

Other (Income) Expense, Net 2015

2014 Other (income) expense, net, GAAP $ 62 $ 46 2012

Restructuring Program (27 ) (29 ) Charges for foreign competition

law matters (14 ) (30 ) Other (income) expense, net,

non-GAAP $ 21 $ (13 )

Operating Profit

(Loss) 2015 2014 % Change Operating profit

(loss), GAAP $ (139 ) $ 995 (114 %) Venezuela accounting change

1,084 - 2012 Restructuring Program 56 55 Charges for foreign

competition law matters 14 30

Operating profit, non-GAAP $ 1,015 $ 1,080 (6 %)

Basis Point Operating Profit Margin

2015 2014 Change Operating profit margin, GAAP

(3.6 %) 23.6 % (2720 ) Venezuela accounting change 27.8 % - % 2012

Restructuring Program 1.4 % 1.3 % Charges for foreign competition

law matters 0.4 % 0.7 % Operating profit

margin, non-GAAP 26.0 % 25.6 % 40

Net Income (Loss) Attributable to Colgate-Palmolive

Company 2015 2014 % Change Net income

(loss) attributable to Colgate-Palmolive Company, GAAP $ (458 ) $

628 (173 %) Venezuela accounting change 1,058 - 2012 Restructuring

Program 41 41 Charges for foreign competition law matters 14

30 Net income (loss) attributable to

Colgate-Palmolive Company, non-GAAP $ 655 $ 699 (6 %)

Diluted Earnings (Loss) Per Common Share(1)

(2) 2015 2014 % Change Diluted earnings

(loss) per common share, GAAP $ (0.51 ) $ 0.68 (175 %) Venezuela

accounting change 1.18 - 2012 Restructuring Program 0.04 0.05

Charges for foreign competition law matters 0.02

0.03 Diluted earnings per common share,

non-GAAP $ 0.73 $ 0.76 (4 %) Note: (1) The

impact of non-GAAP adjustments on diluted earnings per share may

not necessarily equal the difference between "GAAP" and "non-GAAP"

as a result of rounding.

(2) The computation for Diluted (loss) per

common share, GAAP for the three months ended December 31, 2015

excludes 6.6 million of incremental common shares outstanding

during the period as they are anti-dilutive. These incremental

common shares are included in the computation for Diluted earnings

per common share, non-GAAP.

Table 9

Colgate-Palmolive Company Non-GAAP

Reconciliations For the Twelve Months Ended December

31, 2015 and 2014 (Dollars in Millions Except Per

Share Amounts) (Unaudited) Gross Profit

2015 2014

Gross profit, GAAP $ 9,399 $ 10,109 2012

Restructuring Program 20 29 Costs related to the sale of land in

Mexico - 4 Gross profit, non-GAAP $

9,419 $ 10,142

Basis Point Gross

Profit Margin 2015 2014 Change Gross

profit margin, GAAP 58.6 % 58.5 % 10 2012 Restructuring Program

0.1 % 0.2 % Gross profit margin, non-GAAP

58.7 % 58.7 % -

Selling,

General and Administrative Expenses 2015 2014

Selling, general and administrative expenses, GAAP $ 5,464 $ 5,982

2012 Restructuring Program (64 ) (62 ) Selling,

general and administrative expenses, non-GAAP $ 5,400 $

5,920

Basis Point Selling, General and

Administrative Expenses as a Percentage of Net Sales

2015 2014 Change Selling, general and

administrative expenses as a percentage of Net sales, GAAP 34.1 %

34.6 % (50 ) 2012 Restructuring Program (0.4 %) (0.3

%) Selling, general and administrative expenses as a

percentage of Net sales, non-GAAP 33.7 % 34.3 % (60 )

Other (Income) Expense, Net 2015

2014 Other (income) expense, net, GAAP $ 62 $ 570 2012

Restructuring Program (170 ) (195 ) Venezuela remeasurement charges

(34 ) (327 ) Charges for foreign competition law matters (14 ) (41

) Gain on sale of South Pacific laundry detergent business

187 - Other (income) expense, net, non-GAAP $

31 $ 7

Operating Profit

2015 2014 % Change Operating profit, GAAP $

2,789 $ 3,557 (22 %) Venezuela accounting change 1,084 - 2012

Restructuring Program 254 286 Venezuela remeasurement charges 34

327 Charges for foreign competition law matters 14 41 Costs related

to the sale of land in Mexico - 4 Gain on sale of South Pacific

laundry detergent business (187 ) -

Operating profit, non-GAAP $ 3,988 $ 4,215 (5 %)

Basis Point Operating Profit Margin

2015 2014 Change Operating profit margin, GAAP

17.4 % 20.6 % (320 ) Venezuela accounting change 6.8 % - % 2012

Restructuring Program 1.6 % 1.7 % Venezuela remeasurement charges

0.2 % 1.9 % Charges for foreign competition law matters 0.1 % 0.2 %

Gain on sale of South Pacific laundry detergent business

(1.2 %) - % Operating profit margin, non-GAAP

24.9 % 24.4 % 50

Net Income

Attributable to Colgate-Palmolive Company 2015

2014 % Change Net income attributable to

Colgate-Palmolive Company, GAAP $ 1,384 $ 2,180 (37 %) Venezuela

accounting change 1,058 - 2012 Restructuring Program 183 208

Venezuela remeasurement charges 22 214 Charges for foreign tax

matters 15 66 Charges for foreign competition law matters 14 41

Costs related to the sale of land in Mexico - 3 Gain on sale of

South Pacific laundry detergent business (120 ) -

Net income attributable to Colgate-Palmolive Company,

non-GAAP $ 2,556 $ 2,712 (6 %)

Diluted Earnings Per Common Share (1) (2) 2015

2014 % Change Diluted earnings per common share, GAAP

$ 1.52 $ 2.36 (36 %) Venezuela accounting change 1.16 - 2012

Restructuring Program 0.20 0.23 Venezuela remeasurement charges

0.02 0.23 Charges for foreign competition law matters 0.02 0.04

Charges for foreign tax matters 0.02 0.07 Gain on sale of South

Pacific laundry detergent business (0.13 ) -

Diluted earnings per common share, non-GAAP $ 2.81 $

2.93 (4 %) Notes: (1) The impact of non-GAAP

adjustments on diluted earnings per share may not necessarily equal

the difference between "GAAP" and "non-GAAP" as a result of

rounding. (2) Basic and diluted earnings per share are

computed independently for each quarter and any year-to-date period

presented. As a result of changes in shares outstanding during the

year and rounding, the sum of the quarters’ earnings per share may

not necessarily equal the earnings per share for any year-to-date

period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160129005170/en/

Colgate-Palmolive CompanyBina Thompson, 212-310-3072orHope

Spiller, 212-310-2291

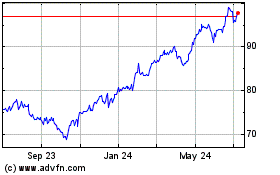

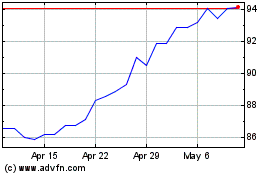

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024