Conn. Review Of Insurers' Deal Faces Scrutiny -- WSJ

June 17 2016 - 3:04AM

Dow Jones News

By Joseph De Avila

A Connecticut ethics board voted Thursday to open an inquiry on

whether the state's insurance commissioner should recuse herself

from leading a review of the proposed merger between Anthem Inc.

and Cigna Corp.

Commissioner Katharine Wade was a vice president at Cigna, based

in Bloomfield, Conn., until 2013, and her husband works for the

company as associate chief counsel.

Common Cause Connecticut, a government watchdog group, asked the

state's Citizen's Ethics Advisory Board Monday to rule on whether

Ms. Wade has a conflict of interest because she is now leading the

multistate review of the proposed tie-up of the two insurance

companies.

Common Cause Connecticut said it "questions the ability of Ms.

Wade to conduct a review of the merger of Anthem and Cigna in an

unbiased way." Anthem notified Connecticut of its intent to acquire

Cigna in September.

Some of the state's top Republicans and the Democratic speaker

of the House have asked Ms Wade to recuse herself, though

Democratic Gov. Dannel Malloy, who appointed Ms. Wade in 2015, has

said she could conduct a fair review

The state Department of Insurance is coordinating a 27-state

review of the merger because Cigna is based in Connecticut. Ms.

Wade has said she has no conflict in leading the review.

"The commissioner has sought [the Office of State Ethics']

guidance throughout the process," a spokeswoman for the insurance

department said. "Should that guidance change, she will follow that

instead."

A spokesman for Mr. Malloy said his administration would abide

by whatever guidance the ethics board issues.

Ms. Wade, who earns $160,000 a year as insurance commissioner,

sent the Office of State Ethics a letter in September stating no

conflict would be posed by her previous employment at Cigna and her

husband's current position with the company. She and her counsel

later met with staff from the Office of State Ethics, said Carol

Carson, the office's executive director.

he commissioner didn't have a conflict because he placed most of

his stock options from the company in a blind trust, and he agreed

to postpone vesting rights for other stock options. He took part in

the hearing.

Ms. Wade stated in her September letter to the Office of State

Ethics that she and her husband had put their assets into a blind

trust and that her husband's unvested Cigna stock would also go

into the blind trust when it is vested.

The ethics board typically has 30 days to reach a decision, but

it could choose a later date, Ms. Carson said. Its rulings are

legally binding but appealable in state court.

Write to Joseph De Avila at joseph.deavila@wsj.com

(END) Dow Jones Newswires

June 17, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

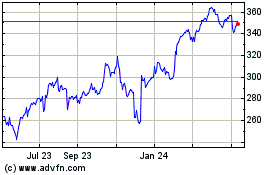

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

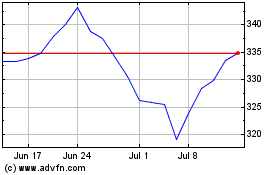

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024