Colgate to Make Super Bowl Debut With 'Save Water' Ad

December 22 2015 - 1:07PM

Dow Jones News

By Nathalie Tadena

When Colgate makes its debut as a Super Bowl advertiser in

February's big game, it won't be using its 30-seconds of airtime to

promote its line of toothpastes and toothbrushes.

Instead, the oral-care products brand's Super Bowl spot "Save

Water" aims to remind consumers to turn off the tap when brushing

their teeth.

"It's an unusual type of messaging, it's not really about a

product or new news on a product," said Scott Campbell, General

Manager for Integrated Marketing Communications, North America at

Colgate-Palmolive. "It's a message about our consumers and the use

of our product that we think is interesting and different."

It's also not a new message from Colgate. A 60-second version of

the creative for "Save Water" was originally developed for the

brand's Latin America division last year.

The spot, created by Y&R Peru, shows a man brushing his

teeth. As he leaves the tap running, hands reach under the faucet

to fill up a cup, wash a dirty fruit and grab a drink of water to

signify how valuable the water running is. Colgate will run a

shorter version of the creative during the Super Bowl that will

include a new campaign hashtag #EveryDropCounts. On average,

Americans waste at least four gallons of water per year by running

the tap while brushing their teeth.

The ad ran for a one-week period in Peru and Colombia in 2014

and 2015 in connection with World Water Day. The campaign in Latin

America garnered 48 million TV impressions and 34 million digital

impressions, Colgate said.

Colgate wanted to use the Super Bowl as a way to significantly

ramp up and amplify the brand's ongoing water conservation message

in North America, Mr. Campbell said. The "Save Water" ad ran on TV

in the U.S. in the first quarter of the year, though it didn't get

much attention.

"We absolutely bought the [Super Bowl] ad for this piece of

information, " Mr. Campbell said. "It's an important venue for

which we could communicate this in the biggest way possible."

The Super Bowl spot will be the primary TV exposure for the

"Save Water" campaign, though it will also have an online

component. In addition, Colgate is launching a landing page with

more information for consumers on the impact of water

conservation.

The commercial will air at the two-minute warning in the

second-half of the game, around the time viewers are likely

preparing themselves for bed and getting ready to brush their

teeth.

The Colgate brand spent roughly $149 million on measured media

in the U.S. last year and roughly $103 million this year through

September, according to Kantar Media, whose analysis includes

spending on traditional media and online display.

This is the Colgate oral health care brand's first appearance in

the Super Bowl. Its parent company Colgate-Palmolive has previously

advertised in the Super Bowl in 2013 with a commercial for the

Speed Stick deodorant brand.

For any advertiser -- let alone rookies -- it can be a challenge

to stand out on television's biggest stage. The Super Bowl's

advertisements garner as much attention as the actual game, setting

up high expectations for brands to deliver spots that are memorable

or funny. The 2015 game attracted the largest number of first-time

advertisers since the dot-com boom, according to Kantar Media.

PayPal and LG are also among advertisers making their first-ever

Super Bowl appearance in the upcoming big game. There were 13

first-time big game advertisers in Super Bowl XLIX, representing

32% of the game's total advertising, a higher percentage than in

previous years, according to data from Kantar Media.

Last February's Super Bowl XLIX drew in a record 114.4 million

viewers, the largest audience for a U.S. television program ever.

Advertisers are paying as much as a record $5 million for 30

seconds of airtime for Super Bowl 50 on Feb. 7, CBS Chief Executive

Leslie Moonves has said. (CBS is broadcasting the upcoming game.)

Colgate declined to comment on how much the brand is paying for its

big game spot, but Mr. Campbell said it is a "significant

commitment."

The Super Bowl push comes as Colgate-Palmolive makes global

market share gains in the toothpaste and toothbrush categories. In

the most recent quarter, Colgate-Palmolive's organic revenue

increased 5% and it increased its global toothpaste market share to

44.7%.

Write to Nathalie Tadena at nathalie.tadena@wsj.com

(END) Dow Jones Newswires

December 22, 2015 12:52 ET (17:52 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

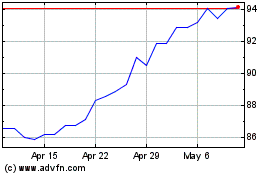

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

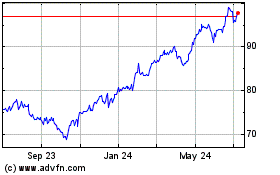

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024